What Does EOM Mean in Finance? The Critical Timestamp Shaping Markets and Decisions

What Does EOM Mean in Finance? The Critical Timestamp Shaping Markets and Decisions

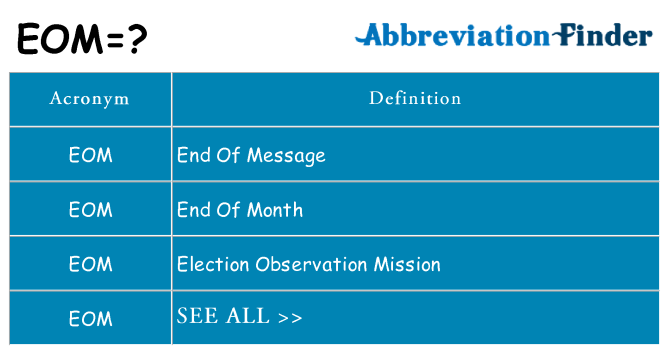

EOM, a concise yet pivotal acronym in modern finance, stands for “End of Market.” Unlike vague temporal references or colloquial shorthand, EOM carries precise technical weight in financial systems, serving as a standardized timestamp that anchors trading activities, settlement processes, and risk assessments across global markets. In an era defined by algorithmic precision and millisecond decision-making, understanding EOM’s role reveals how financial infrastructure operates with uncanny accuracy and coordination. At its core, EOM denotes the official close of a trading session at a specific location—typically a stock exchange, commodities market, or foreign exchange hub—triggering a range of automated and manual processes essential to market function.

For example, when Wall Street’s New York Stock Exchange closes at 4:00 PM Eastern Time, EOM marks not just the end of active trading but the full operational cutoff after which no new orders can be executed, positions cannot be adjusted, and settlements begin in earnest. This seemingly simple mark carries monumental implications. In derivatives trading, EOM signals the “card well” cutoff time, when positions must be locked in before final settlement.

Missing EOM can disrupt automated strategies, trigger margin calls, or lead to settlement failures—potentially costing institutional investors significant sums. As senior trading architect Marcus Lin of Quantitative Finance Solutions notes, “EOM isn’t an exaggeration or typo; it’s a hard deadline that synchronizes the entire ecosystem. One missed EOM entry can create a domino effect across clearinghouses and custodians.”

The Mechanics Behind EOM: How Markets Operate Around the Close

The EOM timestamp governs multiple critical functions across financial markets.While variations exist by exchange and instrument, the fundamental rhythm remains consistent: - **Trading Cutoff Window**: EOM establishes the final moment for placing orders on primary exchanges. Extended hours or after-hours sessions may still recognize EOM as the fashionable close, even if trading continues postclock, ensuring continuity in order flow and price discovery. - **Settlement Timing**: For equities, bonds, and certain derivatives, EOM aligns with the represented time of settlement—marking the instant when ownership and funds transfer.

In equities, physical settlement occurs T+2 (two business days after trading), making EOM a legal and operational anchor. - **Risk Management Triggers**: Many risk engines pause real-time exposure calculations as EOM approaches. This freeze halts new positions, halts margin calls on open trades, and flags positions requiring final validation before settlement.

- **Data Archival and Compliance**: Regulatory bodies and auditors rely on EOM timestamps to verify transaction integrity. Precise EOM records ensure compliance with reporting rules under frameworks like MiFID II and SEC regulations, minimizing audit risk. Examples illustrate EOM’s downstream impact: futures contracts settle at or before EOM, determined by the exchange’s actual close.

Commodity markets, such as crude oil traded on NYMEX, use EOM to align delivery dates and custody markings. Failing to close positions before EOM can result in rolling over contracts at higher or unfavorable terms—especially in volatile environments where intraday swings are sharp.

EOM Across Asset Classes: A Universal Benchmark for Discipline

Though EOM originated in equity markets, its application now spans nearly every segment of financial infrastructure.Each asset class interprets and applies the concept differently, yet universally with the same purpose—to close transactions decisively. In equities, EOM at a “fashionable close” (earlier than the official cutoff, when volume remains meaningful) is common practice, especially in after-hours trading. Institutional investors use EOM lock-up periods to finalize portfolio adjustments and avoid unwanted exposure post-closing.

Bond markets rely on EOM to define settlement times, particularly for callable and structured notes where embedded options are sensitive to exact settlement dates. Missing EOM in bond clearing can result in inaccurate coupon or principal payments. Foreign exchange markets, operating 24/5, recognize multiple EOM windows—one per active trading region (e.g., London, New York, Tokyo).

Each EOM triggers settlement synchronization across time zones, ensuring global clearinghouse alignment and reducing counterparty risk. Even in decentralized finance (DeFi), where settlements occur via blockchain smart contracts, EOM-like timestamps validate transaction finality—demonstrating its lasting relevance across both traditional and emerging financial architectures.

“EOM is the silent guardian of market integrity,”* says Dr.Elena Torres, financial systems analyst at the Global Markets Institute. *“It’s not about spectacle—it’s about ensuring every trade, every settlement, begins with a clear, unambiguous close time.”

Related Post

Aaron Doughty’s Informal World: Age, Height, and Personal Life Revealed Through His YouTube Journey

Depth Strider Enchantment: The Ultimate Guide to Unleashing Lightning-Fast Aquatic Navigation in Minecraft at Max Level

Bun B’s Height: The Facts Behind the Oddity That Defined a Rap Icon’s Presence

Norman Character Unveiled: The Character Behind the name That Speaks Across Time