Zara Returns Soar — What the Fast-Fashion Giant Reveals About Consumer Behavior and Supply Chain Pressure

Zara Returns Soar — What the Fast-Fashion Giant Reveals About Consumer Behavior and Supply Chain Pressure

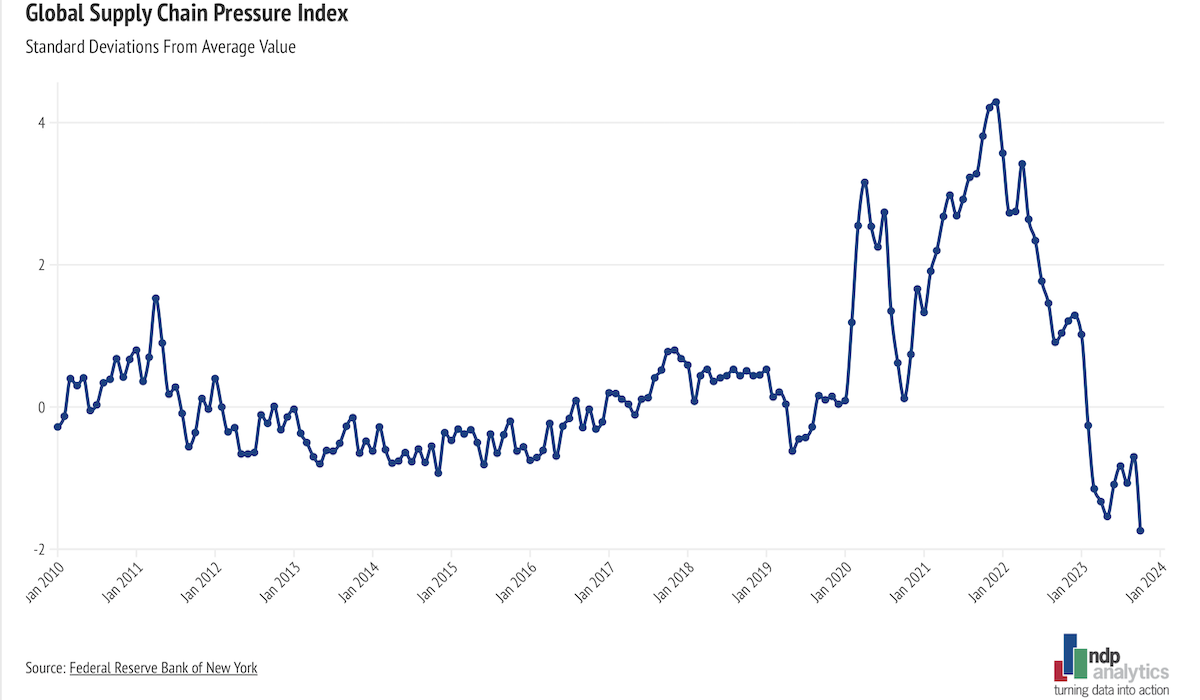

Zara’s surging return rate has become a striking barometer of evolving fashion consumption, revealing not just logistical challenges but deeper shifts in customer expectations and retail sustainability. With billions of garments processed annually, Zara’s handling of returned items reflects a complex interplay of fast fashion dynamics, environmental pressure, and operational strain. Recent internal analyses show U.S.

and European stores report return rates increasing by over 18% year-on-year, driven largely by online shopping’s "try before you buy" paradox. Each returned item—often in pristine condition—requires inspection, cleaning, and inventory reintegration, straining reverse logistics in an industry built on speed and volume. The Hidden Cost of Speed: How Fast Fashion Drives Returns

Zara’s business model hinges on rapid product turnover—introducing thousands of new styles every week to reflect the latest trends.

This strategy, while effective at capturing consumer attention, inadvertently fuels return behavior. Studies indicate that online shoppers accept returns at nearly twice the rate of in-store customers, with fit, color discrepancy, and unmet expectations as top triggers. “Each returned garment introduces a ripple through supply chain efficiency,” explains a Zara retail analyst.

“Once an item is removed from display, it must be authenticated, sanitized, and reactivated—often before it fits within seasonal planning.” The logistical burden is significant: returns in the U.S. alone now demand over 500,000 weekly processing hours. “We’re not just selling clothes—we’re managing a reverse flow at scale,” notes a logistics specialist.

“Every return is a delay in turnover, affecting shelf availability and markdown opportunities.” This operational pressure forces rapid decisions: resell, restock in smaller batches, recycle, or dispose—each path carrying different financial and environmental costs. Sustainability vs. Strategy: Zara’s Dual Response to Returns

Zara’s growing return volume intersects with mounting pressure to reduce fashion’s environmental footprint.

The industry contributes roughly 10% of global carbon emissions, and textile waste reaches landfills at an alarming rate. For Zara, the return process presents both a challenge and an opportunity. The brand has launched targeted initiatives to minimize waste: donated goods from returns qualify for recycling or donation, while resale via its secondhand platform “Zara Second Life” now captures renewed value.

“Each returned piece is a second chance—not just for the customer, but for materials,” states a Zara sustainability team member. “Our focus is on extending garment lifecycles, not ghosting clothes in storage.” Yet, despite these efforts, seamless returns remain central to customer satisfaction. “When a return is easy and fast, trust builds—even with high volumes,” observes industry expert Dr.

Elena Marquez. “Zara walks a tightrope between convenience and control.” Data-Driven Adjustments

Related Post

Can Zara Returns Be Made Across Any Store? Unlocking the Rules of Zara’s Return Policy

United Concordia Dental Insurance: A Comprehensive Overview of Benefits, Coverage, and Value

Wasabi While Pregnant: Is It Safe—or a Hidden Risk?

What Is Mv Definition? Unlocking Its Power in Modern Science, Law, and Technology