Understand Arizona Tax Refund Offset: How It Shapes Your Spring Paycheck

Understand Arizona Tax Refund Offset: How It Shapes Your Spring Paycheck

Arizona tax refund offset plans are transforming how residents access upcoming tax refunds, offering a powerful financial tool that keeps more money in residents’ pockets when income taxes are owed. For thousands of Arizonans, the annual refund isn’t just a yearly Luber—it’s an opportunity to offset penalties or manage tax balances seamlessly. With careful planning and awareness of Arizona’s specific rules, taxpayers can leverage this mechanism to reduce financial burdens and improve cash flow.

This article cuts through the complexity to deliver essential insights into Arizona’s tax refund offset system: how it works, who qualifies, when benefits drive immediate savings, and practical steps to maximize your refund efficiently.

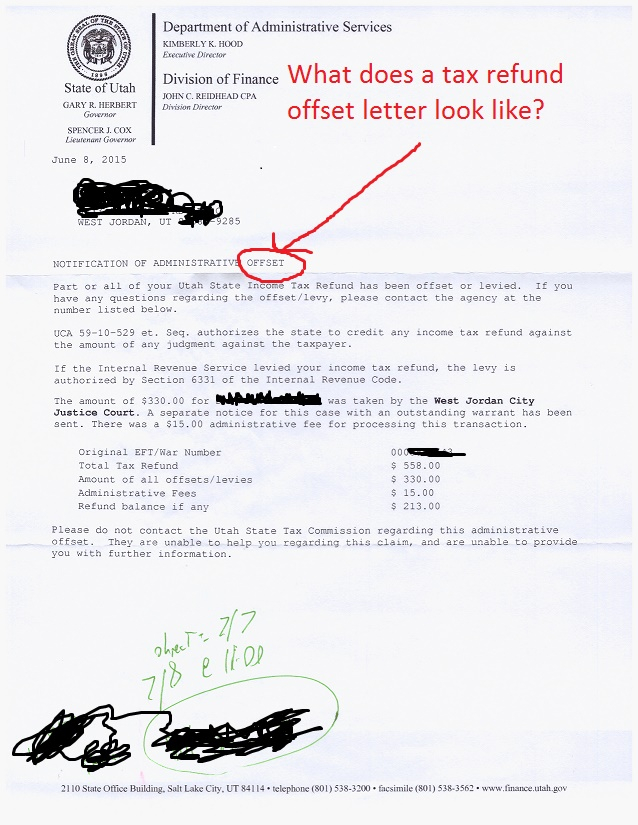

What Exactly Is the Arizona Tax Refund Offset?

The Arizona Tax Refund Offset program allows eligible individuals and families to apply part or all of their tax refund directly toward overdue state income tax payments, penalties, or other tax-related liabilities. Unlike lump-sum payments that settle balances all at once, the offset function adjusts refunds in real time, effectively turning refund funds into a living credit against future tax obligations.States nationwide offer similar mechanisms—such as California’s “upcoming refund offset” provisions—but Arizona’s framework stands out for its clarity and direct integration with refund processing at the point of disbursement. This system reduces the need for multiple filings and simplifies compliance for both taxpayers and state revenue offices.

At its core, the refund offset acts as a safety net.

Rather than waiting months for a refund—or facing penalties after underpayment—the Arizona jumpstart leverages annual filings to offset current liabilities. For many, the uptick in liquidity is more than a relief—it’s a lifeline during inconsistent income cycles, seasonal employment, or post-pandemic financial readjustment.

Who Qualifies for the Arizona Tax Refund Offset?

Eligibility hinges primarily on two factors: past tax liability and refund timing. Taxpayers with prior filings that showed underpayment or outstanding balances are prime candidates.The Arizona Department of Revenue assesses refunds eligible for offset based on: - Actual back taxes owed - Carried-over credits or rebates - Overwhelmingly, refunds disbursed after filing (typically April or May payroll checks deferred for current year liabilities) A key distinction: refunds tied to refundable credits—such as the Earned Income Tax Credit (EITC), Child Tax Credit, or preschool tax credits—are preferred candidates. Non-refundable credits or bonus credits notClaimed in initial filings are typically excluded.

