Senfase In Finance: A Game-Changer in Risk Mitigation and Market Stability

Senfase In Finance: A Game-Changer in Risk Mitigation and Market Stability

Senfase In Finance represents a transformative paradigm in modern financial risk management, integrating dynamic modeling with real-time market analytics to enhance decision-making under uncertainty. At its core, Senfase functions as a sophisticated framework enabling institutions to quantify, monitor, and respond to systemic financial vulnerabilities—shifting the focus from reactive damage control to proactive resilience building. As markets grow increasingly complex and interconnected, the implications of adopting such a system reach far beyond individual portfolios, influencing corporate governance, regulatory compliance, and even macro-level financial stability.

Understanding Senfase requires unpacking its conceptual roots: the term “Senfase” derives from a fusion of “sensitivity” and “response phase,” capturing its dual role in assessing market sensitivities and triggering timely corrective actions. Unlike static risk models, Senfase synthesizes macroeconomic indicators, behavioral financial data, and algorithmic forecasting to generate granular risk profiles. “Traditional models often lag behind real-world volatility,” notes Dr.

Elena Torres, a senior quantitative analyst at GlobalFin Solutions. “Senfase closes that gap by embedding adaptive sensitivity analysis into daily trading and strategic planning.”

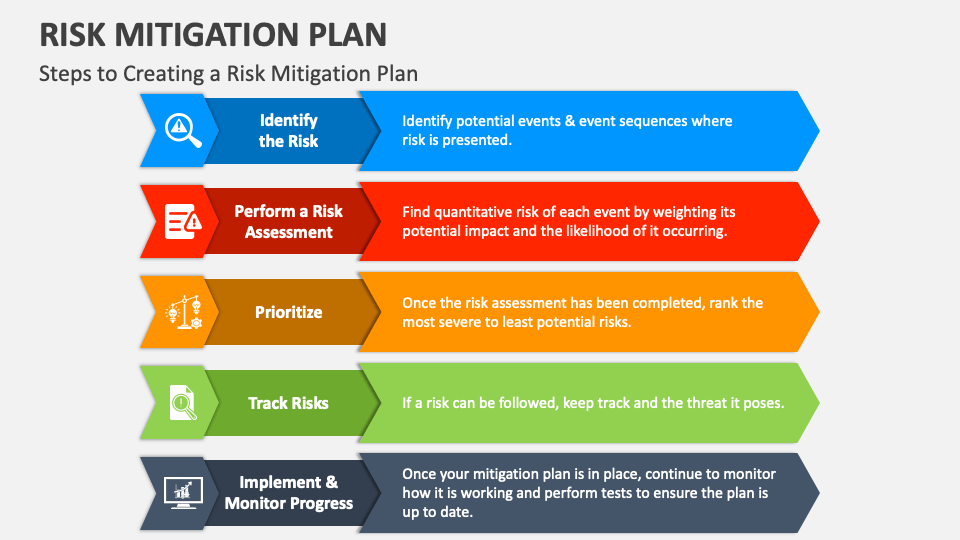

Central to Senfase’s architecture is its multi-layered sensitivity mapping, which identifies key exposure points across asset classes—equities, currencies, commodities, and fixed income—under varying stress scenarios. This granular approach allows financial managers to: - Pinpoint hidden leverage and counterparty risks before they trigger cascading failures - Simulate cascading market shocks using scenario-based stress testing - Develop dynamic hedging strategies responsive to evolving volatility regimes For instance, during periods of rising interest rate tightening, Senfase can rapidly recalibrate exposure in bond portfolios by detecting early signs of duration risk, enabling preemptive rebalancing.

The operationalization of Senfase relies on cutting-edge data integration and machine learning.

It processes terabytes of structured and unstructured data—from central bank policy shifts and geopolitical news to social sentiment and dark pool transactions—feeding them into predictive algorithms trained on historical crises. “Senfase doesn’t just react; it anticipates,” explains Dr. Rajiv Mehta, lead architect at Senfase Systems.

“By identifying subtle pattern shifts in market microstructure, it alerts users to emerging risks invisible to conventional monitoring tools.” This fusion of AI and finance enables institutions to move from predominantly backward-looking analysis toward a forward-looking, resilience-oriented model.

