Unlock Nevada’s Financial Power: The Clark County Credit Union Routing Number Guide

Unlock Nevada’s Financial Power: The Clark County Credit Union Routing Number Guide

For residents and financial professionals in Nevada’s Clark County, understanding routing numbers—especially those tied to the region’s largest credit union—opens doors to seamless banking, faster transactions, and exclusive local services. This guide explores the Clark County Credit Union routing number, detailed breakdowns of its use, and why this route to financial stability matters more than ever in today’s digital economy.

The tracking backbone of every financial transaction, a routing number connects deposits, transfers, and payments across banks and credit unions. In Clark County, Nevada’s largest population and economic hub, the Clark County Credit Union (CCCU) stands out not only for its community-driven mission but also for its pinpoint routing number that ensures speed, security, and precision.

For anyone managing accounts, paying bills, or transferring funds locally, mastering this routing number is nonnegotiable.

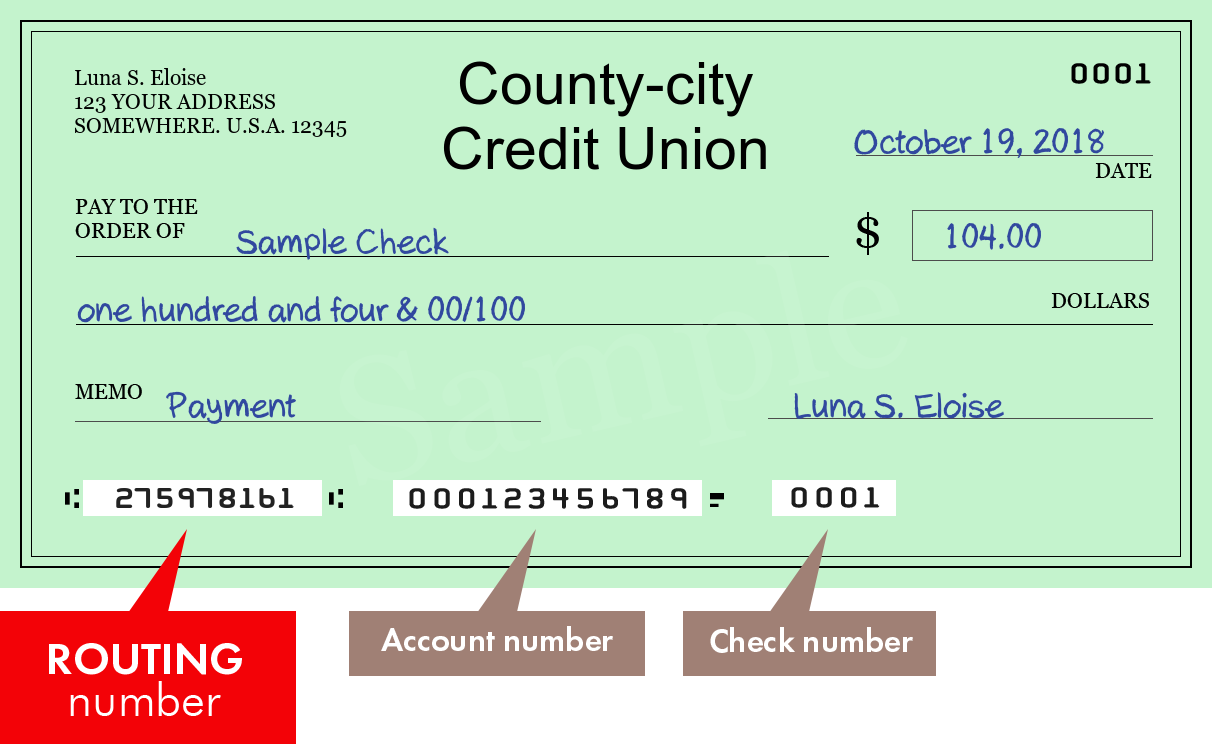

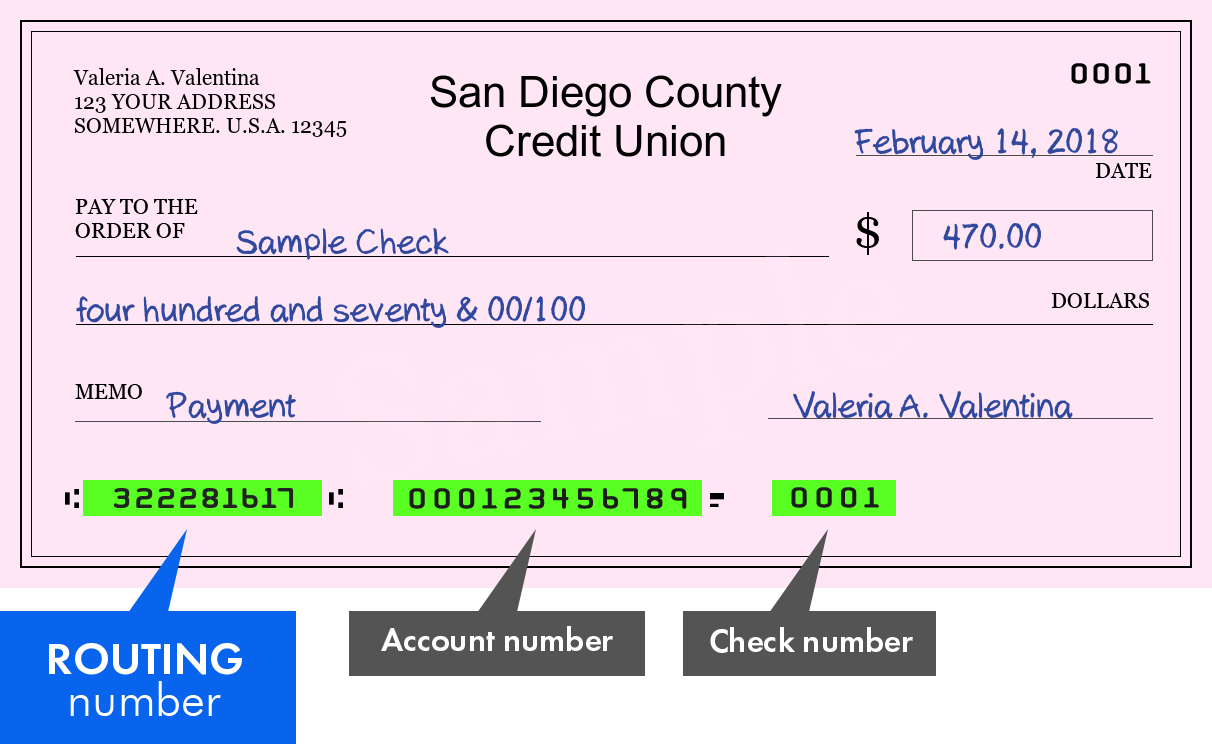

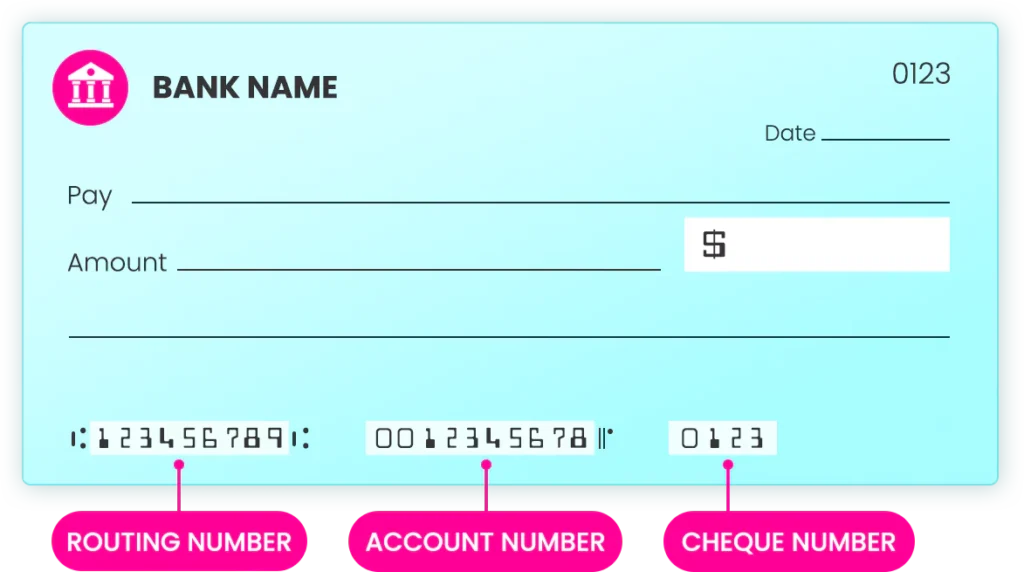

What Is a Routing Number and Why It Matters in Nevada A routing number—specifically the nine-digit numerical code assigned to financial institutions—acts as a nationwide banking identifier. In Nevada, where banking infrastructure supports both massive nationwide networks and regional credit unions, the routing number determines where funds originate and how efficiently they move. For the Clark County Credit Union, its routing number enables seamless integration with the federal ABA (American Bankers Association) system, ensuring transactions clear smoothly and securely across state lines and within Nevada’s local financial ecosystem.

