Unveiling Lil Baby's Wealth: Unlocking The Secrets Of A Music Mogul

Unveiling Lil Baby’s Wealth: Unlocking the Secrets of a Music Mogul reveals how a once-underrated Atlanta rookie ascended to gospel-tier success through strategic reinvestment, savvy brand loyalty, and an uncanny ability to tap into cultural momentum. From early mixtapes sold door-to-door to a multi-million-dollar empire anchored in music, merchandise, and media ventures, Lil Baby’s journey reflects more than individual talent—it reveals the financial architecture behind modern hip-hop royalty.

At the core of Lil Baby’s financial rise lies an understanding of artist-audience relationships that transcends traditional music industry models. Unlike many contemporaries reliant solely on streaming royalties and touring revenue, Baby leveraged his star power to diversify income streams early.

His 2017 breakout single “Snow Magic” wasn’t just a chart-topper; it served as a launchpad for brand partnerships with youth-focused labels, sneaker deals, and early investments in digital content. “I knew music alone wouldn’t sustain me,” Baby has reflected. “I had to build assets—both tangible and intangible—that outlive trends.”

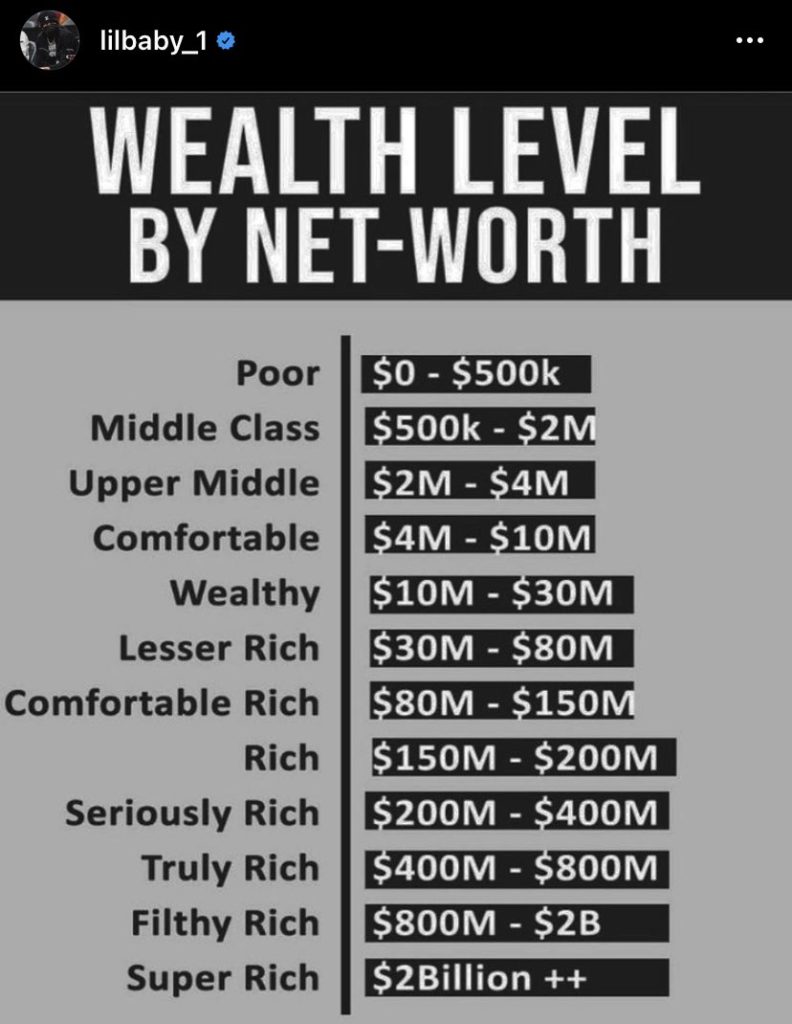

One of the most revealing secrets of his net worth—estimated in the multi-digit millions—rests in his aggressive brand expansion.

Lil Baby co-founded Unlu Money, a venture fueled by royalties and equity stakes in associated ventures, transforming earnings into long-term wealth. This financial discipline mirrors broader industry shifts, where top-tier artists now function as entrepreneurs, not merely performers. His 2023 partnership with a tech-enabled merchandising platform, for example, unlocked recurring revenue streams tied to global fan engagement, a model that concentrates value rather than dispersing it through one-off deals.

