Flight Overheads: The Invisible Engine Powering Skies, Costs, and Travel Uncertainty

Flight Overheads: The Invisible Engine Powering Skies, Costs, and Travel Uncertainty

Above the sprawling chaos of terminal gates and blinking departure boards, millions of travelers tread unaware: a small but mighty force shapes every flight’s economic and operational reality. This force is flight overhead—encompassing air traffic control fees, airport service charges, slot allocations, and regulatory levies that collectively form the hidden financial backbone of global aviation. Far more than booking fees or airport bolts, flight overheads determine airline profitability, route viability, and even ticket prices.

As airports grow busier and skies more congested, understanding these overheads becomes essential for industry insiders, investors, and conscious passengers alike. The economics of flight overheads are both complex and consequential. Each takeoff and landing triggers a cascade of charges—ranging from air traffic services to terminal usage and security fees.

Airlines do not pay a single flat overhead; rather, they navigate a layered system of regulated and discretionary charges that often vary by airport, region, and traffic volume. The International Air Transport Association (IATA) notes that overhead costs constitute 30–40% of total airline operating expenses, making effective cost management critical.

Deciphering the Components of Flight Overheads

Flight overheads are far from uniform; they break down into distinct, interrelated categories, each influencing airline strategy.Airport charges, the single largest component, include landing fees, parking charges, and infrastructure dues funded by passenger demand. These fees are often jurisdiction-driven: major global hubs like London Heathrow or Dubai International impose significantly higher rates than secondary airports aiming to stimulate growth. Slot allocations—time slots reserved for takeoffs and landings—represent another vital overhead.

In congested airspace, securing prime slots at hubs like New York’s JFK or Frankfurt Airport can translate into competitive advantages, sometimes bought, sometimes inherited through legacy rights. Beyond these fixed costs, operational overheads such as air traffic control services, navigation support, ground handling, and security protocols add significant complexity. Modern surveillance and communication systems, essential for safety and efficiency, require ongoing investment; ICAO estimates that radar modernization and satellite-based navigation upgrades alone cost airlines and governments billions annually.

Fuel surcharges—though volatile—also fall under this umbrella, fluctuating with global oil markets and geopolitical tensions. Finally, regulatory levies—including environmental taxes and passenger facility charges—are increasingly shaping the financial landscape. Carbon pricing mechanisms, such as the EU Emissions Trading System’s expansion to aviation, add another layer of compliance cost, pushing airlines toward sustainable optimization.

Real-World Impact: How Overheads Shape Travel Decisions The financial burden of flight overheads rarely disappears from the ticket; it manifests in pricing patterns familiar to every traveler. During peak seasons or when airports mark up fees—such as at Hong Kong International during holiday surges—passengers absorb surcharges baked into ticket costs. Carriers often designate “base fare” to exclude these overheads, creating transparency gaps but protecting profitability.

This practice reflects a grounded operational truth: overhead costs are unavoidable, but opaque pricing can fuel traveler frustration. “Airports and regulators treat overheads as investment in infrastructure and safety,” explains Dr. Elena Martinez, a transport economist at the Geneva-based International Transport Forum.

“But passing these costs forward isn’t just about revenue—it’s about maintaining the very systems that keep flight safe and efficient.” Regional disparities further highlight travel’s economic inequities. In emerging markets, high overheads—combined with underdeveloped infrastructure—can limit airline competitiveness, restricting connectivity. Conversely, in deregulated environments like North America, aggressive slot trading and network optimization help airlines mitigate costs, though at the risk of over-concentration on high-margin routes.

The rise of low-cost carriers has intensified pressure on overhead efficiency. These airlines minimize non-essential services, lightweight fleet designs, and streamlined ground operations to offset higher airport fees. Yet even LCCs face hidden costs: slot premiums at hubs or shifting leasing terms can squeeze margins unexpectedly.

Looking ahead, sustainability pressures will redefine overhead economics. As carbon pricing becomes global standard, previously optional environmental charges may become mandatory line items. Airlines adapting early—through fuel-efficient fleets, optimized routing, and partnerships with green infrastructure providers—will likely see reduced long-term overheads.

Ultimately, flight overheads are not just numbers on a statement—they are dynamic forces shaping the accessibility, cost, and resilience of global air travel. Understanding their layers illuminates the unseen architecture of the skies, revealing why every flight originates from a complex interplay of policy, infrastructure, and economics. As passengers board and depart, they navigate a system where invisible fees fund safety, innovation, and movement across continents—proof that even the quietest cost carries profound weight.

Related Post

Dani Speegle Married: Navigating Love, Identity, and Public Gaze in Modern Relationships

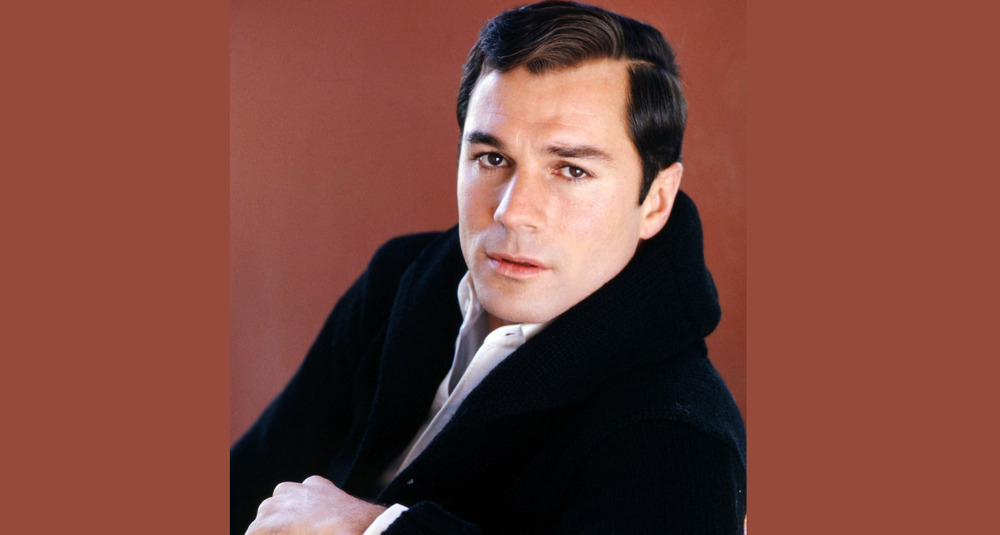

Was George Maharis Ever Married? The Untold Story of a Hollywood Heart

50 Court Street, Brooklyn: The Pivotal Heart of Williamsburg’s Cultural Evolution

Exploring The Truth Behind Jensen Ackles Divorce Rumors, Reality, and Relationships