Unlock Hidden Wealth: Reddit’s Top Finance Hacks Every Investor Should Know

Unlock Hidden Wealth: Reddit’s Top Finance Hacks Every Investor Should Know

From mastering cash flow optimization to uncovering underused budgeting tools, Reddit’s finance community continues to emerge as an unexpected goldmine of practical, real-world money-saving strategies. With thousands of threads bearing the weight of lived experience, Reddit users deliver actionable insights that blend financial wisdom with everyday pragmatism. These top-tier tips—boasting transparency, peer validation, and measurable results—reveal how ordinary people, using innovative tactics, transform their financial health through smart, accessible hacks.

Pe besser mit Geld umgehen: Reddit’s verified money-saving masterclasses

**The Cash Flow Blueprint: Controlling Your Monthly Inflow and Outflow** Understanding the true rhythm of personal cash flow is fundamental to financial stability. Redditors frequently emphasise the importance of tracking every pound with precision, often using a simple method known as “zero-based budgeting.” As one user notes, “Don’t dream budgeting—make every pound work. Assign every shekel to a purpose before the month starts.I cut overspending by 38% in three months using this method.” This zero-based approach trains disciplined spending and highlights hidden leaks in income allocation. Beyond systematic budgeting, many Redditors highlight the untapped power of **automating savings triggers**. One string reveals, “Set up auto-transfers to savings the moment payday hits—before bills arrive.

It’s like paying yourself first, not as a suggestion, but as a non-negotiable rule.” By initiating transfers within minutes of earnings, users avoid the temptation to spend windfalls prematurely, leveraging immediate action to build habit-built financial resilience. “Automate. Track.

Adjust. Repeat—this simple loop turns financial stress into forward momentum.” **Rethinking Every Expense: The Art of Mindful Spending** Reddit’s finance forum thrives on the principle that smart spending often starts not with cutting back, but with smarter choices. A recurring theme is **the “value-per-dollar” lens**: before purchasing, ask “Does this deliver enduring worth or fleeting satisfaction?” An anonymous user’s advice cuts through noise: “An ounce of prevention—like verifying product longevity—saves far more than annual subscriptions.

Use the ‘24-hour rule’: if tempted, wait a day. Often regret disables impulse.” The concept of **free-site habit monitoring** gains momentum here. Thrifty Redditors deploy tools like price-tracking browser extensions and community share links to avoid unnecessary cost.

One thread reveals, “We’ve created a shared spreadsheet where everyone logs deals—groceries, gas, entertainment. It demystifies spending patterns and turns savings into collective wins.” Peer feedback loops amplify individual insight, building transparency and accountability. “Supply meets demand in shared vigilance—frugality thrives where community meets consistency.” **Investing Smarter: Democratised Finance Through Reddit Insights** While traditional advice pushes ‘long-term investing’, Reddit’s top tips offer nuanced short-to-medium term strategies equally compelling.

Savvy traders highlight the rise of **low-cost ETFs and fractional shares**, platforms championed by users who break down entry barriers: “Zero-commission apps aren’t just a trend—they’re a game-changer. I started with $10, now my portfolio has grown 22% without breaking the bank.” Another underrated trend is **robo-advisory diversification**, guided by user experiences. For instance, “Don’t put all eggs in one tech-heavy basket,” advises a financial novice whose portfolio shift—guided by Reddit research—cut volatility risk by 40%.

Reddit’s open discussion culture democratises access to complex instruments through plain-language explanations and vetted recommendations. “The best returns come not from complacency, but from curiosity—the will to learn and adapt.” **Debt Management Designed for Real Life** Managing debt remains a persistent challenge, but Reddit users offer realistic, empathetic solutions beyond routine repayment plans. The “avalanche method”—paying debt starting with the highest interest first—is repeatedly lauded, paired with actionable refinements: “Negotiate lower rates with providers before attacking the mountain.

