Unlocking Trust: The True Essence of Due Diligence in a Complex World

Unlocking Trust: The True Essence of Due Diligence in a Complex World

In an era defined by rapid transactions, global interconnectivity, and escalating risks, due diligence has emerged not just as a procedural formality but as the cornerstone of responsible decision-making across business, law, and finance. Often synonymous with rigorous investigation and risk mitigation, due diligence today goes far beyond checklists—it represents a strategic commitment to transparency, accountability, and informed choice.

At its core, due diligence is the systematic process of clinical inquiry and evidence evaluation conducted before a major transaction or investment.

It serves as a protective shield, uncovering hidden liabilities, validating claims, and revealing qualitative nuances that financial statements alone cannot capture. According to legal scholar Elena Márquez, “Due diligence is not merely due diligence in name—it is due diligence as a discipline, a mindset that transforms uncertainty into insight.” This definition reflects a modern understanding: the practice demands skepticism, depth, and relentless attention to detail.

The Multifaceted Nature of Due Diligence

Due diligence extends well beyond its traditional application in mergers and acquisitions.It permeates key domains including corporate governance, environmental compliance, cybersecurity risk assessment, and regulatory adherence—each requiring tailored methodologies and expert insight.

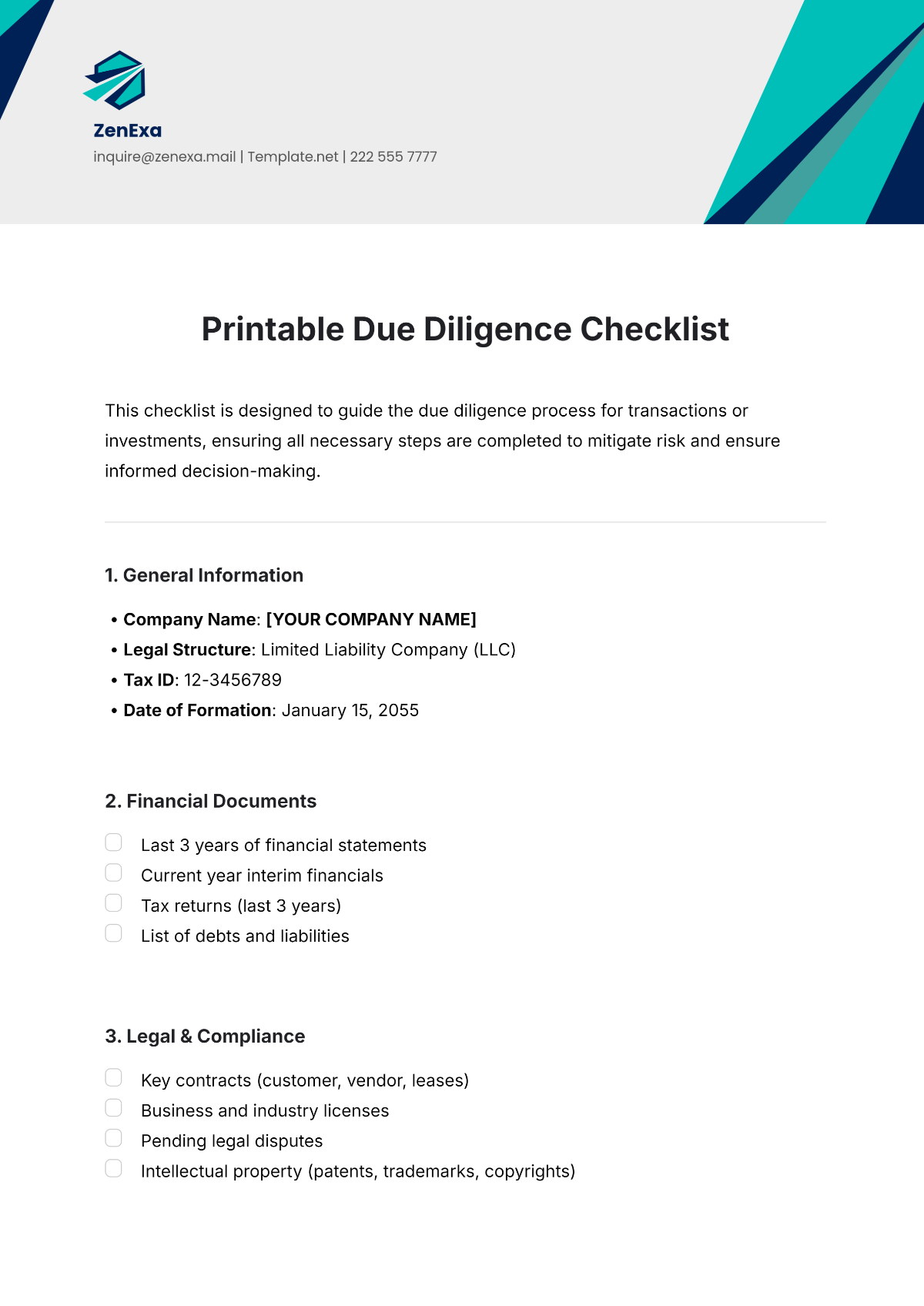

Three principal types guide practitioners through complex landscapes: - Financial Due Diligence, which scrutinizes historical statements, revenue models, and debt structures to validate business viability and uncover discrepancies. - Commercial Due Diligence, assessing market positioning, competitive dynamics, and growth potential to inform strategic decisions.

- Compliance and Regulatory Due Diligence, analyzing adherence to laws including anti-corruption rules, data protection standards, and industry-specific requirements. Each type operates on a shared principle: identify, verify, and act. Yet, the depth of investigation varies significantly based on transaction scale, sector risk, and stakeholder expectations.

Financial Due Diligence: The Numbers That Speak

Of all forms, financial due diligence remains the most widely practiced. It begins with a forensic examination of accounting records, cash flows, and tax filings. Practitioners deploy forensic accounting techniques, ratio analysis, and trend forecasting to distinguish performance from projection.“Every dollar examined is a safeguard,” notes James Carter, a senior partner at KPMG’s corporate advisory division. “Inaccuracies or deliberate misstatements may remain invisible to the naked eye but can unravel at closing if not challenged.” This process includes verifying revenue recognition practices, assessing reserve quality, and validating asset valuations. The output is not just a report but a risk-adjusted valuation that empowers deals with factual anchors.

Commercial Due Diligence: Beyond the Balance Sheet

While financial data provides a foundation, commercial due diligence evaluates the market-driven essence of a business. This involves deep dives into customer concentration, supply chain resilience, brand strength, and innovation pipelines. Interviews with suppliers, clients, and industry analysts reveal competitive vulnerabilities and growth corridors invisible in financials.“Customer churn rates

Related Post

Doing Due Diligence: The Indispensable Practice Behind Smart Decision-Making

Unveiling The Life of Jeremy Wade’s Wife: Secrets Behind the Angler’s Quiet Successor’s Partner

Gaby Gardez Unlocks the Science of Flavor: How One Palate Transformed Culinary Innovation

Inside the Cavins Family: Age, Wife, and the Pillars of Jeff Cavins’ Life and Ministry