Clark County Credit Union routing number, though not publicly advertised as a standalone public key, operates under a designated federal routing framework tied to Nevada’s banking geography.

While exact public disclosure varies, CCCU leverages a specialized routing identifier aligned with regional Fedwire systems and vehicle-to-person (VTP) transfer protocols, reflecting its deep operational integration with Nevada’s financial backbone.

Breaking Down the Role of Clark County Credit Union’s Routing Number Within Clark County’s financial landscape, the CCCU routing number facilitates: - **Same-day ABA payments** for local businesses and individuals - **Secure online and mobile banking** that syncs transactions instantly - **Direct access** to federal clearinghouse messaging - **Enhanced fraud detection**, leveraging route-specific security protocols - **Interstate transfer efficiency**, reducing hold times for Nevada residents navigating cross-border financial needs

For credit union members, the routing number isn’t just a code—it’s a gateway. By properly configuring routing details during account setup or fund transfers, users ensure payments land reliably and fraudulent activity is minimized. The CCCU routing system, built on decades of Nevada banking experience, supports both routine banking and complex transactions with consistent accuracy.

How to Find and Use Clark County Credit Union’s Routing Number

Though not prominently listed in public directories as a singular “route number,” members locate CCCU’s routing identifier through trusted banking channels: - Bank branch materials - Online banking profile settings - Checks (via routing number on the bottom), though newer banks favor digital access - Direct contact with CCCU’s member services for verification Once