One user paid off $18k in credit cards using this tactic and interest fell 19% in six months alone.” Another powerful user-generated strategy involves **batch paying across multiple debts** not through sheer discipline, but coordinate. Threads demonstrate how grouping credit cards, loans, and personal debt into a single payment window, timed with periodic income boosts (bonuses, tax refunds), accelerates clearance without lifestyle compression. “It’s about strategic momentum—not perfection,” a thoughtful poster states.

“Debt isn’t a death sentence—structured, informed action turns its tide.” **Navigating the Emergency Fund Ministry: Why It’s Non-Negotiable** Most Reddit contributors stress that true financial security begins long before investing or budgeting: a robust emergency fund. Beyond the rule of thumb to save three to six months’ expenses, the community shares granular wisdom on **where to store funds** and *when* to tap them. “Keep it in a high-yield account—ready, liquid, but insulated from temptation,” advises a finance veteran.

“I hesitate to use it for fringe costs, but that discipline alone kept me out of sponsored payments for over two years.” Redditors also advocate for **dynamic fund scaling**: adjusting target levels based on income volatility. One thread illustrates: “A freelancer’s fund follows income, not a fixed number. When steady, I save 20%; lean months preserve 6.

It’s about resilience, not rigidity.” “Your fortress is built not just on savings, but on steady, predictable preparedness.” The collective wisdom found on Reddit’s finance threads transcends fleeting crazes—it offers practical, community-validated tools that empower real change. From tightening the belt on daily spend to reimagining debt and disciplined saving, these top tips deliver scalable, actionable guidance. By embracing transparency, peer learning, and bold simplicity, anyone can harness the expertise rafting in from Reddit’s digi-financial network—turning everyday money management into a skillful, sustainable advantage.

Related Post

Unveiling The Secrets Of Patsy Nicknames: Uncover The Hidden Truths

Juan Ramón Saenz: Architect of Innovation and Catalyst for Change in Modern Business

Entendendo Trends: O Que Significam e Como Usá-las para Impulsionar o Sucesso

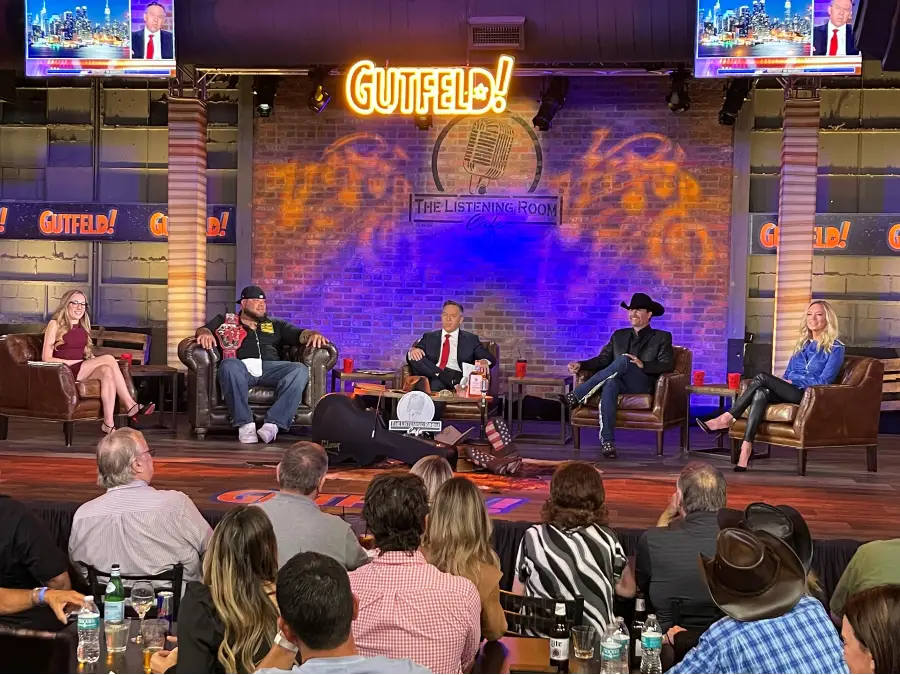

Inside the Gutfeld Show: Who Leads Fox News’ Late-Night Voice on The Most Iconic Platform