Travis Scott’s Artist Price Mechanics: Decoding the Real Cost Behind the Megastar Prestige

Travis Scott’s Artist Price Mechanics: Decoding the Real Cost Behind the Megastar Prestige

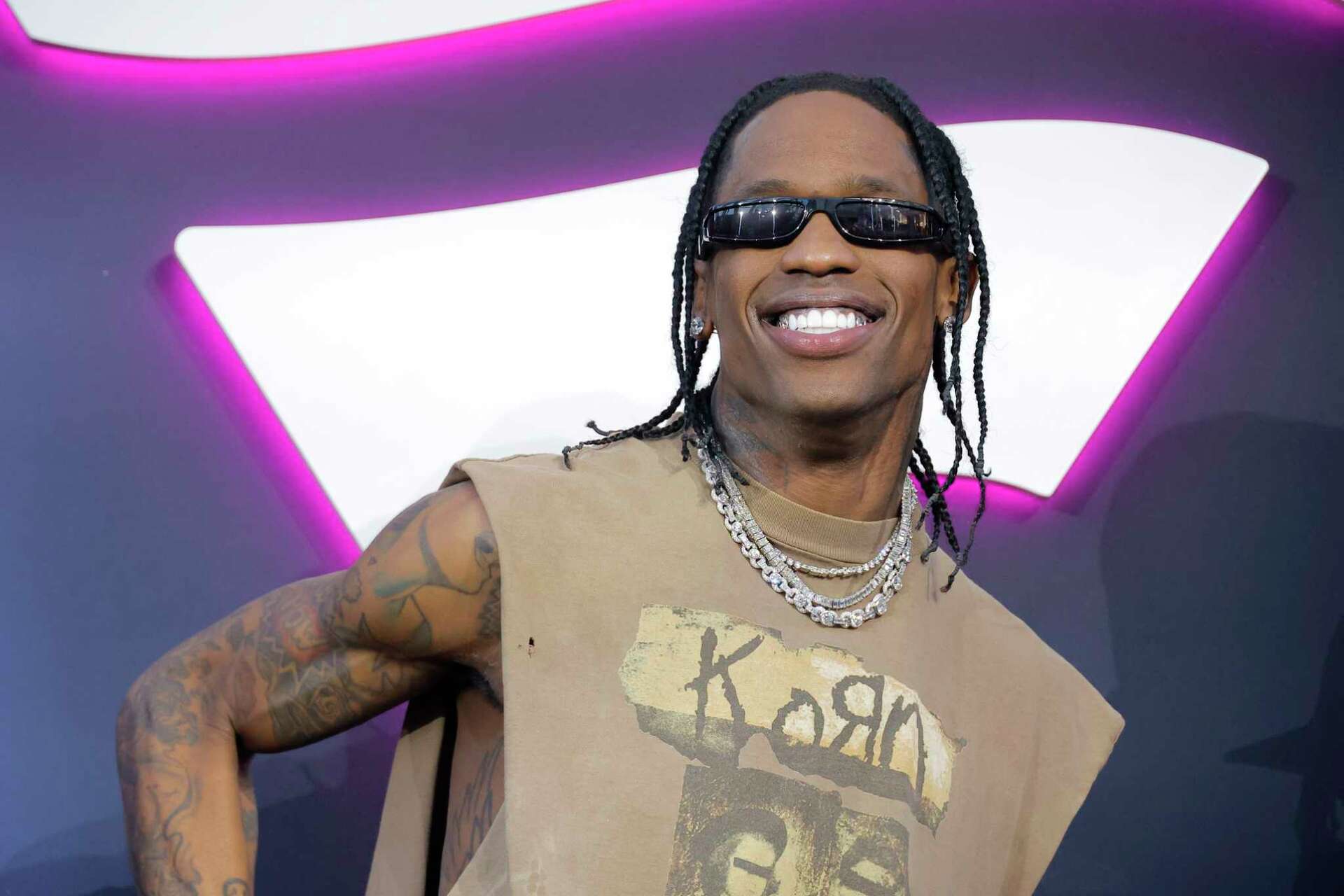

Travis Scott’s global dominance in music, fashion, and culture corresponds directly to a carefully constructed financial ecosystem where his artistic value, brand leverage, and market influence converge into staggering monetary principles. Understanding the true cost behind Travis Scott’s value requires peeling back layers of pricing factors—ranging from ticket sales and merchandise revenue synergies to brand partnerships and streaming economics. This analysis reveals how artist price isn’t just about paydays, but a sophisticated interplay of exposure, demand elasticity, and cross-industry monetization.

