Unraveling the Subprime Mortgage Crisis: How a Housing Bubble Unraveled the Global Financial System

Unraveling the Subprime Mortgage Crisis: How a Housing Bubble Unraveled the Global Financial System

In the mid-2000s, a crisis born in the American housing market escalated into a global financial catastrophe—the Subprime Mortgage Crisis. What began as a localized downturn quickly spiraled into a systemic collapse, eroding trillions in wealth, triggering widespread foreclosures, and threatening the stability of banks and economies worldwide. This crisis revealed profound flaws in financial regulation, risk management, and the interconnectivity of global markets—lessons that remain essential for safeguarding economic resilience today.

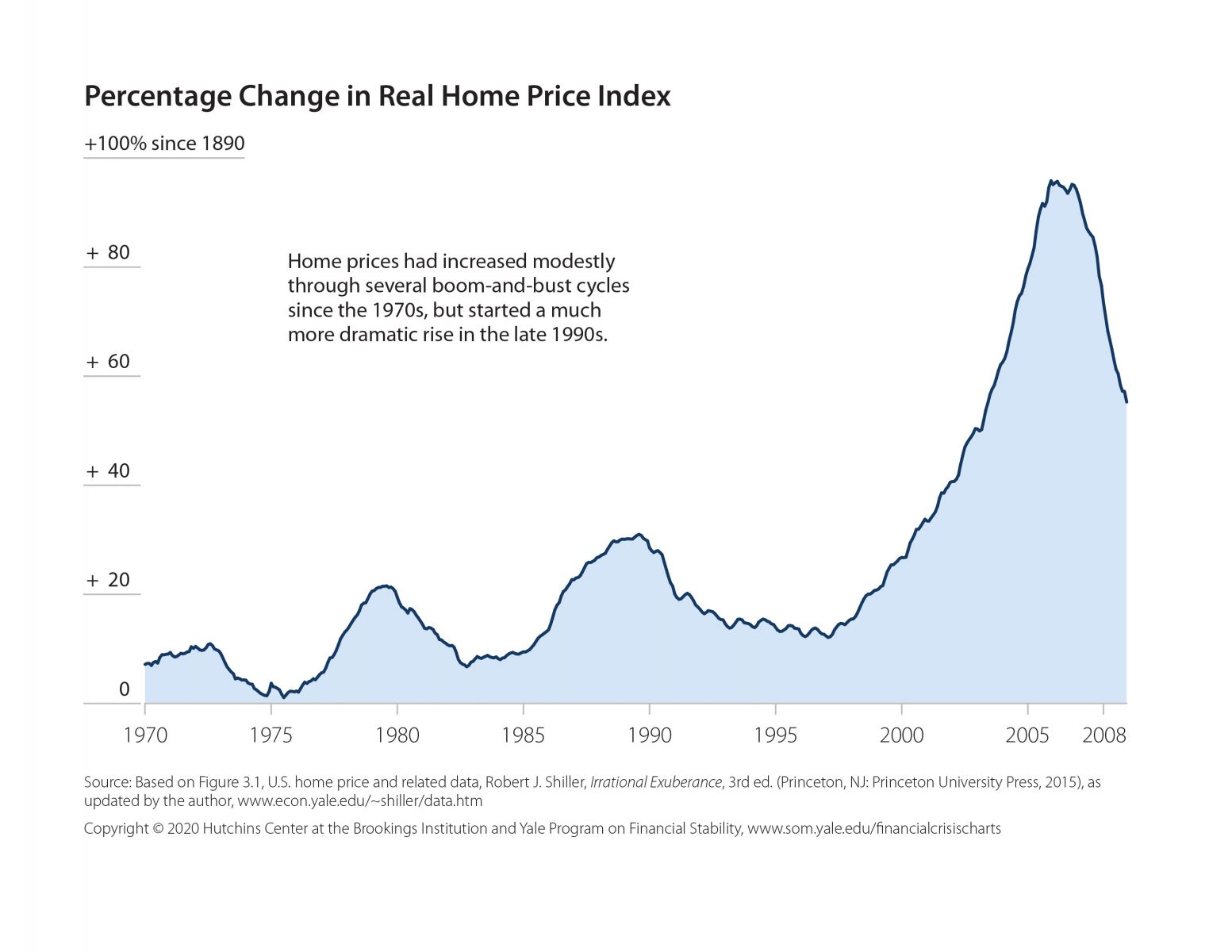

The roots of the crisis lie in the explosive expansion of subprime lending—home loans extended to borrowers with poor credit histories, often secured by adjustable-rate mortgages (ARMs) that featured initially low payments but ballooned after initial terms ended. Banks and financial institutions, fueled by the widespread belief that housing prices would forever rise, aggressively packaged these high-risk loans into mortgage-backed securities (MBS), which were then sold to investors across the globe. As housing prices peaked and drew near a peak—and then collapsed—the value of these securities plummeted, unleashing massive losses.