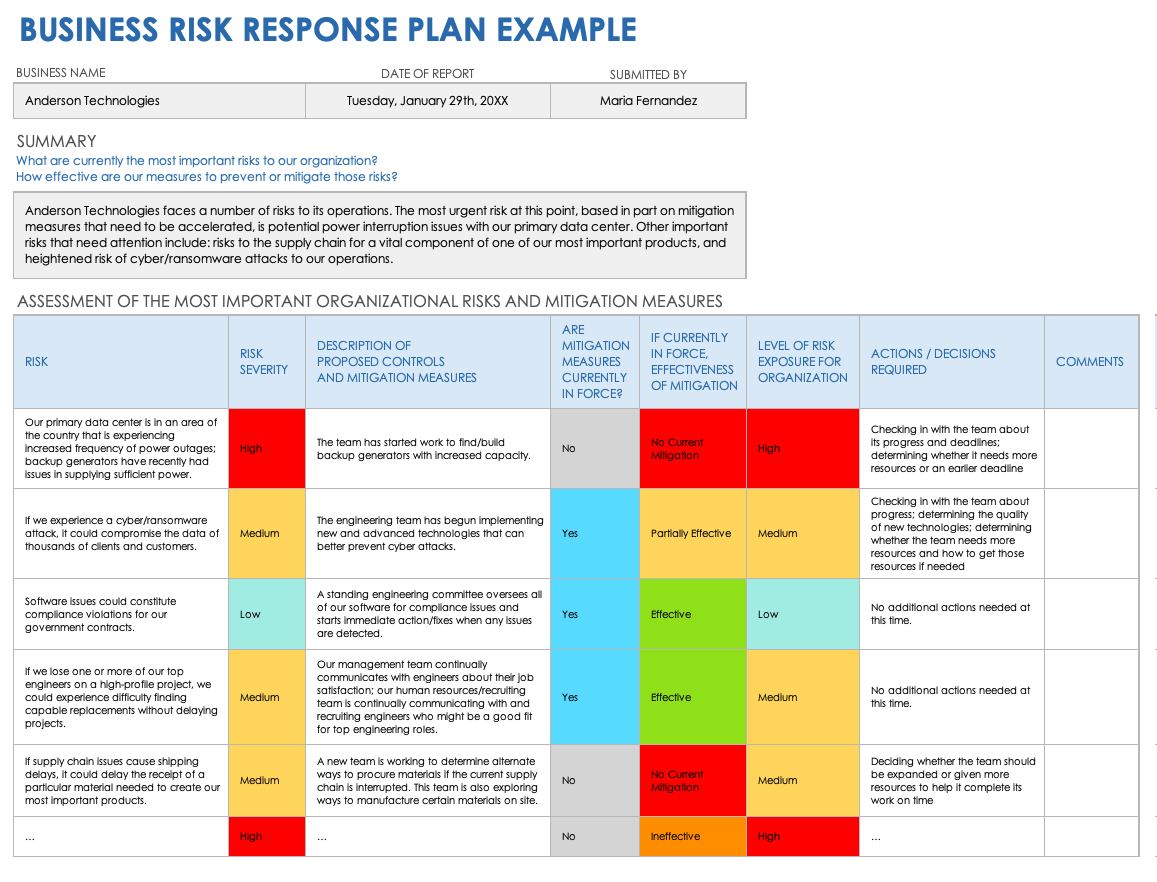

One tangible implication is its impact on regulatory capital requirements. As supervisors demand more granular risk reporting, Senfase provides auditable, real-time sensitivity metrics that support compliance with frameworks like Basel III and the EU’s Markets in Financial Instruments Directive II (MiFID II).

Firms using Senfase report reduced capital volatility and improved stress-test accuracy, directly lowering regulatory friction and audit burdens. Moreover, senior risk officers cite enhanced transparency in C-suite reporting as a key benefit—executives now engage with risk data through intuitive dashboards rather than complex reports, fostering culture-wide risk awareness.

Real-World Applications and Market Impact

The practical value of Senfase emerges in volatile environments.During the 2022 bond market dislocations triggered by aggressive Fed rate hikes, major asset managers deployed Senfase to rapidly assess interest rate sensitivity across pension funds and sovereign portfolios. By detecting duration mismatches weeks in advance, clients averted massive unrealized losses. Similarly, in emerging markets facing currency stress—such as Sri Lanka in 2023—Senfase’s real-time FX exposure analyzers enabled timely intervention, stabilizing liquidity and preventing sovereign debt spirals.

Another critical implication lies in its influence on investment strategy. Pension funds and insurance companies, traditionally risk-averse and conservative, now leverage Senfase’s scenario simulations to rebalance portfolios proactively. For example, pension schemes use Senfase projections to adjust longevity and inflation risk allocations, ensuring long-term solvency amid demographic and economic shifts.

“Senfase turns volatility from threat into strategized opportunity,” remarks Amara Nkosi, portfolio strategist at Horizon Investments. “Rather than avoiding turbulence, we use it to strengthen resilience.”

Senfase also plays a growing role in fintech innovation. Non-bank lenders and robo-advisors integrate Senfase modules to assess borrower sensitivity, pricing risk dynamically and tailoring loan terms in real time.

This shifts credit risk management from a one-size-fits-all model to personalized, adaptive lending—reducing default rates while expanding financial inclusion.

Challenges and Future Trajectory

Despite its advantages, Senfase adoption faces hurdles. Data quality remains paramount—garbage in, garbage out—requiring rigorous governance to ensure clean, timely inputs.Additionally, integrating Senfase into legacy systems demands significant IT overhaul and skilled personnel, creating entry barriers for smaller institutions. Regulatory clarity on model validation and output interpretation also lags behind technological progress, impacting cross-border deployment. Yet the momentum is clear.

As intermarket linkages deepen and climate-related financial risks factor into risk models, Senfase’s adaptive framework positions it as indispensable. Future iterations may incorporate climate stress tests, ESG sensitivity mapping, and quantum-enhanced modeling—extending its reach beyond traditional finance into holistic sustainability risk assessment. “Senfase isn’t just a tool; it’s a movement toward smarter, more adaptive financial ecosystems,” asserts Dr.

Torres. “The future of finance depends on our ability to sense, respond, and evolve—Senfase makes that possible.”

Senfase In Finance stands at the forefront of a new era—where risk is no longer a hidden liability, but a strategically managed asset. Its fusion of depth, agility, and foresight redefines resilience, transforming how markets anticipate and navigate uncertainty.

As volatility becomes the norm, Senfase offers not just protection, but confidence—investors, firms, and regulators alike.

Related Post

8009359935: Unlocking the Secret Powers Behind a Revolutionary Innovation

Camel Toe: The Hidden Pain That Slips Into Your Grip Without Warning

Master Galaxy Clicker: The Ultimate Guide to Dominating the Universe in Galaxy Clicker