The Power of Early Reinvestment Lil Baby’s trajectory underscores a decisive pattern: wealth accumulation accelerated through early, purposeful reinvestment. In the mid-2010s, rather than spending surrenderingly, Baby channeled profits into equipment, production tools, and smart marketing. This approach mirrored early adopters in tech and entertainment who hoarded value by owning infrastructure.

“I bought quality instruments when I couldn’t afford tours,” he explained in a 2022 industry roundtable. “Those tools shaped my sound—and my ability to scale.” This principle extended beyond instruments; early investments in digital marketing agencies and data analytics teams enabled granular fan targeting, maximizing ROI on promotion spend years before algorithmic shifts made such strategies standard.

Merchandising: From Sneak Peeks to Scalable Revenue Merchandising emerged as a cornerstone of Baby’s financial strategy, going far beyond tie-dye hoodies and hats.

The Atlanta base artist pioneered limited-edition drops tied to milestone releases—album anniversaries, hit singles, or cultural moments. His “Money in the Bank” collection, released alongside a breakout project, combined high-performance apparel with collectible packaging, driving shortages that fueled secondary market demand. “It’s not just selling clothes,” he noted.

“It’s creating desire—bridging fandom with ownership.” Merch sales now account for a substantial segment of his annual turnover, with timed drops generating real-time revenue spikes while deepening fan investment.

Strategic Partnerships and Licensing Agreements Baby’s success is further amplified by calculated industry partnerships that extend reach without diluting brand equity. Collaborations with major sneaker brands, like a 2021 capsule with Adidas, merged cultural relevance with product excellence, transforming music releases into must-have lifestyle moments.

Licensing his music for streaming playlists, video games, and film trailers multiplied exposure, indirectly boosting revenue across his portfolio. These strategic moves reflect a modern artist’s mindset: leveraging music as software—easily distributed, endlessly remixed, and monetized across ecosystems.

The Role of Fan Engagement and Direct-to-Consumer Models Behind the scenes, Baby’s operations reflect a deep commitment to direct-to-consumer (D2C) financial control.

Leveraging social media and fan clubs, he cultivated direct relationships, enabling pre-sales, exclusive content access, and loyalty rewards. This D2C model bypasses intermediaries, retaining margin and capturing real-time consumer data—critical intelligence for forecasting demand and optimizing inventory. “Fans aren’t just consumers,” Baby emphasized.

“They’re stakeholders in my story. When they invest emotionally—and financially—it strengthens the whole system.” This F2F dynamic enhances retention, repeat purchases, and organic growth, reinforcing his financial resilience.

Diversification Beyond Music: Media and Media Investment Recognizing the volatility of individual hit success, Baby expanded into adjacent media ventures, investing in digital platforms that amplify artist narratives and fan experiences.

His early backing of a Atlanta-based podcast network, focused on music, culture, and personal journeys, tapped into audio’s rising dominance. These outlets serve dual roles: cultivating community and generating revenue through ads, sponsorships, and premium subscriptions. Such diversification aligns with industry trends where multi-platform presence reduces reliance on seasonal music cycles and live performance volatility.

Financial Liquidity and Long-Term Wealth Preservation Managing wealth at scale demands more than earned income—it requires disciplined financial stewardship. Lil Baby’s structured approach includes professional asset allocation, long-term real estate holdings, and tax-efficient investment vehicles, ensuring sustained liquidity and capital appreciation. While specific holdings remain private, transparency in financial planning underscores his status as a savvy mogul capable of preserving and growing fortune across economic cycles.

Unveiling Lil Baby’s Wealth reveals a blueprint not just for individual triumph, but for the evolving blueprint of artistic entrepreneurship. His journey—from underground mixtapes to moguls—illustrates how vision, reinvestment, brand dominance, and digital fluency converge to build enduring wealth. More than a story of music, it’s a masterclass in turning talent into timeless enterprise.

Related Post

What Percentage Of The World Is White

Newport News Public Schools Strengthens Campus Safety in Bold Security Overhaul

Why Did Melanie Safka Die? Unraveling the Life and Tragic End of a Beloved Voice

Garrison, Colorado: A Thriving Community at the Heart of the Front Range