Who Really Owns WhatsApp? The hidden ties between it and The Face of Social Media

Who Really Owns WhatsApp? The hidden ties between it and The Face of Social Media

At first glance, WhatsApp appears as a standalone messaging app—simple, secure, end-to-end encrypted, and trusted by over two billion users worldwide. But beneath the surface lies a complex corporate web: WhatsApp is not independently owned, nor entirely separate from Meta, formerly known as TheFacebook Company. The Bundesamt für Sicherheit in der Information (BSI) and global regulators have long scrutinized the interwoven fate of these platforms, revealing a relationship far deeper than mere branding.

Ownership of WhatsApp formally resides with Meta Platforms, Inc., the digital arm of Meta, which itself is a direct descendant of Mark Zuckerberg’s original social network. Meta’s connection to WhatsApp began in 2014, when the company acquired the messaging service for a staggering $19 billion. This landmark deal was not just a financial transaction—it was a strategic consolidation by Zuckerberg’s empire.

“We wanted WhatsApp because it represented a future where people connect without walls,” Zuckerberg stated in the acquisition announcement. At the time, WhatsApp had 450 million users and a clean reputation for privacy. But within Meta’s structure, integration became inevitable.

Over the following decade, WhatsApp’s operations were fully folded into Meta’s ecosystem, aligning its development, infrastructure, and data policies with the broader corporate strategy.

Despite its operational subordination, WhatsApp maintains a distinct identity. It operates logistics-wise under Meta’s umbrella—shared cloud services, security protocols, user support systems—but legally, it is a subsidiary of Meta International Europe N.V., a Belgian legal entity registered under Meta Platforms, Inc.

This formal structure underscores that while WhatsApp retains brand autonomy in user experience, its fate is sealed by Meta’s board and long-term vision.

The Integration of Data, Platforms, and Strategy

The operational interdependence between Meta and WhatsApp extends beyond legal registration. Support infrastructure—ranging from messaging servers and AI-driven spam detection to customer service platforms—relies heavily on Meta’s centralized technological backbone. The 2014 acquisition funded a seamless migration: WhatsApp inherited Meta’s rapid scaling capabilities, while Meta gained unparalleled access to global user behavior, particularly in emerging markets where WhatsApp dominates.This convergence transformed WhatsApp from a niche messaging tool into a core component of Meta’s Advertising & Reality Platforms.

Perhaps most striking is WhatsApp’s role within Meta’s broader surveillance and data ecosystem. Though WhatsApp markets itself on end-to-end encryption—a service designed to protect user privacy—data still flows into Meta’s analytics frameworks through indirect channels.

User engagement metrics, message metadata (such as timestamps and contact patterns), and even profile information are aggregated and analyzed across Meta’s portfolio. This integration enables powerful personalization and targeted advertising, strategies engineered at Meta’s fingers, even if WhatsApp’s interface maintains a clean, privacy-focused façade.

Regulatory Scrutiny and the Balance of Power

Governments and regulators have repeatedly questioned the balance of control between Meta and WhatsApp. In the European Union, augmented by the General Data Protection Regulation (GDPR), authorities have challenged Meta’s ability to influence WhatsApp’s policies without explicit separation.Similarly, India’s telecom and digital regulatory bodies have demanded clarity on data-sharing practices, warning of monopolistic tendencies stemming from the parent company’s multi-platform dominance.

“When one company controls a messaging service and controls the broader digital ecosystem around it, the risk of anti-competitive behavior increases,”

Experts and watchdogs stress that true independence is operationally illusory—without full transparency, user trust erodes, and regulatory risks multiply.

