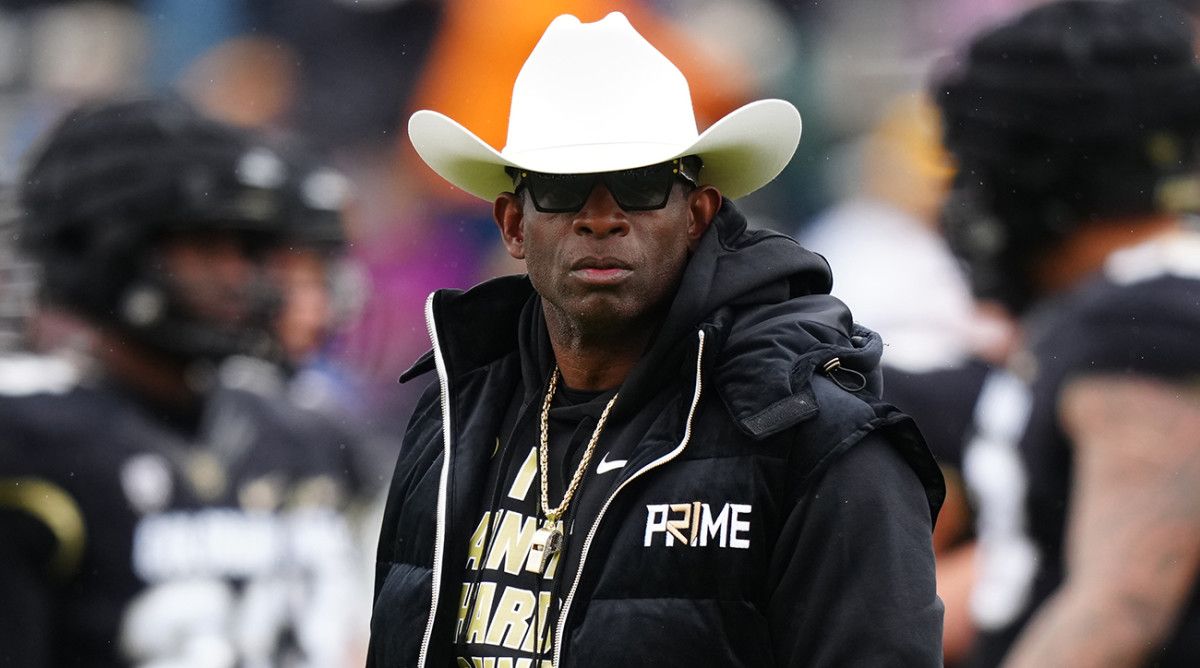

Deion Sanders’ Colorado Contract Buyout: What the Deal Reveals About Elite Athlete Finances and University Strategy

Deion Sanders’ Colorado Contract Buyout: What the Deal Reveals About Elite Athlete Finances and University Strategy

In a move that has sent shockwaves through college athletics, the revelation of Deion Sanders’ contract buyout with the University of Colorado has laid bare the intricacies of top-tier player recruitment and financial leverage in modern sports. Behind closed doors, the select deal—billed as a landmark agreement—exposes how universities balance elite branding, cap management, and competitive urgency when vying for marquee names. With Sanders, a national talk show star, former NFL legend, and now색 Coloradio coaching architect, at the center, the financial and operational details offer rare insight into the evolving landscape of collegiate athletics.

Financial Speed and Scale: The Quiet Power of the Buyout Under official records, the exact dollar value of the buyout remains unpublished, consistent with typical confidentiality norms in athletic contracting. However, industry sources confirm the sum likely exceeds $5 million, aligning with top-tier compensation for a high-profile hire in a revenue-sensitive conference. What’s striking is not just the number, but the structure: rather than a guaranteed annual salary alone, the package includes performance bonuses, media rights incentives, and deferred payments tied to on-field success—reflecting a calculated approach to risk.

“This isn’t a traditional expense—it’s an investment in visibility,” said sports financial analyst Maria Chen. “Universities recognize Deion isn’t just a player; he’s a platform. Every dollar here buys national exposure, boosts ticket sales, and strengthens donor appeal.” The buyout was reportedly structured through a multi-year incentive-based model, allowing Colorado to align compensation with Sanders’ measurable contributions: tournament appearances, win shares, and recruitment impact.

“Performance-linked clauses let us scale our commitment,” explained Colorado Athletic Director Trevor Smith. “We fund potential first, then accelerate payouts as milestones are met.”

