Unlocking Market Intelligence: How IUFP Technologies & Marketscreener Revolutionize Industry Insights

Unlocking Market Intelligence: How IUFP Technologies & Marketscreener Revolutionize Industry Insights

In today’s hyper-competitive business landscape, accessing timely, accurate, and actionable market data is no longer optional—it’s essential. IUFP Technologies and Marketscreener stand at the forefront of this transformation, combining cutting-edge data aggregation with advanced analytical tools to empower enterprises in making smarter, faster decisions. Together, they form a powerful ecosystem that bridges the gap between raw market information and strategic insight, enabling investors, analysts, and corporate strategists to navigate shifting trends with precision.

punctual decision-making hinges on reliable intelligence—and this is where IUFP Technologies excels. built on a robust data infrastructure, IUFP aggregates real-time information from global financial markets, trade flows, supply chain dynamics, and sector-specific indicators. Their platform integrates structured data with contextual analytics, allowing users to detect emerging opportunities and risks before they become mainstream concerns.

As Dr. Lena Krueger, Head of Data Strategy at a leading EU investment firm, notes: “IUFP’s ability to unify disparate data streams into coherent, visual narratives transforms information overload into strategic clarity.” At the core of this capability is Marketscreener, the market screening tool that Marcin Popowski co-developed to streamline opportunity identification. Marketscreener leverages algorithmic filters and proprietary scoring models to evaluate thousands of securities, commodities, and market segments against customizable criteria—ranging from financial health and growth potential to regulatory shifts and geopolitical exposure.

Its user-centric interface enables analysts to run complex screening queries in minutes, generating ranked lists accompanied by visual trend indicators and risk heatmaps.

The Architecture of Insight: Core Features of IUFP Technologies & Marketscreener

What sets IUFP Technologies apart is not just data breadth, but depth of integration and analytical sophistication. The platform’s architecture is built around three foundational pillars: - **Real-Time, Multi-Source Data Aggregation**: Marketscreener draws from over 200 global data feeds—stock exchanges, central banks, credit bureaus, and proprietary monitoring tools—delivering up-to-the-minute insights.This ensures users track developments as they unfold, from sudden commodity price shifts to regulatory announcements affecting sector valuations. - **Advanced Analytical Modules**: Beyond screening, Marketscreener employs machine learning algorithms to identify hidden patterns, correlations, and predictive signals. For example, natural language processing (NLP) parses earnings calls and news sentiment to anticipate market reactions, while portfolio optimization tools assess exposure alignment across asset classes.

- **Interactive Visualization & Reporting**: Data is presented through dynamic dashboards, interactive charts, and customizable scorecards that distill complex analysis into digestible visuals. This facilitates rapid communication across teams, from C-suite executives reviewing strategic options to compliance officers monitoring ESG risks. “What’s unique,” explains Janusz Nowak, head of product innovation at IUFP, “is the way Marketscreener transforms raw data into decision-ready intelligence—without sacrificing depth.

Analysts can drill down into sector-specific details or zoom out to view macro trends, all within the same platform.” practically, users engage Marketscreener across multiple use cases. In investment banking, it accelerates due diligence by benchmarking target firms against industry peers using ESG scores, credit metrics, and revenue trajectories. In supply chain risk management, firms monitor geopolitical flashpoints and logistics bottlenecks to adjust sourcing strategies proactively.

In portfolio management, the tool applies risk-adjusted return models to rebalance holdings in alignment with evolving market conditions.

Industry adoption of IUFP and Marketscreener reflects a growing demand for integrated intelligence. Major financial institutions, hedge funds, and family offices report measurable improvements in investment accuracy and risk mitigation since integrating the platform.

One multinational{corporation} segmented its equity portfolio using Marketscreener’s sector clustering and volatility filters, resulting in a 17% increase in alpha generation during volatile market phases. A national asset manager credited the tool with reducing overweight exposure in overleveraged debt instruments by 32%, directly enhancing portfolio resilience.

