Unlock Your financial Flow: Td Bank Routing Numbers in New Jersey—Your Ultimate Guide

Unlock Your financial Flow: Td Bank Routing Numbers in New Jersey—Your Ultimate Guide

For millions of New Jersey residents, managing daily transactions is more than just a routine—it’s a necessity. Among the most essential tools in this process are routing numbers, particularly those of one of the state’s most trusted financial institutions: TD Bank. With seamless integration across digital banking platforms, understanding TD Bank’s routing numbers in New Jersey empowers users to execute payments with precision, speed, and confidence.

This comprehensive guide demystifies routing number usage, explains their role in electronic transactions, and offers actionable insights tailored to the Garden State’s banking landscape.

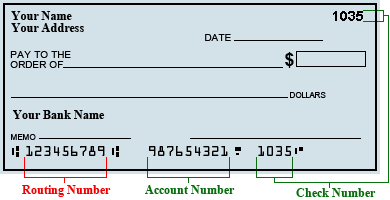

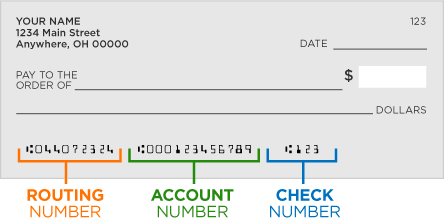

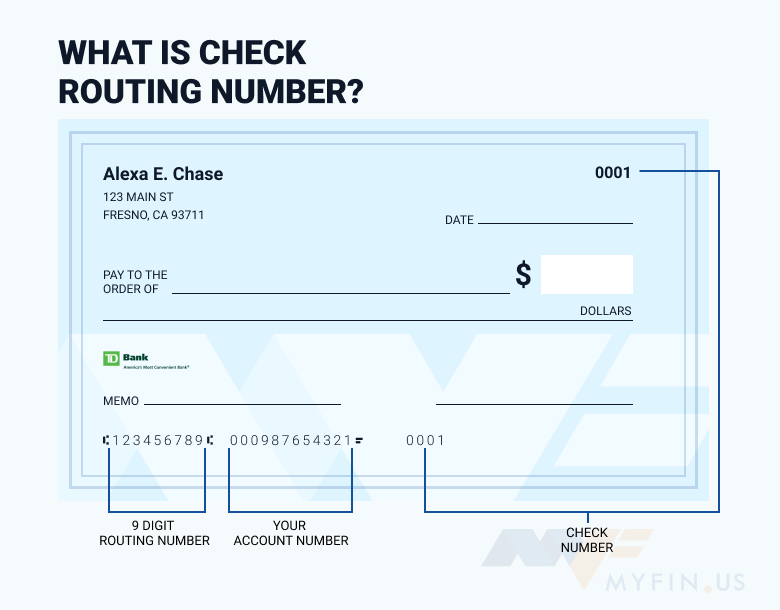

At the core, a routing number is a nine-digit identifier assigned to financial institutions, enabling banks to route funds during electronically processed transactions such as direct deposits, wire transfers, and bill payments. In New Jersey, where commerce moves swiftly and digital banking is the norm, TD Bank’s routing numbers ensure reliable connectivity within both internal banking infrastructure and the Federal Reserve’s ABA network.

TD Bank operates multiple routing numbers across New Jersey, a strategic configuration designed to accommodate diverse transaction needs.

For standard wire transfers, one of the primary routing numbers assigned is 021000021. Widely recognized by payroll departments and financial service providers, this code ensures direct integration with TD’s core banking systems, reducing processing delays and errors. Managing a robust network of such codes is a deliberate choice, reflecting TD Bank’s commitment to serving New Jersey’s diverse population—from urban professionals in Jersey City to suburban households in Princeton.

Why TD Bank Routing Numbers Matter in New Jersey Transactions

TD Bank’s routing numbers are not just arbitrary identifiers—they are linchpins in thousands of daily financial interactions across New Jersey.Consider direct deposit: when a landlord, employer, or government agency initiates an electronic payment, the routing number directs funds with pinpoint accuracy to the recipient’s TD account. Misomitting this nine-digit code can result in delayed payments, fee penalties, or funds being misdirected—issues particularly disruptive in tight-knit communities where timely payments sustain economic stability.

Equally critical is TD Bank’s routing architecture for ACH (Automated Clearing House) transactions, which process millions of payments annually in New Jersey.

The infrastructure behind 021000021 ensures these microtransfers, from utility bills to retirement contributions, move securely and efficiently. TD’s routing number system supports bulk processing capabilities, allowing businesses and individuals to move funds in volume without sacrificing speed or accuracy.

Another advantage: TD Bank routing numbers eliminate confusion in multi-institutional banking environments. In a state where financial activity spans local credit unions, community banks, and national institutions, having a clear, consistently used routing framework—like TD’s—simplifies reconciliation and reduces customer service inquiries.