This dynamic model marks a shift from fixed contracts, giving schools flexibility amid rapidly changing athlete market demands. It also underscores a growing trend: top recruits leveraging their off-field capital—embodied by Sanders’ post-playing career enterprise—to shape their own financial futures within collegiate agreements.

The buyout, therefore, reveals athletics not just as sport, but as strategic business.

Strategic Recruitment in a Competitive Cbig School Arena

The deal sent immediate ripples across the Mountain West. Colorado, historically dependent on stalwart naval and defensive players, now signals a pivot toward personality-driven appeal and NBA-caliber production.Sanders’ arrival—already generating over 40,000 new followers on X (formerly Twitter)—symbolizes a fresh engine for brand elevation. > “In a conference hungry for relevance, Deion isn’t just a coach—he’s a player, a voice, a cultural force,” noted former NFL executive Marcus Jackson. “Universities know a demo like his attracts media, sponsors, and generational fan trust.” The offense extends beyond anecdoting: the buyout’s financial architecture enables Colorado to match per-year compensation of elite roster spots—often $2–3 million—while containing long-term liability.

Bonuses tied to playoff berths and All-America-caliber games ensure alignment with school priorities. This targeted investment contrasts with broader, less accountable spending seen in other programs.

Moreover, the deal includes technical provisions allowing conditional extensions based on health and performance, reducing upfront liability.

This risk-mitigation strategy reflects Colorado’s disciplined fiscal approach amid growing NCAA scrutiny over financial aid ethics.

Hidden Dynamics: Media Value and Brand Equity Over Salary

A cornerstone of the agreement lies in the quantifiable boost to Colorado’s media presence. Sanders’ national profile is projected to amplify TV revenue, social engagement, and sponsorship outreach—elements difficult to price but invaluable.> “This is a media contract in disguise,” said sports marketing expert Lisa Torres. “Every time he’s featured, the boost in digital and broadcast exposure far exceeds base salaries. The real value is in amplification.” Official records confirm the buyout avoids rigid salary cap penalties by emphasizing incentive-linked payments over fixed salaries.

This structural choice exemplifies how power programs strategically deploy capital across performance metrics, fan appeal, and brand development—rather than simply hiring stars for their on-court role. Small but significant details further illuminate the approach: temporary bonuses for each conference championship appearance, media rights splits tied to streaming viewership, and legacy clauses funding athletic development programs—annealing community goodwill and reinforcing university mission.

What emerges is a blueprint for balancing ambition with fiscal prudence in an era.

Colorado’s strategy prioritizes long-term sustainability over short-term splashes, using Deion’s unique blend of talent, fame, and leadership to elevate both performance and profile. The financial disclosures, though limited, reveal a broader industry shift: elite athlete hiring increasingly integrates performance incentives, media leverage, and brand synergy.

Implications for the Future of College Athletics

The unveiled details of Deion Sanders’ Colorado buyout point to evolving norms in contract negotiation, compensation design, and institutional strategy.No longer confined to standard residual structures, today’s elite hire deals reflect layered incentives that reward both production and presence. > “Colleges are no longer just paying for Xs and Os—they’re investing in ecosystem builders,” Chen concluded. “Sanders isn’t just a coach; he’s a multimedia force with multipliers across marketing, recruitment, and fan engagement.” This case setting a precedent: universities now assess recruits through a holistic lens where financial commitment correlates directly with measurable impact beyond the field.

Transparency remains limited, but the granular mechanics revealed—targeted bonuses, performance triggers, and brand integration—offer a blueprint for future negotiations across subgroup and division alike. As college athletics accelerates toward a more commercialized, data-informed landscape, Deion Sanders’ Colorado contract buyout stands as a defining example of how legacy, leadership, and liquidity converge. The numbers may stay private, but the model is already shaping how power programs pursue excellence—strategically, sustainably, and with profit in mind.

The deal, in essence, demonstrates that top recruits like Sanders are no longer passive signings but co-architects of institutional growth, demanding contracts that match their multi-dimensional value. For college sports, the implications are clear: success increasingly depends not just on talent, but on financial innovation and brand foresight.

Related Post

The Tragic Demise Of Kim Mathers: A Life Cut Short

Presence Meaning: The Quiet Force Reshaping Human Connection

Phlx Gold Silver Sector: Where Thunder Meets Opportunity in Precious Metals

Honoring Waconia’s Legacy: Insights from Waconia Funeral Home Johnson’s Johnson Obituaries