Importantly, waitlisted refunds may emerge eligible if earlier filings revealed unpaid amounts.

One Tucson resident, Maria Chen, shared, “I got my refund early last year, but I hadn’t claimed my EITC. When I filed with updated numbers, the state automatically offset the owed balance—my $800 refund didn’t go just to the IRS; it cleared my back tax debt too.”

When and How Does the Offset Apply?

Refunds eligible for offset are processed automatically upon refund generation, usually within two to four weeks after filing. The Arizona Department of Revenue coordinates with state payroll and direct deposit systems to redirect applicable refund portions toward current tax liabilities.This reactivity means: - Refunds from temporary income spikes or bonus payments can reduce future tax bills immediately - Delays or underreported earnings may trigger larger offset impacts when corrected - Multi-year filers benefit from cumulative offset opportunities across annual returns

While the refund offset is an automatic step, taxpayers retain full visibility through their e-file confirmation and annual Revenue Statement. Requests for enhanced tracking or prior authorization are processed through standard state channels but are rarely required for routine refinancing.Practical Steps: How to Leverage Your Arizona Tax Refund Offset

Maximizing refund offsets starts with accurate, timely filing—and awareness of how your refund structure enables better tax management.Follow these actionable steps:

1. Confirm Refund Type: Prioritize refundable credits over non-refundable ones. Non-refundable credits may not fully offset payable taxes but still affect reporting accuracy.

2.

Update Your Tax Profile: File precisely, reporting all applicable income and credits. Discrepancies can delay offset eligibility or trigger repricing of refunds.

3. Anticipate Post-Filing Offsets: Once a refund is processed, monitor its allocation.

Use e-File status updates or Revenue Statement reports to confirm offset applications.

4. Collaborate with Employers: For part-time or gig workers, clarify how advance deposits or quarterly estimates tie into annual refund offsets—reducing mismatched liabilities.

Practical case example: Juan, a Phoenix-based freelancer, received a $2,300 refund after refunding Q2 income with claimed self-employment deductions. After filing his April return with updated Form 540, the state immediately offset $1,850 of his unpaid tax balance—effective cash flow access without bureaucratic delays.Maximize Your Refund, Not Just Receive It

Refund offset programs offer more than delayed payment—they represent a strategic shift in tax liquidity. By aligning refund timing with liability resolution, Arizonans turn a once-passive yearly event into an active financial planning tool. The system empowers awareness: understanding qualifying credits, filing honestly, and embracing digital transparency places taxpayers in control.“This isn’t magic,” says state tax analyst Laura Mendoza. “It’s policy designed to meet taxpayers where they are—with measurable, real-time benefits that build financially stronger communities.”

The Future of Arizona Refund Offsets and Community Impact

As wage volatility persists post-pandemic, Arizona’s refund offset mechanism grows increasingly vital. Beyond individual relief, the program strengthens state revenue reliability by accelerating debt clearance and reducing delinquency.For residents managing variable incomes, the system symbolizes progress: tax obligations adapt to real earnings, not rigid schedules. Accurate refund offsets mean fewer family financial shocks and more predictable budgeting at the household level. In an era of heightened financial scrutiny, Arizona’s transparent, refund-linked adjustment process stands out as a model of equitable tax management—one where refund checks don’t just settle balances, but actively reshape financial futures.

Whether you receive a modest return or

Related Post

What Happened to Dr Lisa Jones on Dr Pol? The Silent Fall of a Trusted Medical Voice

NCAA Softball Transfer Portal Tampering: The Rising Crisis Behind Collegiate Recruitment Shenanigans

From Centimeters to Feet: The Precision Behind Every Inch in Global Measurement

Unlock GitHub Mastery with Telegram Channel Report Bot: The Ultimate Guide