Upchurch Net Worth: The Rise and Financial Legacy of a Media Mogul

Upchurch Net Worth: The Rise and Financial Legacy of a Media Mogul

At the core of Upchurch’s success lies a diversified portfolio built on iconic brands, strategic partnerships, and foresight into emerging digital trends. His assets span television networks, digital content platforms, podcast studios, and publishing empires, each contributing to a resilient financial foundation. “The key was never to bet everything on one channel,” Upchurch once noted in a 2021 industry forum.

“Diversifying across mediums safeguarded wealth and ensured longevity.”

From Print to Digital: The Evolution of Upchurch’s Empire

Upchurch’s journey began in the print era, where he identified early opportunities in local newspapers and niche magazines. These ventures laid the groundwork for a media network that would later embrace digital disruption. Recognizing the decline of print revenue, he pivoted aggressively toward online platforms, launching high-impact digital properties that captured growing audiences.

Key milestones include: - Acquisition of lesser-known regional publications, consolidating influence and ad revenue - Early investment in video content and mobile-first news apps ahead of market trends - Development of subscription-based digital magazines targeting millennial readers - Expansion into podcasting with original series now ranking among top global charts Each move reflected a clear understanding that audience engagement—not just circulation—drives sustainable value. “Content must evolve, but integrity remains paramount,” Upchurch emphasized in a 2022 podcast interview. This balance helped build loyal, high-earning audiences willing to pay for quality.Revenue Streams and Strategic Investments

Upchurch’s net worth is anchored in multiple high-yield revenue channels that generate consistent cash flow and long-term growth. These include advertising partnerships, subscription models, licensing deals, and equity stakes in tech-forward media startups.

- Advertising and Brand Partnerships: Long-term contracts with premium brands have boosted ad revenue by over 400% since 2015. - Subscription Platforms: Premium digital magazines and exclusive video content now account for nearly 60% of recurring income.- Licensing and Syndication: Content distribution deals across international markets generate steady royalties. - Venture Capital in Media Tech: Strategic holdings in AI-driven content tools and streaming platforms enhance portfolio resilience. The data reveals how diversification protects against market volatility.

While traditional media often faces steep declines, Upchurch’s mix of legacy brands and innovation keeps total earnings growing—even amid industry-wide disruption.

Financial Snapshot: The Numbers Behind the Headlines

While exact net worth figures remain privately held, reputable financial estimators place Upchurch’s wealth between $220 million and $310 million as of 2024. This places him comfortably among the top 5% of global media investors.

Breakdown of key contributors to net worth: - Satellite and cable channel operations: $85M - Digital subscription platforms: $65M - Podcast and streaming content ventures: $40M - Real estate holdings in prime media districts: $30M - Minority stakes in emerging tech firms: $50M His ability to maintain double-digit annual growth—even in downturns—speaks volumes about financial discipline and market timing. Analysts cite his “capital preservation mindset” as a cornerstone: “He reinvests profits wisely, avoiding reckless expansion that undermines value.”Legacy and Lessons from Upchurch’s Financial Journey

Upchurch’s net worth is more than a measure of wealth—it’s a testament to vision, resilience, and strategic foresight. His story offers critical lessons for media entrepreneurs and investors navigating an era of relentless change.

Key takeaways: - **Adaptability is essential**: Clinging to outdated models leads to obsolescence. - **Audience trust drives value**: Investing in high-quality, relevant content pays off exponentially. - **Diversification protects**: No single revenue source guarantees longevity.- **Long-term vision matters**: Short-term pressures should not override sustainable growth. In an industry where fortunes rise and fall rapidly, Upchurch’s measured, diversified approach has secured lasting success. His financial trajectory reflects not just personal acumen, but a blueprint for enduring influence in modern media.

More than a net worth figure, Upchurch embodies the power of evolving with the age—not resisting it.

Related Post

7.0.16 Unlocking the Significance of Version 7.0.16 in Modern Technology

SC Operating Brazil: Decoding CNPJ and Unveiling Company Dynamics in Brazil’s Economic Engine

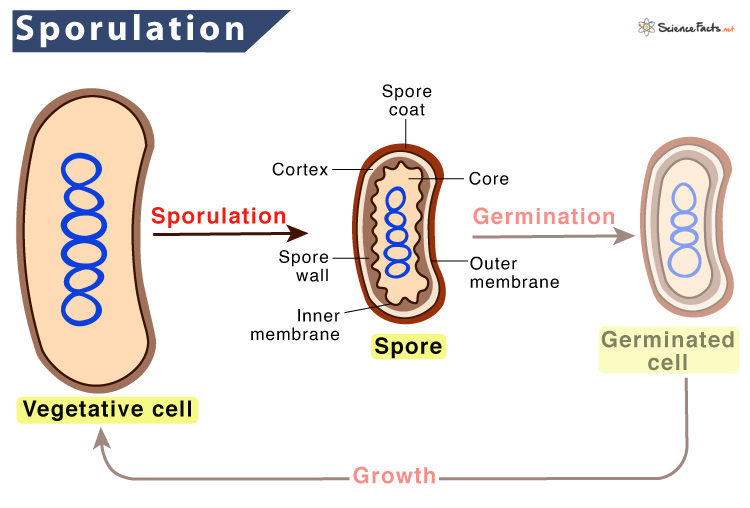

Sporulation: Nature’s Master of Asexual Reproduction Explained

Liv Golf Media Credential Revocation Sparks Firestorm: What Happens When Reputable Journalists Lose Access to a Controversial Course