Unlock Your Capital One REI Mastercard: The Ultimate Guide to Hassle-Free Digital Access

Unlock Your Capital One REI Mastercard: The Ultimate Guide to Hassle-Free Digital Access

For travelers and outdoor enthusiasts, managing credit cards across multiple platforms can feel like navigating a dense forest—complex, time-consuming, and fraught with risk. Capital One’s REI Mastercard simplifies this with intuitive login access that combines security, speed, and seamless integration with the REI ecosystem. This guide reveals how the Capital One REI Mastercard Login Easy Access Guide empowers cardholders to secure their card, track spending, and access benefits—all in minutes—without sacrificing safety or convenience.

Mastering the Login Experience with Minimal Friction

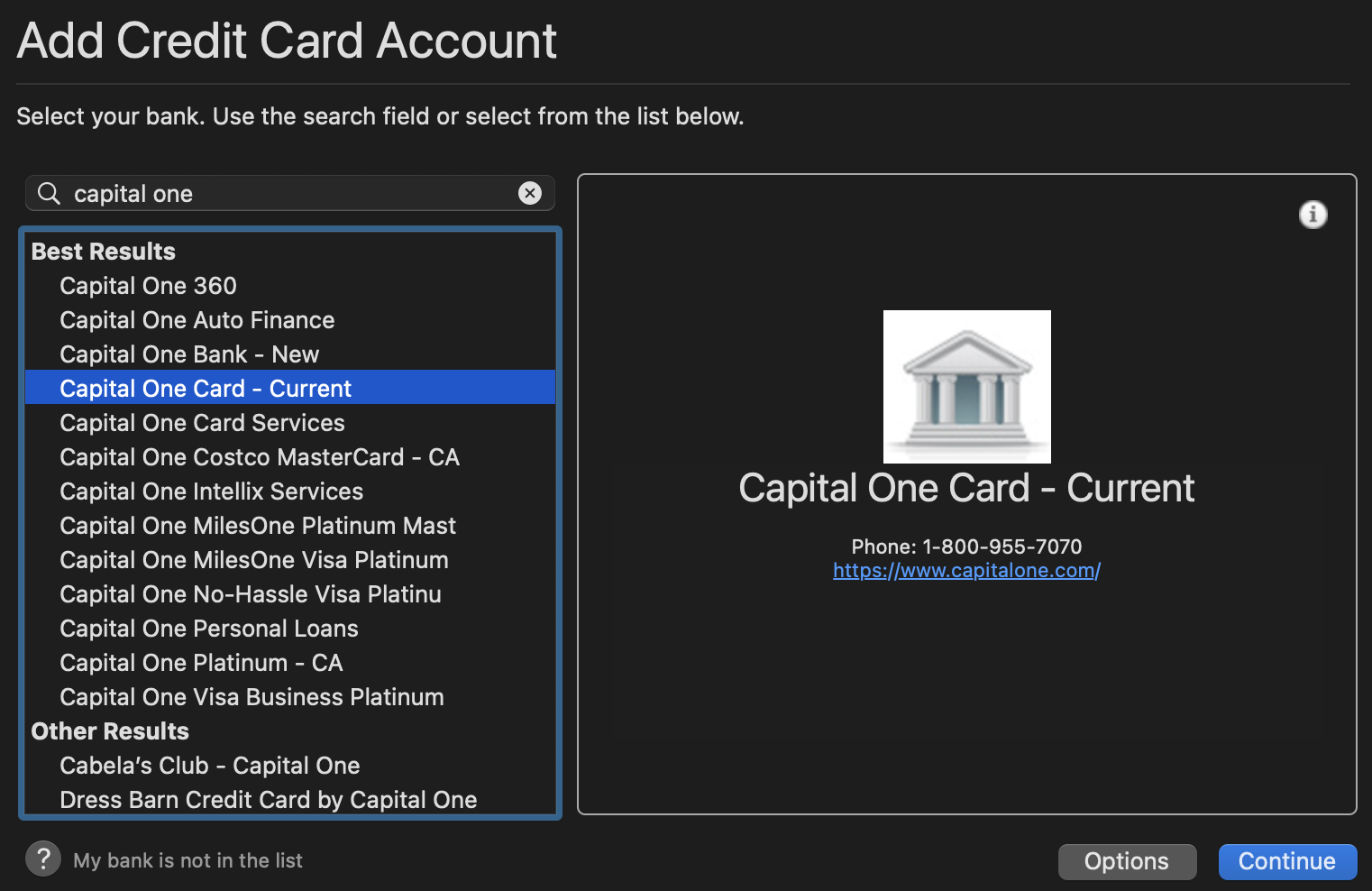

Accessing the Capital One REI Mastercard has never been simpler. Designed with user experience at the forefront, the login process leverages modern authentication methods to deliver fast, secure entry without unnecessary hurdles. Cardholders can log in via multiple methods: through the Capital One mobile app, the REI website, or MetaSign-in, Capital One’s cross-platform authentication tool.Upon first login, the system prompts secure setup using either a PIN, biometric verification (face or fingerprint), or a single-tap password derived from a trusted device. “Our goal is to make logging in feel effortless while never cutting corners on security,” states a Capital One representative. This philosophy is evident in features like adaptive authentication—where access attempts are continuously assessed for risk in real time—ensuring that legitimate users face minimal friction, while suspicious activity is swiftly flagged.

