Wedding Finance Options: Your Guide to Funding the Big Day Without Breaking the Bank

Wedding Finance Options: Your Guide to Funding the Big Day Without Breaking the Bank

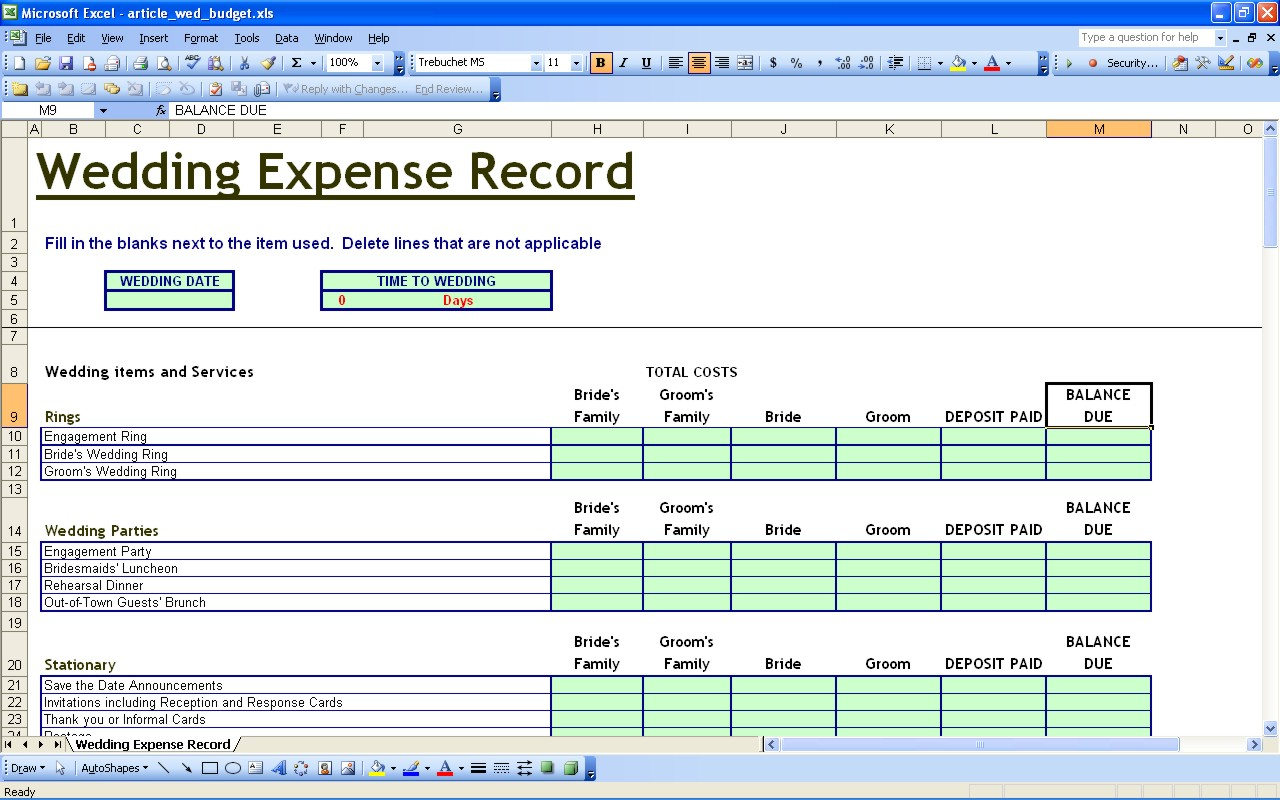

When planning a wedding, the emotional weight of the occasion often collides with the harsh reality of mounting costs—many couples find themselves buried under deposits, venue payments, and vendor contracts long before the ceremony begins. With average wedding expenses exceeding $30,000 in the U.S., securing a clear, manageable financial path is not just advisable—it’s essential. This guide lays out the full spectrum of wedding finance options, empowering couples to navigate budgets, loans, financing tools, and strategic planning with confidence and clarity.

Understanding the financial landscape starts with recognizing that weddings are both personal milestones and significant financial commitments. Modern couples face diverse funding models, each suited to different lifestyles, priorities, and financial circumstances. From personal savings and family support to loans, crowdfunding, and innovative financing apps, the available tools reflect evolving wedding expectations—and how to afford them within means.