As one of the most influential artists of the 2020s, Travis Scott commands premium pricing across every platform, but his market value isn’t derived solely from streaming numbers or concert ticket harvests. Industry experts stress that his pricing model is multi-tiered. Music revenue—generated through digital streams, downloads, and physical sales—serves as the foundation.

A single dominant track like “SICKO MODE” or a breakout album on chart-topping platforms can generate millions in royalties. But these figures represent only one facet of his economic footprint. Multiply this by high-demand live performances, where tickets routinely soar to $500–$1,000+ for premium seating, and his immediate financial reach expands exponentially.

Merchandise sales amplify this value, often spinning off brand identity into wearable equity. From “Flight” hoodies to custom capsule collections with Nike, Scott’s merch transcends accessory status—it becomes cultural currency. During tour dates, merchandise revenue can surpass traditional album sales, anchoring long-term sustainability.

A 2023 report noted artist-driven merchandise campaigns under Scott’s ventures can generate upwards of $10 million per tour cycle, reinforcing his status as a lifestyle brand as much as a musician.

The Economics of Exclusivity and Hype

By leveraging scarcity, his team transforms availability into demand, allowing for premium pricing that regular circuit tours don’t always command. This exclusivity feeds into fan psychology, encouraging pre-purchases, collectibility, and premium resale markets.

Brand partnerships and cross-industry synergies Scott’s 2022 Nike collaboration remains a landmark case study in artist monetization ethics. Valued at an estimated $250 million, the project fused music, lifestyle, and retail, illustrating how star power amplifies brand desirability. Such partnerships extend beyond advertising: they unlock global retail distribution, amplify social media reach, and diversify income beyond traditional music sales. Each collaboration acts as a catalyst, multiplying influence and profit margins across rotational campaigns rather than one-off deals.

Each collaboration acts as a catalyst, multiplying influence and profit margins across rotational campaigns rather than one-off deals.

Streaming economics further shape his financial picture—notably via data-driven royalty structures and platform algorithms. While per-stream payouts remain minimal, high-engagement artists like Scott generate outsized cumulative earnings through tracks going viral, playlist congruence, and algorithmic promotion. Moreover, the “emotional equity” tied to his brand increases listener retention and repeat streams, creating a feedback loop where engagement begets financial reward at scale.

Tour revenue: the crown jewel of artist valuation

Agent fees, production costs, and logistical investments form the operational backbone enabling such returns.

High-stakes artist management demands significant upfront allocation: hiring top-tier choreographers, securing elite venues, designing cutting-edge tech assets, and ensuring global security. These expenses are factored into ticket and merchandise pricing tiers to maintain profitability while preserving fan appeal.

From Sound to Valuation: The Hidden Costs Behind the Travis Scott Brand

Creating and sustaining Travis Scott’s artistic empire involves far more than recording songs.It requires a seamless integration of marketing, logistics, fan psychology, and data analytics, each feeding into a total economic value that extends well beyond the digital clip. Every released track, every sold-out show, every curated merch item and partnership aligns with a broader pricing architecture—where scarcity, access, and influence translate directly into revenue. As the creative economy grows ever more interconnected, Scott’s approach serves as a masterclass in how artists convert cultural capital into financial sustainability.

His pricing model reflects a nuanced understanding of 21st-century monetization—one where artistry and enterprise are not opposing forces, but carefully calibrated forces working in tandem to define a global standard of value. Travis Scott’s ascent underscores a pivotal truth: in today’s entertainment arena, artist price is not simply set by contract—it’s engineered. Behind every headline-grabbing cost lies a calculated ecosystem balancing demand, exclusivity, and brand power, yielding a figure that remains endlessly negotiable yet consistently rooted in demonstrable economic force.

Related Post

Oz to Pounds: The Precision Every Cook, Traveler, and Professional Needs

How to Send Robux to Friends: The Definitive Guide to Transferring Value Instantly

The Next Big Shift After Erome Desktop Has Just Begun Surviving “Embedded Realities”

Unveiling The Truth: Is Sam Witwer Gay? Sur400-Pound Dark Comedy Star’s Identity Remains Off Limits