Vencimiento IVA El Salvador 2025: Key Dates Every Taxpayer Must Know by Year-End 2025

Vencimiento IVA El Salvador 2025: Key Dates Every Taxpayer Must Know by Year-End 2025

The 2025 tax landscape in El Salvador is unfolding under strict deadlines governed by the country’s Vencimiento del IVA — the official deadline for annual tax filings and compliance. As 2025 approaches, tax authorities are sharpening focus on critical dates that businesses and individuals cannot afford to miss. Understanding the key deadlines tied to the Iva vencimiento enables timely preparation, avoids penalties, and ensures uninterrupted operations in El Salvador’s evolving fiscal environment.

For El Salvador’s 2025 fiscal year, the official Vencimiento del IVA — the deadline for submitting Value Added Tax declarations and finalizing filings — is scheduled for June 30, 2025. This date marks the final milestone of the annual tax cycle, requiring all registered taxpayers to file their IVA returns within 30 days after the calendar year ends. Missing this deadline triggers substantial fines and interest charges, making proactive planning essential.

The importance of timing is underscored by El Salvador’s digital tax framework, which integrates automated reporting and electronic submission via the country’s SAT (Servicio de Administración Tributaria) portal.

Tax agencies now enforce strict online compliance, meaning that the Vencimiento term closes precisely 30 calendar days after December 31, not a working week-end. Taxpayers must finalize their accounting records and submit via the official platform before noon local time to avoid processing delays.

Critical Interim Dates: Pre-Filing Markers and Sanctions

To manage the tax year effectively, several pivotal dates precede the June 30 deadline, each with distinct implications. Key milestones include: - January 31, 2025: Income Reports Due: Taxpayers must submit preliminary income declarations and value-added tax accumulation for the first quarter.Failure to file by this date disrupts annual reconciliation and may trigger provisional assessments. - April 30, 2025: Quarterly Reconciliations Required: Quarterly financial statements and IVA reclaimed balances must be reconciled and submitted to prevent discrepancies that delay full-year filings. - May 31, 2025: Incomplete Filings Subject to Penalties: Any return filed late, even partially, incurs preliminary fines of 5% of outstanding tax owed, with escalation possible if not corrected.

“The Government of El Salvador ties enforcement tightly to transparency,” notes Dr. Elena Mendoza, tax compliance expert at the Universidad Centroamericana. “Every taxpayer must treat the Vencimiento IVA not as a formality, but as a legal obligation with real-time consequences.”

Penalties and Enforcement: Costs of Delay in 2025

Non-compliance with the Vencimiento IVA creates a cascading financial burden.Once the 30-day window ends, the SAT automatically escalates outstanding balances with interest rates rising from 0.25% daily to 1.5% after 90 days. Penalties begin at 5% of the unpaid IVA amount and increase with each week of delay, reaching up to 15% if not resolved within six months. Core Penalty Escalation Timeline: - 31 days past due: 5% daily interest on unpaid IVA - 60 days: 10% penalty - 90 days: 15% penalty, potential suspension of tax registration - 180 days: Automatic collection by SAT with asset garnishment possible These measures reflect El Salvador’s shift toward rigorous tax administration under President Bukele’s fiscal modernization push.

Taxpayers caught short risk not only fines but also reputational damage and restricted access to formal economic channels.

Digital Submission: Streamlining the Vencimiento Process

To ease compliance, El Salvador’s SAT has expanded online filing via its secure portal, reducing processing time from months to days. Taxpayers must register their business in the Sistema de Administración Tributaria (SAT-Sistema), a requirement for all IVA filers starting in 2025.Using this digital route minimizes errors, ensures audit trails, and enables real-time tracking of filing status. “Electronic submission drastically cuts administrative friction,” says SAT spokesperson Hugo Rivera. “It allows us to verify data automatically, flag inconsistencies instantly, and keep the process transparent—benefiting both authorities and compliant businesses.”

Importantly, discrepancies detected post-submission—such as missing documentation or mismatched figures—trigger editorial reviews, potentially extending the effective deadline by up to 10 business days, provided taxpayers submit corrected filings before final closure.

This grace period, however, applies only to honest mistakes, not deliberate evasion.

Best Practices for Timely Vencimiento del IVA Compliance

Staying ahead of the June 30, 2025, deadline demands disciplined preparation. Experts recommend several actionable steps:- Cross-verify accounting software data with pending tax reports weekly.

- Engage certified tax professionals early to validate quarterly filings and identify high-risk entries.

- Use SAT’s electronic filing tool demo versions to test submissions before official submission.

- Maintain digitized records of invoices, receipts, and payments to expedite reconciliation.

- Set internal alerts 7–10 days before each key date to monitor progress.

“Delays cascade—so we reset our timelines monthly and audit every return rigorously.”