One of the most straightforward approaches remains self-financing, where couples allocate savings specifically for the wedding. “Dedicating a portion of your overall wedding budget—20% to 30%—early helps prevent last-minute strain,” advises financial planner Sarah Chen. “This disciplined approach keeps stress low and ensures key elements like the venue and photographer are secured on time.” Wise budgeting prioritizes core values—whether a destination resort, a live band or a vibrant open-air ceremony—so funds direct to what matters most.

Loans: When to Consider Financing Your Vision

For couples unable to cover costs solely through savings, loans present a viable path. Traditional wedding loans, personal loans, and home equity lines of credit (HELOCs) are common choices. While interest rates and repayment terms vary, these options allow unfettered booking power—especially useful for destination or elaborate weddings where advance deposits are mandatory. - **Traditional Wedding Loans**: Specialized lenders offer packages tailored to wedding expenses, often with fixed terms and rates.- **Personal Loans**: Available through banks or online platforms, these come with flexible terms but variable rates tied to creditworthiness. - **HELOCs**: Ideal for homeowners with significant equity, these lines offer large sums at low interest but require collateral and long repayment periods. “It’s critical to shop rates and understand the total cost of debt,” cautioned Amir Patel, a wedding finance consultant.

“Never overlook fees or prepayment penalties—these can drastically increase net expenses.” Loans extend access to lavish venues and premium services but require careful repayment planning to avoid long-term financial burden.

Crowdfunding and Peer Support: Harnessing Community for Wedding Funds

For many, crowdfunding has emerged as a popular, flexible financing tool. Platforms like GoFundMe or WeddingWire’s financing section enable couples to solicit donations from family, friends, and even wider networks.This option demystifies funding by turning the wedding into a shared celebration where loved ones contribute to a single goal. - **Transparency in Offering**: Successful campaigns share clear breakdowns of expenses, demystifying costs and building trust. - **Recognition and Gratitude**: Publicly acknowledging contributors—not just material gifts—strengthens community bonds and often inspires larger support.

- **Limitations**: Over-reliance risks strain or perceived exploitation; responsible use includes setting realistic goals and setting boundaries. “Crowdfunding works best when paired with personal effort—live events, heartfelt appeals, and consistent updates turn passive donors into active participants,” says wedding expert Elena Flores. “It’s about connection, not just collection.”

For those wary of borrowing or asking others for help, rental packages and phased planning offer alternative strategies.

Renting décor, attire, or equipment—rather than buying—reduces upfront outlays. Similarly, spreading the wedding planning over 12–18 months allows incremental funding, easing the financial shock of peak expenses during peak seasons like summer.**