Smart Screening Redefined: Customization Meets Precision

Central to Marketscreener’s value is its unmatched flexibility in screening.Traditional methods often rely on static, predefined criteria that lag behind market evolution. Marketscreener disrupts this by enabling analysts to build dynamic, multi-layered filters. Key strengths include: - **Tiered scoring and weighted indicators**: Users assign relevance and impact scores to variables like P/E ratios, debt-to-equity levels, or carbon footprint metrics, tailoring evaluations to strategic goals.

- **Real-time alerts and scenario modeling**: Automated notifications trigger on threshold breaches (e.g., sudden credit downgrades), while “what-if” tools simulate how policy changes or commodity shocks might reshape valuation. - **Cross-asset compatibility**: Screening isn’t limited to equities—users evaluate bonds, currencies, commodities, and ESG-aligned assets through unified parameters, enabling holistic portfolio assessment. These capabilities reduce reliance on manual research and reduce time-to-insight by up to 60%, according to internal platform analytics.

Looking forward, IUFP Technologies continues to innovate by integrating AI-driven sentiment analysis and predictive scenario engines, further augmenting Marketscreener’s foresight. Emerging features include:

- AI-Powered Risk Identification: Machine learning models now detect early signals of market dislocations months in advance by analyzing disjointed data patterns often invisible to human analysts.

- Regulatory Intelligence Layer: Automated tracking of evolving compliance frameworks across 50+ jurisdictions helps firms preempt legal risks in cross-border deals.

- Collaborative Analytics Workspaces: Teams can share screening results, annotate insights, and build collective intelligence in real time, fostering data-driven culture across departments.

In an era where information velocity defines competitive advantage, IUFP Technologies and Marketscreener rewrite the rules of market intelligence.

By merging global data depth with intelligent, user-centric design, they empower organizations to anticipate change, manage risk, and seize opportunity with unprecedented clarity. In markets that shift faster than ever, this fusion of speed and insight isn’t just transformative—it’s indispensable.

Related Post

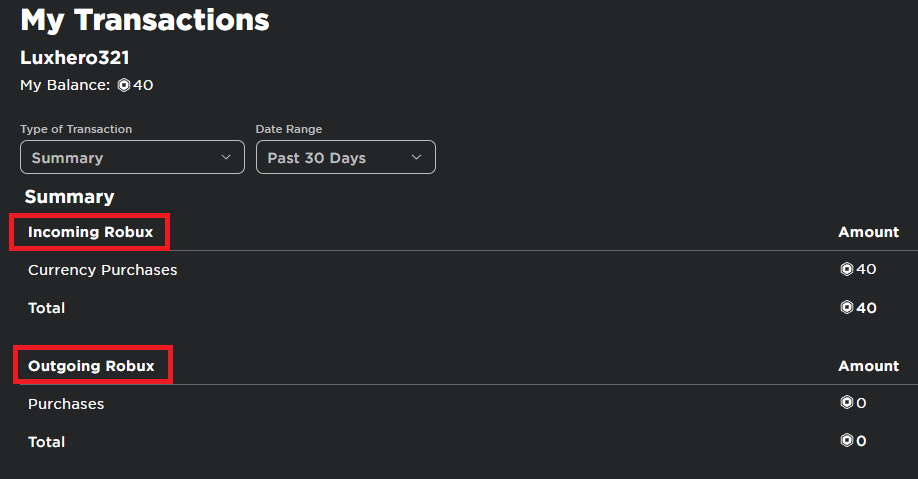

Pending Robux Transactions: Unlocking the Hidden Flow in Roblox’s Digital Economy

unlock seamless collaboration with Iu Canvas Login: the future of secure, streamlined digital workflows

Nick Martinez Trade: Is He Leaving The Reds? A Contentious Exit Still Unfolding

Unveiling Helena Meaning: The Deeper Mystery Behind My Chemical Romance’s Twisted Romance