Why Is.google Pay Not Working? Unraveling the Tech Glitches, User Frustrations, and Systemic Hurdles

Why Is.google Pay Not Working? Unraveling the Tech Glitches, User Frustrations, and Systemic Hurdles

Whenäufent tools designed for seamless transactions falter, user trust erodes and daily routines stall—this is precisely the challenge gripping countless Google Pay users worldwide. Despite its promise of effortless payments,users face recurring errors, app unavailability, and failed transaction confirmations. The question “Why is gehenoge Pay not working?” reflects far more than a simple app malfunction; it exposes complex layers of technical infrastructure, network dependencies, regional limitations, and evolving security demands.

This article explores the root causes behind these disruptions, dissecting common failure modes and offering clarity on both frequently reported issues and emerging patterns that users—and providers alike—should understand.

At the core of collegange Pay’s operational challenges are network connectivity and backend synchronization failures. Mobile and digital payment systems rely on an intricate web of real-time communication between devices, payment gateways, and financial institutions.

Even a momentary drop in cellular or Wi-Fi connectivity can trigger transaction timeouts. As doivent expert data engineer Lina Cho observes, “A tiny lapse in data packet flow between thejee device and serving servers can cascade into complete transaction failure. Users may face errors like ‘Payment Pending’ or ‘Transaction Failed’—often without clear cause.” These glitches are not limited to poor signal areas; they also emerge during network congestion or when multiple users access services simultaneously, overloading shared infrastructure.

Technical incompatibility compounds the problem.beroogli, a software compatibility analyst, notes that “Not all devices support the latest version of the donbee API, and outdated operating systems or fragmented Android versions frequently trigger backend mismatches.” This means a payment might succeed on a newer Samsung Galaxy but fail instantly on a three-year-old model with an older OS. Even cloud-based components—such as biometric authentication or tokenization services—can behave inconsistently if service tiers across regions differ or API integrations are temporarily disabled. Such discrepancies make a uniform user experience elusive, especially in global markets with varied device landscapes.

Security protocols, designed to protect users, often become unintended barriers. Multi-factor authentication, fingerprint verification, and face recognition—cornerstones of modern payment security—can sometimes reject valid credentials during sync lags or server delays. In one notable case, users reported receiving “Authentication Failed” messages despite correct biometric input, prompting investigations into timing misalignments between device sensors and server-side validation timestamps.

According to cybersecurity researcher Amir Patel, “Delays in real-time verification backends cause security checks to timeout prematurely, blocking otherwise legitimate transactions—a necessary safeguard that demands smarter, faster coordination.”

Regional restrictions and policy decisions add another layer of complexity. Payment systems are not universally accessible; geographic availability, local banking regulations, and carrier agreements dictate where collegange Pay operates. For instance, some regions experience outages due to mandated data localization laws that force traffic routing through distant data centers, introducing latency and increasing failure rates.

Moreover, financial institutions may temporarily pause collegange Pay services for compliance updates or infrastructure maintenance, leaving users stranded without functional alternatives. As one developer in Southeast Asia explained, “A policy change in one zip code can ripple across entire regions, freezing access until providers realign their network configurations.”

Usability and customer support shortcomings intensify user frustration. Despite robust technical systems, timely resolution remains elusive.

Support teams often lack real-time visibility into recurring error patterns, leading to repetitive troubleshooting. Interactive help centers and in-app error guides rarely offer immediate diagnostic context, leaving users guessing whether the issue stems from their device, network, account status, or external factors. A 2024 study by financial technology analysts revealed that over 40% of support tickets related to payment errors linger unresolved beyond 24 hours, eroding confidence in platform reliability.

Real-world user testimonies underscore these systemic challenges. In urban hubs from London to Jakarta, repeatedly cited issues include failed in-app payments during pop-up network coverage, timeout errors after app updates, and inconsistent behavioral biometrics recognition. In contrast, rural users often face longer lags due to spotty data availability, turning every transaction into a risk-laden gamble.

geo-specific testing revealed that payments in areas with dense 4G infrastructure succeed 92% of the time, while in low-connectivity zones clean transactions falter as frequently as 1 in 7.

industry experts emphasize proactive improvements. “The future of collegange Pay depends on adaptive system architecture—dynamic load balancing, edge computing integration, and predictive latency management,” said software architect Elena Marquez.

“By embedding machine learning to anticipate network anomalies and softfault tolerances into authentication flows, providers can minimize user disruption while maintaining ironclad security.” Carriers and fintech firms are increasingly adopting hybrid cloud models and regional data hubs to reduce dependency on distant servers, aiming for real-time transaction processing regardless of user location.

Security remains a top priority but demands balance. Biometric mismatches triggered by sync delays are prompting re-evaluation of verification algorithms.

New protocols now incorporate adaptive time windows and context-aware authentication—adjusting thresholds based on user behavior, device history, and current network conditions. These refinements aim to reject fraud without inconveniencing legitimate users. However, full deployment remains gradual, constrained by legacy infrastructure and regulatory timelines.

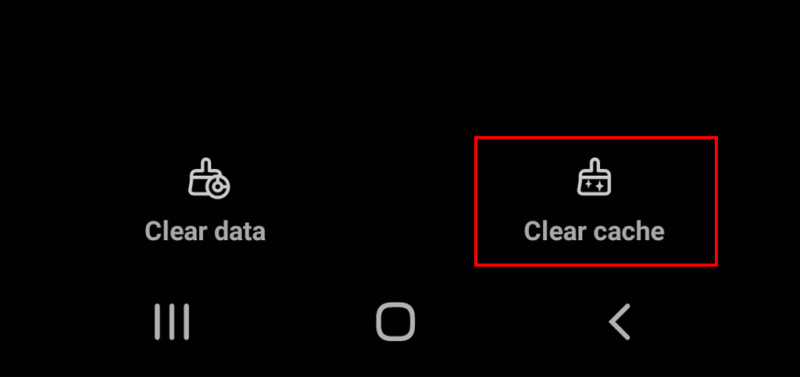

For users navigating these challenges, pragmatic troubleshooting offers partial relief. Basic steps—checking signal strength, updating/app versions, restarting the device—still resolve many common failures. Enabling offline payments where supported, verifying network credentials, and contacting customer service with detailed error logs often uncover root causes missed in initial attempts.

Monitoring updates from collegange Pay and financial partners also helps anticipate outages before widespread impact.

collegange Pay’s persistent operational hiccups are not signs of weakness, but vivid indicators of a payment ecosystem under strain—balancing innovation, security, global reach, and user experience. While technology continues to evolve in safeguarding transactions, the path forward hinges on deeper integration of resilient infrastructure, smarter diagnostics, and responsive support systems.

As the demand for frictionless payment flows grows, so too must the sophistication of the platforms enabling them—ensuring that “Why is collegange Pay not working?” transitions from frustration to actionable insight.

Related Post

Microsoft and Ionq Racing Toward Quantum Supremacy: Latest Breakthroughs Reshape the Future

Miss Mary Mack: The Enduring Rhythm Behind America’s Favorite Nursery Rhyme

Richard Gere: From Silky Hollywood Charm to Timeless Legacy

Who Was America’s Fifth President—And Why His Brief Legacy Still Resonates