TSMC Stock: The Global Investor’s Playground in Semiconductor Dominance

TSMC Stock: The Global Investor’s Playground in Semiconductor Dominance

At the heart of the global tech supply chain pulses TSMC—Taiwan Semiconductor Manufacturing Company—whose stock has emerged as a cornerstone for sophisticated investors seeking exposure to the semiconductor revolution. As the world’s largest dedicated foundry, TSMC doesn’t just manufacture chips; it shapes the futuristic technologies underpinning AI, 5G, electric vehicles, and advanced consumer electronics. For discerning investors, TSMC stock represents not only access to a multi-decade growth trajectory but also a tangible link to the foundational infrastructure powering modern innovation.

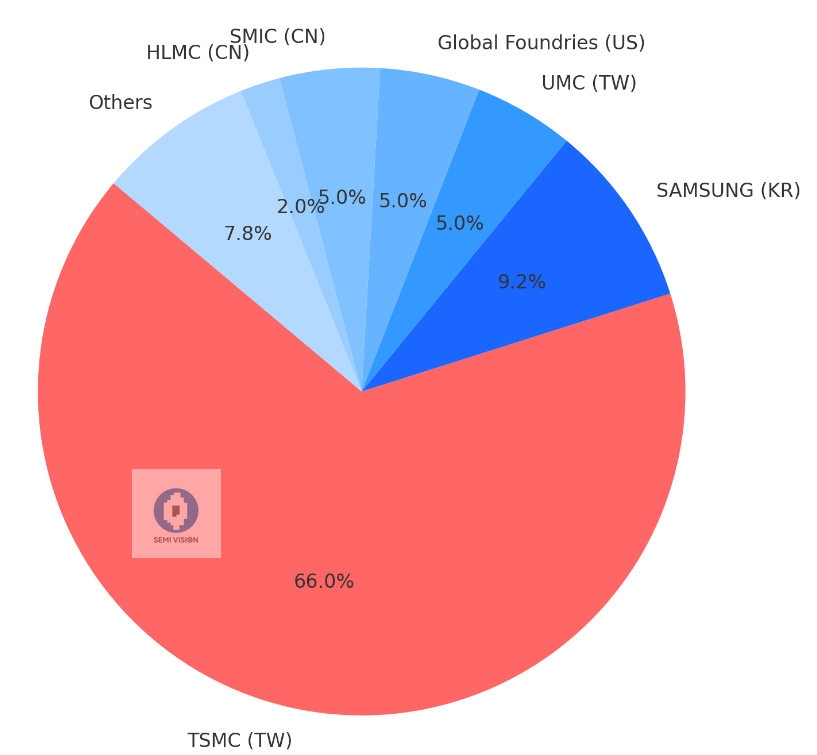

Once viewed as a niche player in the semiconductor landscape, TSMC has ascended to strategic importance, especially amid escalating U.S.-China tech tensions and the global race for chip independence. Its dominance is quantified by staggering market share—controlling over 50% of the global foundry sector—and a client roster that includes Apple, NVIDIA, AMD, and Qualcomm. This blend of technological leadership, customer confidence, and unparalleled process-edge capability drives both valuation and investor interest.

Why TSMC Stands Unrivaled in Semiconductor Manufacturing

The company’s edge lies not just in scale but in cutting-edge process technology. TSMC’s 3nm and upcoming 2nm fabrication nodes set industry benchmarks, enabling the production of more powerful, energy-efficient chips critical for next-gen applications. According to industry analysts, “TSMC’s technological trajectory is the gold standard—its R&D investment consistently exceeds US$5 billion annually, funding innovations that redefine what’s possible in chip performance.” Beyond engineering prowess, TSMC’s strategic positioning strengthens its investment case.Operating across Taiwan, the U.S. (via Arizona fab expansions), and Japan, TSMC diversifies geopolitical risk while capitalizing on global demand. Its foundry model—focusing solely on manufacturing without dealing end-market products—avoids conflicts of interest and reinforces trust with global partners.

Market Dynamics and Financial Resilience

TSMC’s stock, listed on the Taiwan Stock Exchange as 2333.TW, has delivered long-term compound growth exceeding 15% annually over the past decade, outperforming both regional and global semiconductor peers. This resilience is fueled by structural tailwinds: the global chip shortage of 2020–2022 cemented TSMC’s role as a supply linchpin, while sustained AI and IoT adoption continue to boost demand. Key financial metrics underscore the company’s strength: a robust $90 billion+ market cap, high gross margins above 45%, and consistent free cash flow generation—factors that underpin investor confidence.Analysts note, “TSMC’s balance sheet is fortress-like,” with over US$250 billion in cash and equivalents, affording flexibility for reinvestment, acquisitions, and shareholder returns via dividends and buybacks.

Strategic Investments and Geopolitical Positioning

TSMC’s future growth is anchored in massive capital expenditures—totaling over US$40 billion in planned capex through 2025—targeting new fabrication plants in Taiwan, Japan, and the U.S. These investments align with critical government incentives, such as Taiwan’s semiconductor subsidies and U.S.CHIPS Act funding, effectively de-risking expansion while magnifying returns. “The synergy between private investment and national tech policy creates a self-reinforcing cycle,” explains Dr. Mei-Chun Lin, a semiconductor policy expert.

“TSMC’s geographic spread reduces exposure and enhances its ability to serve clients across all major markets—without reliance on any single region.”

Investment Accessibility and Risks

For individual investors, TSMC is accessible via exchange-traded shares, with active liquidity and index inclusion—via ETFs like the iShares Semiconductor Research ETF (SRJR)—facilitating broad market exposure. A position in TSMC offers indirect entry into cutting-edge chip innovation, though it carries sector-specific risks including supply chain disruptions, regulatory pressures, and geopolitical volatility. Despite these challenges, TSMC remains a defensive core in tech-heavy portfolios.Its ability to adapt—from advanced packaging solutions to sustainable manufacturing—positions it to outperform cycle-driven tech swings. Whether through direct equities or diversified vehicles, TSMC stock invites not passive following but deliberate engagement with one of the most consequential industrial players of the digital age. In an era defined by semiconductor dependency, TSMC stands not only as a manufacturing titan but as a strategic investment opportunity—bridging technological ambition with enduring financial value.

For global investors eyeing the future, TSMC is not just a stock; it is a compass pointing toward the next frontier of innovation.

Related Post

Old Mutual Secure Services: Your Key to Seamless Digital Access with Easy Login

Unlock Seamless Access: Brownsburg Schoology Login Powers Modern K–12 Education

Atahualpa Stadium: Where Peru’s Ancient Grandeur Meets Modern Passion on the Field

Arena Do Gremio: Unveiling Total Capacity and Seating Excellence in Porto’s Iconic Stadium