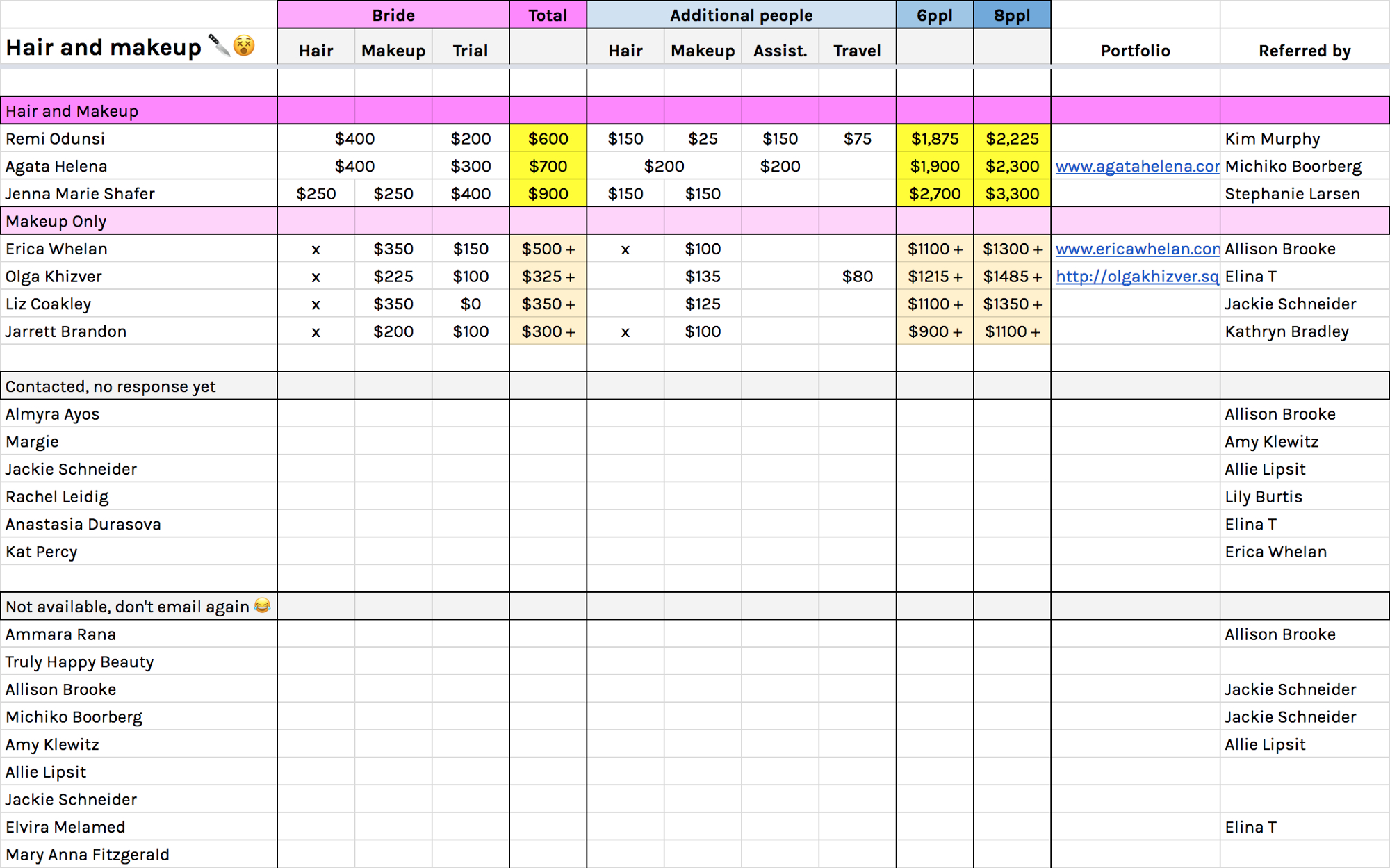

Innovative Financing Technologies: Apps and Platforms Redefining Wedding Budgeting

The rise of mobile apps and online platforms is transforming wedding finance, placing powerful tools at couples’ fingertips. Apps like Mint, Trello, and specialized solutions such as Minted or The Knot integrate budgeting, vendor research, vendor negotiation, and collaborative financing into user-friendly interfaces.- **Real-Time Expense Tracking**: Automated tools sync with bank accounts to monitor spending, flag excesses, and adjust allocations dynamically. - **Vendor Negotiation Support**: Some platforms offer price comparison and historical data to empower smarter bargaining, lowering effective costs. - **Wallet Sharing and Milestones**: Features like shared funds and progress trackers keep couples and partners aligned on spending.

“We’re seeing a shift toward proactive financial management,” notes Chen. “Apps turn abstract budgets into actionable insights, making it easier to stay on track without constant stress.” This tech-driven transparency preserves the spirit of celebration rather than letting finance overshadow meaning.

Tax Advantages and Professional Guidance: Smarter, Legal Funding Strategies

Understanding tax implications can further optimize wedding financing.While gifts and donations are generally not tax-deductible, certain pre-wedding expenses—such as a portion allocated to purchased merchandise or customized goods—may qualify for limited deductions depending on jurisdiction and intent. Consulting a tax professional or financial advisor ensures compliance and maximizes savings. Equally important is professional guidance.

Certified wedding planners, financial planners, and tax specialists bring expertise that prevents costly missteps. “A trusted advisor brings objectivity, helping couples separate emotional decisions from financial reality,” says Flores. Whether negotiating vendor contracts or choosing the optimal loan, their support transforms complexity into clarity.

再生:This guide reveals that wedding finance is no longer a single choice between cutting back or borrowing—it’s a multifaceted strategy demanding planning, transparency, and smart tools. From personal savings and loans to crowdfunding and cutting-edge apps, modern couples have unprecedented options to fund their dream wedding without financial overload. The key lies in matching financing tools to individual values, timelines, and budgets—ensuring the ceremony reflects both vision and fiscal responsibility.

With disciplined budgeting, strategic use of available resources, and informed decision-making, a lavish, unforgettable wedding remains not just a dream, but a well-executed reality.

Related Post

Pictures Of A Wagon Train: The Backbone of America’s Frontier Migration

Boost Your Business with Pseidigitalse Solutions: The Digital Edge That Drives Growth

Estrategias Militares Y Secretos Revelados: Descifrando Tácticas Clásicas y Cómo la Tecnología Moderna Está Reinventando la Guerra

Freddie Highmore: From Boy Star to Jason Bourne — The Unbreaking Arc of a Versatile Prodigy