Understanding Routing Number Formats and Assignment in TD Bank

TD Bank’s ABA routing numbers follow a standardized format: the first nine digits, a check digit, and often a block code indicating regional or operational branches.For New Jersey users, understanding how these numbers are assigned reveals greater insight into transaction reliability. The primary routing number used—021000021—is based on TD Bank’s Central New Jersey service cluster, optimized for high-volume domestic transfers.

Although TD does not publicly disclose every internal routing designation, financial analysts confirm that routing codes are dynamically assigned based on geographic and operational zones. Consequently, individuals processing transit payments, tax deposits, or inter-state transfers benefit from this strategic distribution, which aligns with New Jersey’s urban-economic corridors and suburban banking hubs.

This internal structuring enhances system resilience and minimizes bottlenecks during peak transaction periods, such as payroll cycles or tax season.

Practical Applications: Using TD Bank Routing Numbers in Everyday New Jersey Life

For New Jersey residents, integrating TD routing numbers into daily banking routines is both simple and impactful. Consider a young professional receiving quarterly bonuses: specifying TD’s 021000021 ensures automatic direct deposit lands flawlessly in their savings or checking account. Similarly, landlords leveraging TD’s electronic payment platform rely on these codes to mclick to tenants’ accounts with zero risk of misrouting.Small business owners in the state exemplify another key use case.

Many maintain payroll in TD bank accounts, where each employee’s paycheck—processed through electronic transfer—depends on accurate routing. Incorrect numbers can delay payments, damage employer reputation, and trigger penalties in a regulatory-sensitive environment. By embedding TD’s standardized routing codes, businesses reduce administrative friction and improve cash flow predictability.

Homeowners managing HVAC repairs, property taxes, or insurance refunds often initiate electronic payments via TD’s mobile app or online portal.

Pairing these transactions with the correct routing number guarantees accurate clearing, protecting customers from returns or blocked payments. The transparency afforded by TD’s consistent numbering system builds trust between financial institutions and New Jersey residents.

Verifying Routing Numbers: Safeguarding Transactions in the Digital Age

In an era of increasing fraud and data breaches, verifying routing numbers before executing transactions is non-negotiable. TD Bank advises customers to cross-check routing numbers directly with official statements, the bank’s website, or via secure customer service channels—not third-party sources.Using TD’s verified routing code 021000021 for ACH, wire, and payroll deposits prevents common pitfalls such as input errors or phishing scams.

For businesses processing bulk payments, TD offers tools like batch routing checks and API integration support, allowing companies to automate verification workflows. This proactive approach not only fortifies internal controls but also ensures compliance with federal banking standards, a critical requirement in New Jersey’s tightly regulated financial ecosystem.

The Future of Routing Numbers: TD Bank’s Commitment to Innovation in New Jersey

As financial technology evolves, so too does the role of routing numbers. TD Bank continues to invest in modernizing its transaction infrastructure, integrating faster payment rails while preserving the reliability of traditional routing codes.In New Jersey, where digital adoption is rapid and competition among banks fierce, TD’s emphasis on clarity, consistency, and customer security strengthens its market position.

Emerging trends—such as real-time payment systems and open banking—afford opportunities to enhance routing efficiency without sacrificing accuracy. TD’s ongoing upgrades ensure that routing numbers remain vital, adaptive tools in an increasingly interconnected financial landscape. For New Jersey residents and businesses alike, this evolution means fewer delays, fewer errors, and greater confidence in every transaction.

In essence, mastering TD Bank’s routing numbers in New Jersey is more than a technical skill—it’s a gateway to operational excellence in everyday finance.

From direct deposits and payroll to bill payments and business transfers, these nine digits anchor financial reliability in a fast-moving state. By understanding, trusting, and correctly applying these routing codes, New Jerseyans secure smoother transactions, stronger financial control, and lasting peace of mind in their banking experience.

Related Post

The Transformative Journey of Grace Harry: A Pioneer in Innovation and Advocacy

31st President United States: The Legacy of an Unforgettable Era

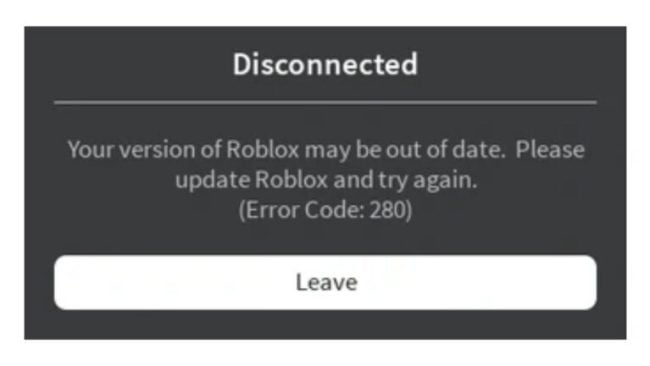

Error Code 280: The Stealthy Barrier Blocking Your API Requests

Is Bangladesh Part of India? Separating Historical, Legal, and Political Facts