Global Context and Future Outlook

El Salvador’s Vencimiento IVA framework aligns with regional trends toward digital tax enforcement and fiscal transparency. While March 2025 introduced minor adjustments to IVA rates and reporting formats, the core deadline structure remains unchanged, underscoring institutional consistency. As 2025 closes, weekly inquiries at SAT offices reveal widespread concern—not fear—driven by accessible guidance and extended digital support.El Salvador’s government continues to invest in public awareness campaigns, leveraging TV, social media, and local workshops to demystify the process. This proactive outreach, paired with strict dates, fosters a culture of ownership among taxpayers. For 2026, analysts expect no step changes—keeping June 30, 2026, the definitive Vencimiento IVA date for another five years, signaling stability under the current system.

In summary, the Vencimiento IVA El Salvador 2025 is not merely a date on a calendar—it’s a precise, enforceable milestone anchoring the nation’s tax compliance ecosystem. By understanding key dates, mastering digital procedures, and acting decisively, businesses secure their financial health and institutional trust in El Salvador’s evolving economy.

Related Post

Unveiling Orion Christopher Noth: Discoveries and Insights That Fuel Unstoppable Growth

Denver Airport Code: What Denver International Airport’s String Reveals About Modern Aviation Identity

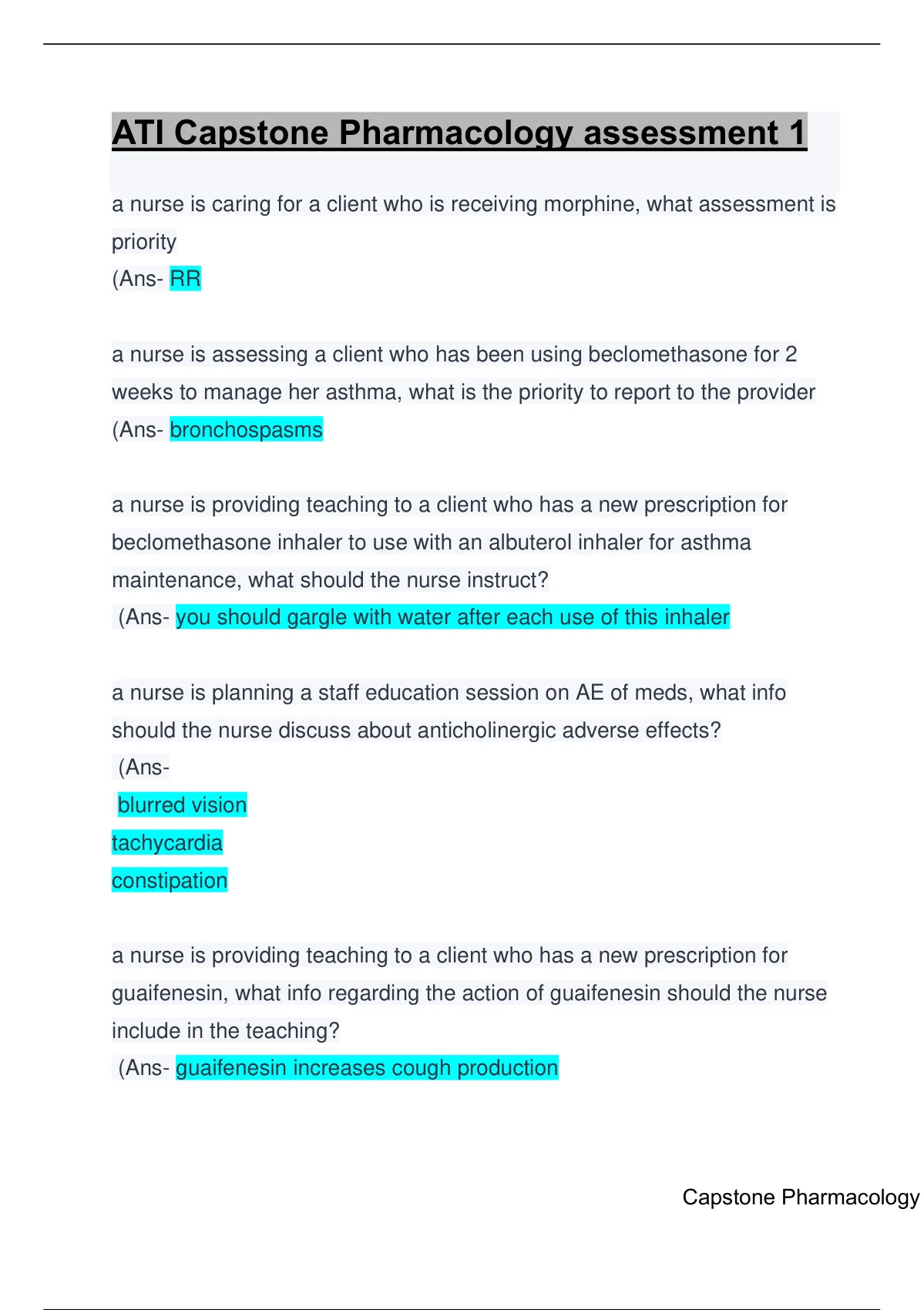

Mastering Pharmacology: Ati Capstone Assessment 1 Unveils Critical Knowledge,每 One Must Know

What Temp Does Water Boil