identified, this number powers critical functions: direct deposits from Nevada employers, automatic bill payments, and instant nearby ATM transactions.For business owners in Clark County, it enables faster payroll processing and seamless integration with local vendor payment systems.

Comparing Clark County Credit Union Routing Number with National Standards While every U.S. financial institution relies on ABA routing numbers, the CCCU’s implementation showcases Nevada’s localized banking culture: - Uses the national 9-digit format but applies regional metadata for faster clearing - Supports unique internal routing extensions for internal state-based transfers - Enables specialized generational routing for multi-tiered credit union networks across Southern Nevada

In an age of digital banking, understanding routing numbers remains foundational. For Clark County Credit Union, its routing number is more than a number—it’s the pulse of regional financial trust, ensuring every transaction honors local roots while meeting national precision standards.

In essence, the Clark County Credit Union routing number is the invisible engine behind daily financial life in Nevada’s most dynamic county.

From paychecks to payments, its reliability strengthens local economies and empowers individuals with frictionless banking power. In a state where financial accessibility drives opportunity, knowing and leveraging this routing number is not just smart banking—it’s essential.

Related Post

Unohana: Revitalizing Traditional Herbal Knowledge for Modern Health

MacBook Air M1: Breaking Through Activation Lock — How to Bypass Apple’s Secure Bypass Methods

Unlock the Wordle Secrets: Master the Art with Tryhard Wordle Solver

What Is Scco Optometry Reddit? Decoding the Online Hub for Contact Lens Enthusiasts and Eye Care Insights