Using Your ATM Card in Thailand: A Comprehensive Guide for Safe and Seamless Transactions

Using Your ATM Card in Thailand: A Comprehensive Guide for Safe and Seamless Transactions

Navigating Thailand’s bustling markets and serene landscapes becomes far easier with a functional ATM card—yet many travelers overlook critical details that ensure smooth, secure, and stress-free cash withdrawals. Whether passing a balcony bar in Chiang Mai or exploring Bangkok’s street food hubs, knowing how to use your ATM card responsibly can save time, prevent fraud, and protect your finances. This guide outlines the essentials: transaction types, card acceptance, safety tips, regional nuances, and smart money habits to master before stepping away from your passport.

ATM card usage in Thailand hinges on compatibility—both physical and digital. Most major international cards, including Visa, Mastercard, and American Express, are accepted across ATMs operated by local banks and global networks like Plus, Cirrus, and Maestro. However, not all ATMs display their chip or PIN security features, so verifying the machine’s type before insertion is crucial.

A card accepted at one ATM may fail at another, especially in remote regions with older infrastructure.

Understanding Transaction Types and Costs

ATMs in Thailand handle multiple transaction types, each with distinct processes and potential fees. Understanding these options empowers users to choose wisely based on their needs.Withdrawals are the most common use—cash accessed via PIN or signature (depending on card type).

Visa and Mastercard support contactless cash pickups, while some POS terminals require a signature unless you’re using a chip-and-PIN card. Signature debit cards, though widespread, are not universally linked to ATMs in every area; requesting chip-only withdrawal often secures a lower fee. Transaction fees vary: international users typically pay 2–4% beyond the bank’s standard domestic rate, plus currency conversion charges.

For instance, withdrawing 20,000 THB in Thai Baht may incur 3% at the ATM and an extra 1.5% during exchange, totaling up to 4.5% in extra costs.

Additional transactions include balance inquiries, deposit slips, and card reprints. While limitless cash deposits are rare, some banks permit one free deposit per day at designated ATMs. Requesting a card reprint is standard if damaged, but fees apply unless you’re a member of a global bank alliance offering free replacements.

Security and Best Practices When Using ATMs

Security remains paramount when using ATM card readers in Thailand, especially in tourist-heavy areas prone to scams.Experienced travelers know that vigilance stops many fraud attempts before they escalate.

Always position your body between the ATM and potential bystanders when entering PINs—overhead screens and keypads offer partial protection. Skimming devices, though less common at major ATMs, persist in older terminals.

Avoid machines with flickering screens, loose parts, or unmarked repairs; these may hide fraud. Never use ATMs after dark unless fully confident in the surroundings.

Block your card’s magnetic strip post-withdrawal using the ATM’s built-in strip blocker—a simple but effective safeguard against unauthorized usage. Opt for chip-based transactions over magnetic stripe when possible, as chips generate unique codes, reducing theft risk.

Never share PINs—even with trusted locals. If an ATM display prompts a language barrier, disengage before entering data. In 2022, the Bank of Thailand reported a 22% drop in ATM fraud incidents after nationwide ATM security upgrades and traveler awareness campaigns.

Revelations About Regional ATM Access and Network Limits

Thailand’s urban centers like Bangkok, Chiang Mai, and Phuket feature dense ATM networks with reliable international support.Bangkok alone hosts over 3,500 ATMs, many linked to major banks such as BahnN Street and Kasikornsplan, enabling instant currency conversion. Rural areas, however, present challenges: remote provinces like Tha Palae or Mae Hong Son often operate on older networks, with occasional outages or single-bank ATMs.

Connectivity varies: while most modern ATMs support 3G/4G internet and accept Visa/Mastercard globally, some standalone terminals in dispersed zones rely on legacy systems, risking delayed status updates.

Travelers venturing beyond urban hubs should confirm card compatibility in advance and avoid unmarked “all cash” machines without clear branding. Local banks such as Rabobank and Shinhan often deploy ATMs with dual tap-mimicking curves and multilingual prompts, easing non-Thai speakers.

Currency conversion engines operate at terminals lay differently: some display visible rates and fees in hard currency, others require mobile app checks. Trust only official government-licensed ATMs—scammers sometimes install fake terminals near busy markets.

Apps like PromptPay or plat.th provide real-time fee estimators, but ensuring Wi-Fi access at the ATM remains critical for accurate cost visibility.

Smart Money Habits: Financial Responsibility Abroad

Beyond avoiding scams, savvy users adopt habits that minimize costs and protect their accounts. Regularly monitoring transaction statements—available via bank apps or SMS alerts—helps detect fraud within 24–48 hours, as recommended by the Bank of Thailand’s consumer protection guidelines.Set daily ATM withdrawal limits through your bank’s mobile platform to limit exposure if cards are lost.

Withdraw only what you need—excess cash increases risk and storage hassle. Inform your bank immediately if cards are compromised; most issue replacements within minutes and freeze linked accounts over security protocols.