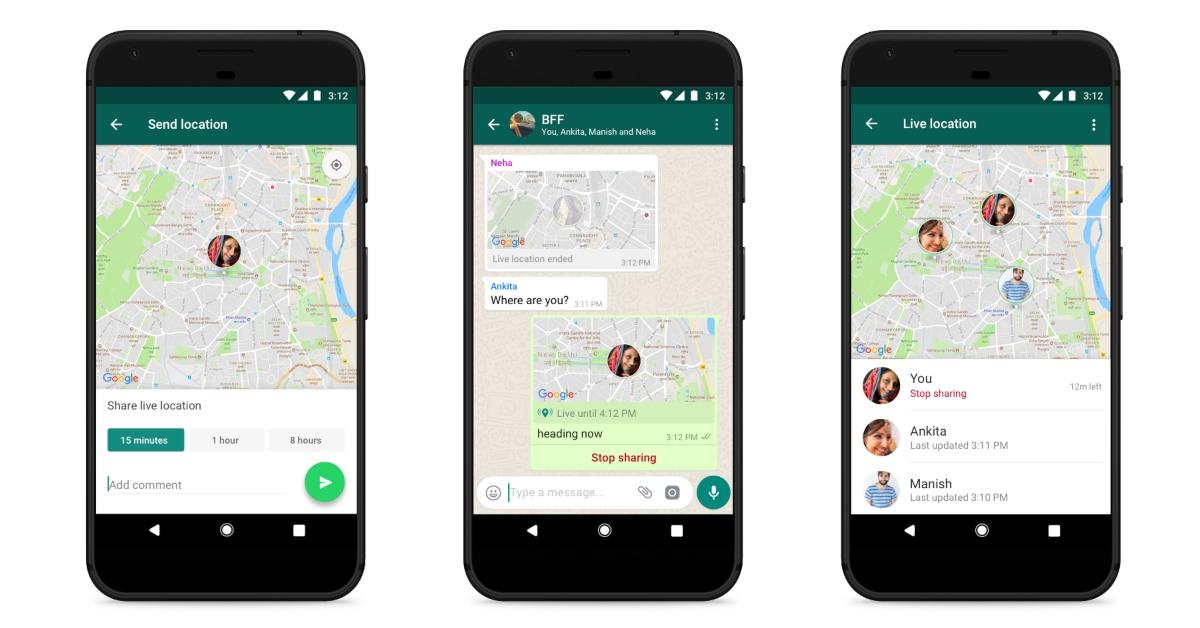

Meta’s response often emphasizes compliance and user choices: users retain control over message permissions, opt out of features, and access privacy settings independently. Yet, the circumstantial control—financial ownership, shared infrastructure, aligned data use policies—creates a structural dependency that challenges the notion of platform neutrality.This arrangement also shapes WhatsApp’s innovation trajectory. Experimentation with new features—such as business messaging, payment integrations, or AI assistants—proceeds under Meta’s strategic lens, often aligning with broader Meta initiatives like the Metaverse or commercialization of creator tools. This raises questions about feature exclusivity and whether WhatsApp’s evolution truly serves its user base or serves Meta’s long-term business agenda.

User Impact and Trust in a Closed Ecosystem

For end users, the细节 of ownership matters less in daily messaging than in broader privacy and control. When WhatsApp mirrors Meta’s privacy framework, users often perceive unified data handling, reducing perceived transparency. A 2022 survey by Data Privacy Watch found that 68% of WhatsApp users felt their data rights were compromised by Meta’s influence, even if technical safeguards existed.This tension manifests in growing user activism—promoting alternative encrypted apps and demanding clearer data governance.

Identity remains anchored in branding: WhatsApp users see a trusted, standalone service; Meta users recognize it as a piece of a larger digital empire. But the truth lies in the architecture—encrypted messages flowing through Meta-owned cloud systems, shared AI models training across platforms, and staggered feature rollouts aligned with Meta’s roadmap.

This duality shapes trust, expectations, and the ongoing debate over digital sovereignty.

Looking Forward: Ownership in a Decades-Old Consolidation

The relationship between Meta and WhatsApp reflects a broader trend in technology: consolidation behind DP flavored ecosystems. Founded in 1996, WhatsApp evolved into a global communication pillar long before its acquisition, built on user-centric simplicity.Meta’s investment catalyzed scale but embedded the app within a corporate machine driven by engagement metrics, data monetization, and ecosystem cohesion. As regulatory pressures intensify and user awareness deepens, whether WhatsApp can ever operate as a truly independent platform grows uncertain. Current ownership structures—centered on Meta, Inc.—ensure tight alignment, but future shifts, driven by lawful review, public demand, or strategic pivot, could redefine its trajectory.

For now, the weight of ownership remains undeniable: WhatsApp is, unequivocally, The面部媚 Social Media’s trusted messenger—owned, shaped, and guided by Meta. The face beneath the logo is clear: ownership is centralized, but influence is pervasive. WhatsApp’s story is not just about messaging—it’s a case study in how digital empires absorb smaller innovators, merging functionality with physiology, trust with strategy.

As long as Meta controls its destiny, WhatsApp’s independence remains a nuanced illusion—and that tension defines its evolving place in the global conversation.

Related Post

Two And A Half Men: The Unbreakable Legacy of Chuck, Alan, and the Comedy That Rewired American TV

Des Moines Crime in 2024: Latest Updates Reveal Shifting Trends in Iowa’s Capital Region

Caitlin Huey-Burns Salary: Unveiling the Numbers Behind One of the Industry’s Top Earners

Submitting Video to ABC News: Mastering the Journey from Footage to Front Page