The system’s design reduces login time from minutes to seconds, making quick access to your REI card—complete with rewards and travel perks—just a few taps away.

Secure Your Card: The Foundation of Easy Access

Security remains paramount in the digital age, especially when managing a card linked to a specialized community like REI, where users value both privacy and trust. Capital One’s REI Mastercard integrates advanced protection layers to safeguard credentials and personal data.Every login session is encrypted using industry-standard protocols, ensuring that passwords, PINs, and transaction details are transmitted securely. Multi-factor authentication (MFA) is default, requiring users to verify identity through secondary devices or biometrics, dramatically lowering the risk of unauthorized access. Biometric login options—available via the Capital One app—leverage device-native security features to offer both ease and protection.

A user once noted, “Logging in via fingerprint is faster than I remember, and knowing my card is secure gives me peace of mind.” This blend of speed and safety sets the REI Mastercard apart, proving that modern security doesn’t need to compromise convenience.

Accessing Benefits: Rewards, Travel, and Exclusive Perks

Beyond basic access, the Login Easy Access Guide unlocks full utilization of the REI Mastercard’s value-driven features. Upon login, cardholders instantly see their current balance, reward points, and exclusive travel credits—details crucial for savers and explorers alike.REI members benefit from cashback on eligible purchases, free trip extras through partner providers, and member-only promotions, all visible without waiting or navigating clunky menus. The card supports contactless payments and mobile wallet integration (Apple Pay, Samsung Pay), streamlining transactions whether at local REI stores or online retailers. Secure spending alerts update in real time via app or email, ensuring users stay informed about every activity—anticipating fraud before it becomes an issue.

This transparency and convenience transform the card from a simple payment tool into a dynamic financial companion.

Step-by-Step: Quick Login Steps for Confidence and Speed

Beginning the login process takes fewer than 60 seconds and follows a universally intuitive path:- Open the Capital One app or visit recreidirect.com/rei card—and tap Login.

- Select “Enter PIN,” “Biometric,” or “MetaSign-in” depending on your device and security preference.

- If using biometrics, upload your face or fingerprint and authenticate instantly.

- Enter a one-time password securely if required—or leverage fingerprint/n biometric verification for one-tap access.

- Upon successful login, your card dashboard appears, showcasing rewards, options to make purchases, and financial summaries.

Why the REI Mastercard Login Experience Stands Out

What separates Capital One’s REI Mastercard login process is its delicate balance of simplicity, security, and smart design.Unlike legacy banking apps burdened by complex menus and redundant steps, the REI interface prioritizes speed without sacrificing rigor. Features like adaptive authentication and one-click MFA ensure users are never asked to sacrifice safety for speed—and security is never an afterthought. This approach aligns with growing consumer demand for frictionless yet robust digital services.

As one seasoned REI cardholder reflected, “Logging in feels natural, like using a trusted companion—always there, always secure.” It’s this user-first philosophy that transforms routine access into a seamless extension of the card’s broader purpose: empowering adventure through financial confidence.

The Future of Secure Card Access: What’s Next for the REI Mastercard

Capital One continues to innovate within its REI Mastercard offering, with future enhancements expected to deepen integration with travel booking platforms, expand real-time fraud detection, and refine personalization through AI-driven insights. The current Login Easy Access Guide already exemplifies how modern financial technology can serve niche communities with tailored, high-performance tools.For REI members, this means less time managing logins, more time enjoying the trails and opportunities that define their lifestyle. The Capital One REI Mastercard isn’t just a payment method—it’s a trusted digital gateway, built for those who value speed, security, and substance. With intuitive access at their fingertips, cardholders experience a spending ecosystem that grows more intuitive by the day.

Related Post

:max_bytes(150000):strip_icc():focal(822x160:824x162)/jay-z-beyonce-blue-ivy-carter-grammys-win-02-020325-a919e11f88a043ffb5f3fb04d51d2f88.jpg)

How Old Is Blue Ivy? The Youthful Endurance of Beyoncé’s 6-Year-Old Carter Amid Jay-Z and Beyoncé acute’s Stylt Phase

What Does Obnoxious Mean? The Shady Psychology Behind Annoying Behavior

Baylor Bears Football Depth Chart Reveals Strategic Depth Could Drive Playoff Push

The Final Battle That Redefined an Era: Cavaliers vs. Warriors in the 2018 NBA Finals