Farga ไปนะ: In Thailand, smart spending means preserving local purchasing power—avoiding bulk cash loads unless necessary. Pair card use with digital wallets like TrueMoney or PromptPay for smaller expenses, reducing physical card handling.

Always receive receipts for large withdrawals, verifying amounts and fees post-transaction to cross-check with official records.

ultimately, mastering ATM usage in Thailand transforms routine transactions into seamless experiences. By understanding network nuances, securing devices, and practicing financial mindfulness, travelers ensure their money stays safe and accessible—whether in bustling city centers or serene countryside villages.

Related Post

Cherokee Resistance and Resilience: Preserving Identity Through the Storm of History

Montreal Airports: The Dynamic Gateway to Canada’s second-largest Metropolis

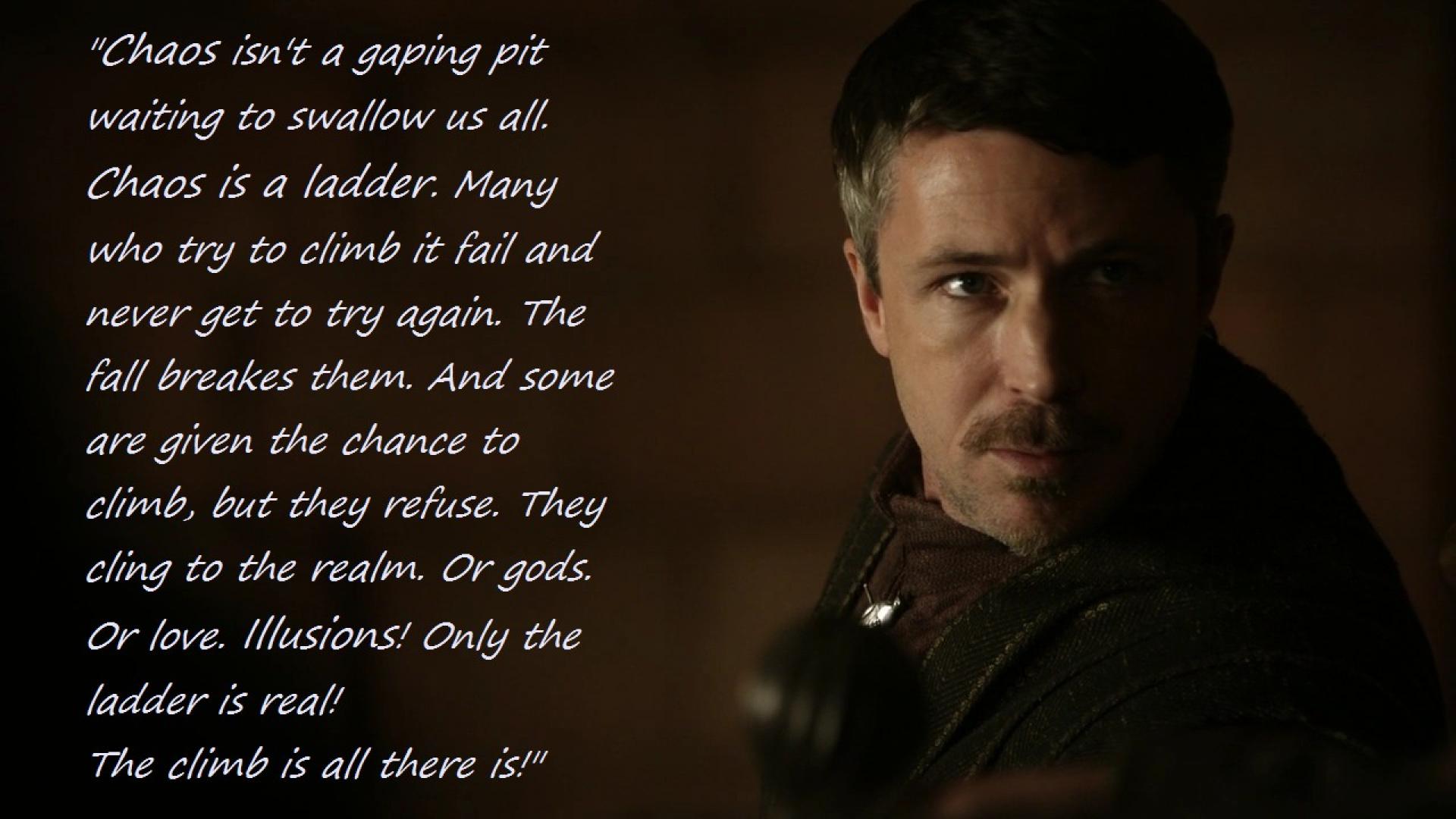

Bernard Hill’s Torric Rail: A Steady Presence at the Edge of Chaos in Game of Thrones

Zitrocin 500mg: Unlocking Its Role as a Potent Antibiotic for Bacterial Infections