The Housing Boom and the Soaring Demand for Subprime Loans

Between 2000 and 2006, the U.S.

housing market experienced one of its most rapid expansions, with home prices increasing by over 90% in many markets. This surge was driven by optimistic forecasts, low interest rates, and aggressive lending practices. Financial deregulation, notably the repeal of key provisions of the Glass-Steagall Act and lax oversight by agencies like the Securities and Exchange Commission (SEC), enabled mortgage lenders to extend credit recklessly.

Subprime borrowers, often walking onto homeownership with little long-term preparedness, found credit easily available—sometimes with teaser rates that reset sharply after 2–3 years.

Lenders, incentivized by short-term profits, reported minimal risk through complex financial models that underestimated default likelihood. Borrowers frequently lacked full transparency about loan terms and risks, encouraged by real estate agents and mortgage brokers focused on closing deals.

“The belief was that homeownership would always rise in value,” said former Fannie Mae executive Michael Williams. “We never truly accounted for a widespread drop in prices or the possibility of mass defaults.” As defaults mounted, lenders were forced to mark down MBS, triggering losses across financial institutions.

Mortgage-Backed Securities and the Chain Reaction

Mortgage-backed securities transformed residential mortgages into tradable financial instruments, sold to banks, pension funds, and foreign investors.

Rating agencies assigned high investment grades—often AAA—even to MBS containing substantial subprime exposure, due to flawed models and conflicts of interest. When defaults surged, these securities lost value rapidly, causing catastrophic losses at institutions across the financial spectrum. Bear Stearns, Lehman Brothers, and Merrill Lynch all saw massive write-downs tied directly to subprime assets.

As confidence evaporated, credit markets seized up—banks stopped lending to one another, fearing hidden exposures. The failure of Lehman Brothers in September 2008 became the symbolic turning point, triggering a global panic. Financial contagion spread beyond Wall Street: insured depository institutions like AIG faced ruin, industrial corporations reevaluated supply chains, and governments prepared bold interventions.

Systemic Collapse and Government Intervention

The crisis revealed a fatal flaw in the financial system’s interdependence—no major institution was too small to threaten the whole. By late 2008, a coordinated global response emerged, including the U.S. Troubled Asset Relief Program (TARP), which authorized $700 billion to stabilize banks, and unprecedented interest rate cuts by the Federal Reserve to near zero.

Emerging markets, tightly linked through trade and investment, also sustained severe blowbacks as demand for commodities and exports collapsed.

Consumer impact was devastating: over 10 million American homeowners faced foreclosure between 2007 and 2014, wiping out retirement savings and community wealth. Governments worldwide grappled with balancing accountability and economic survival, instituting reforms like the Dodd-Frank Act to strengthen oversight and consumer protections—though debates over financial regulation’s scope continue.

Unmasking the Causes: Risk Mismanagement and Regulatory Failure

Rooted in a culture of excessive risk-taking, the crisis reflected a systemic failure across lending institutions, credit rating agencies, and financial regulators. Lenders prioritized volume over due diligence, packaging loans into securities with opaque risk profiles. Rating agencies, paid by the same firms underwriting MBS, given misleading A-rated labels to products with embedded subprime defaults—leading to a false sense of security.

Regulators failed to curb predatory lending or enforce transparency. The absence of stress testing and capital buffers left banks unprepared for widespread defaults. As economist Joseph Stiglitz noted, “The crisis was not inevitable—it emerged from deliberate choices to deregulate and prioritize short-term gains over long-term stability.”

Worldwide Ripple Effects and Lessons Learned

The crisis transcended U.S.

borders, unraveling financial systems in Europe, Asia, and Latin America. Eurozone countries like Greece, Ireland, and Spain faced sovereign debt crises fueled by collapsing housing markets and bank failures. Export-dependent economies contracted sharply, exposing vulnerabilities in an interconnected global economy.

Central banks adopted unprecedented monetary easing, and nations strengthened cross-border regulatory coordination through forums like the Financial Stability Board.

Today, the Subprime Mortgage Crisis serves as a powerful reminder of financial fragility. It underscores the need for vigilant oversight, responsible lending, and transparent markets.

Financial innovations that drive growth must be matched by equally robust safeguards to prevent history’s repeating mistakes.

Understanding this crisis is not merely an academic exercise—it is essential for shaping a more resilient financial future in an era of rising debt and complex instruments. The lessons deltas across time: transparency, accountability, and prudent risk management remain the bedrock of economic stability.

/what-caused-2008-global-financial-crisis-3306176_FINAL-14548e14071e4bdb90ff985fac727225.jpg)

Related Post

Exploring The Quot Planet Of The Apes Quot Movies In Order A Comprehensive Guide

When the Menendez Brothers’ Tragedy Struck: Age at the Loss of Their Parents

Ami James Spouse: The Quiet Strength Behind Her Partner’s Spotlight

What To Do In Wyoming: Explore Its Wild Heart from Yellowstone to Grand Teton