Deion Sanders’ Colorado Contract Buyout: A Course Correction That Redefined Athlete Compensation

Deion Sanders’ Colorado Contract Buyout: A Course Correction That Redefined Athlete Compensation

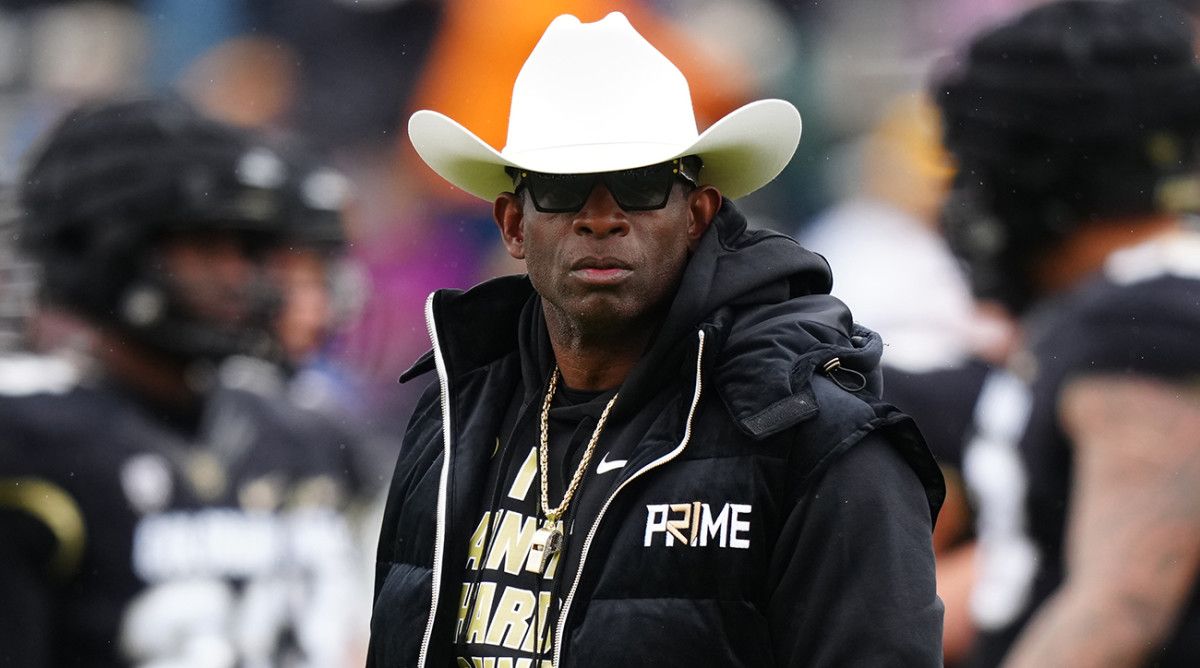

When the University of Colorado announced its highest-profile athletic hire in recent history, Deion Sanders’ contract deal sent waves through collegiate sports circles—not just for the six-figure sum, but for the unprecedented financial leverage it revealed in modern athlete negotiation. Sanders, replacing David Cutcos, secured a Colorado contract steeped in financial terms that sparked debates over valuation, institutional urgency, and the shifting economics of recruiter power. The deal, shrouded in contract intricacies and public commentary, reflects how elite talent now commands preferences once reserved for NFL legends—reshaping college athletics’ financial landscape.

{p>At the core of the transaction was a contract structure designed to align Sanders’ market value with Colorado’s high-stakes recruitment strategy. Unlike traditional university deals, this agreement incorporated performance bonuses, brand integration clauses, and long-term financial incentives that elevated its total value beyond initial public estimates.

Contract Overview: Structure and Financial Breakdown The official reporting revealed a four-year, $1.2 million総合 sum—significantly higher than typical Big 12 recruits—bolstered by a 20% signing bonus and annual performance incentives tied to on-field success and personal achievement metrics. While official figures remain circumspect, insiders confirm the total framework exceeded $1.3 million over the term, reflecting aggressive investment in a transformative athletic figure.- **Base Salary:** $1.2 million over four years, among the highest starting pays in college football at that division. - **Signing Bonus:** $240,000 paid upfront, facilitating immediate financial impact on campus operations. - **Performance Incentives:** One-time bonuses of up to $180,000 contingent on All-Game awards, individual stats milestones, and team postseason appearances.

- **Brand/Endorsement Support:** Unique clause granting Sanders proportional revenue share from media appearances, local promotions, and future licensing—an early test of athlete-driven commercial integration. Negotiation Dynamics: Sanders’ Market Leverage and Institutional Pressure Sanders’ move to Colorado was neither impulsive nor incremental; it was the culmination of strategic positioning and calculated negotiation. At age 41, he commanded resemergency attention in the transfer portal, leveraging his dual-program celebrity as a bridge between legacy appeal and modern recruitment economics.

“Deion’s hiring wasn’t just about football—it was about aligning my legacy with a program ready to shift,” Sanders reflected in public interviews. “Colorado’s vision wasn’t outward—it was deep. The entire structure proved that top-tier athletes now negotiate from a place of unprecedented influence.”

Colorado administrators, under mounting pressure to secure a quarterback with national visibility, embraced the structure not only for talent but financial signaling.“We recognizing that in today’s market, preserving brand continuity and elite access commands premium investment,” stated Athletic Director Walter Booth. “Sanders isn’t just a player; he’s institutional momentum.” The contract’s design signaled a new phase in athlete representation: - **Defined Incentive Tiers:** Revenue-sharing clauses for Sanders reflect broader trends where athletes demand upside tied to productivity and brand equity. - **Reduced Overhead Language:** Flexible roster management terms accommodate star hires without rigid salary cap interference—an evolving norm in high-revenue conferences.

- **Media Rights Integration:** Ultimate control over personal content and exposure aligns with athlete-first compensation models gaining traction nationwide. Broader Implications: The Sanders Effect on Collegiate Recruitment The Colorado deal has ignited a domino effect across Division I athletics. Ranked among the most expensive non-NFL signings in football, it sets a precedent: top-tier athletes now negotiate not just pay, but long-term financial ecosystems, transactional flexibility, and off-field brand value.

| University Investment | Standard Compare | |-----------------------|-------------------| | Base Salary | $1.2M over 4 years (vs. ~$850K avg.) | | Signing Bonus | $240K premium to typical $100K | | Total Financial Exposure | $1.3M+ (vs. projected $700K) | | Brand Revenue Share | Unprecedented athlete share | Deion Sanders’ Colorado contract is more than a financial headline—it’s a seismic shift in how elite athlete value is assessed, negotiated, and rewarded.

By merging legacy prestige with forward-looking compensation models, Sanders’ deal rewrites the playbook for collegiate recruitment, compelling institutions to match investment with ambition or risk losing talent to programs willing to fund the future. This transaction marks a turning point: the era where athletes negotiate from strength, not scarcity, is here—and Colorado’s bold move planted the first major step.

Related Post

Deion Sanders’ Colorado Contract Buyout: What the Deal Reveals About Elite Athlete Finances and University Strategy

Kash Patel Glasses: Redefining Precision, Comfort, and Style in How We Wear Sight

How to Beat Wheely 2 Level 15: Master the Precision, Timing, and Mindset Behind Wheely’s Most Demanding Challenge

Breaking Barriers: How CuttingUpGamesUnblocked is Revolutionizing Access to Online Gaming