The Pulse of New York City: How the Department of Finance Shapes Urban Wealth through Property Tax

The Pulse of New York City: How the Department of Finance Shapes Urban Wealth through Property Tax

The New York City Department of Finance (DFFT) stands as a behind-the-scenes architect of urban fiscal health, managing one of the most complex and consequential property tax systems in the world. With annual revenues exceeding $10 billion and serving over 8.8 million properties, the DFFT’s property tax framework not only funds essential city services but also influences real estate investment, neighborhood development, and economic equity. Far from a static levy, the city’s property tax system evolves dynamically—reflecting policy shifts, market pressures, and long-term urban strategy—making it a critical lens through which to understand New York’s economic heartbeat.

Decoding the Property Tax Foundation: Structure and Mechanics

At its core, New York City’s property tax is derived from assessed value—a calculated portion of a property’s market worth, subject to annual adjustments and local exemptions. The DFFT is responsible for determining assessed value, administering tax rates, and enforcing compliance. Property taxes are levied at both the city and state levels, with New York City setting its own rate—currently fluctuating between 1.25% and 1.96% depending on jurisdiction and property type.Commercial, residential, and vacant properties each follow distinct assessment rules, ensuring nuanced treatment across asset categories. The process begins with annual property appraisals, conducted using a combination of automated valuation models and field inspections. The DFFT maintains a comprehensive digital database integrating data from real estate transactions, tax exemption applications, and spatial analytics.

This rigorous foundation supports accurate valuations, reducing disparities and ensuring fairness across neighborhoods. “I strive to keep assessments aligned with true market value while offering meaningful relief to long-term residents and small property owners,” stated Commissioner Daniel L. O’Donnell in a 2023 citywide update.

“Transparency and equity are non-negotiable in how we calculate bills that fund schools, street repair, and emergency services.”

Exemptions and Incentives: Balancing Public Good with Economic Vitality

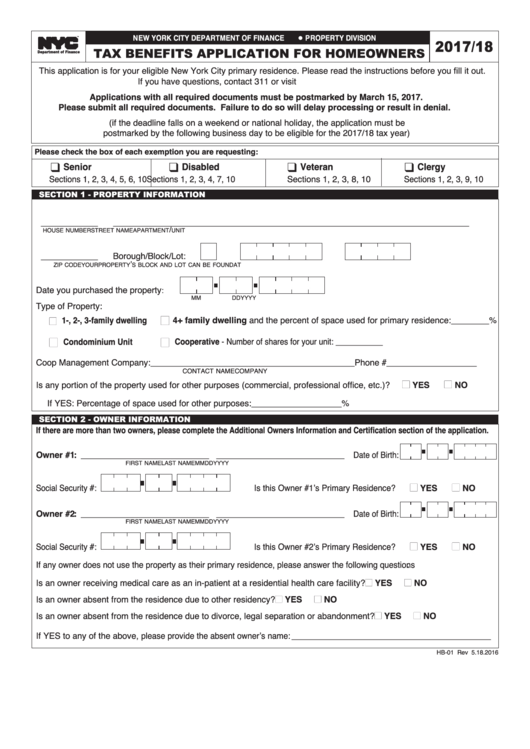

The DFFT administers a range of exemptions designed to support vulnerable populations and encourage economic development. Primary among these is the 100% exemption for homeowners aged 65 or older, alleviating financial pressure on senior residents. Musicians, elected officials, and certain nonprofit organizations also benefit from targeted relief, recognizing non-monetary contributions to the city’s cultural and civic fabric.Additionally, the city’s Vacant and Unused Property Tax (VUPT) program penalizes owners of abandoned buildings while incentivizing rehabilitation through phased decreases and abatement periods. This dual approach combats blight without stifling redevelopment, aligning private investment with public interest. “Our goal is to ensure every property contributes fairly—without burdening those who help build community,” emphasized DFFT Deputy Commissioner Maria Chen, who oversees tax relief programs.

“Exemptions and phased incentives allow us to reward responsibility and spur revitalization.”

Technology and Innovation: Modernizing the Tax Administration

The Department of Finance has embraced digital transformation to enhance accuracy, accessibility, and efficiency. The online Real Property Tax (RPT) Portal enables property owners to view assessments, file appeals, and pay taxes 24/7. Advanced data analytics and GIS mapping allow the DFFT to detect valuation anomalies, prevent fraud, and streamline processing.The launch of the “Assessments Online” dashboard in 2021 marked a pivotal shift: residents now access real-time updates, request re-evaluations, and receive personalized notifications—reducing call center volumes by over 30% in the first year. “The DFFT is committed to making property tax management transparent and user-friendly,” affirmed Commissioner O’Donnell. “Technology bridges the gap between bureaucracy and citizen trust, ensuring the tax system serves—not challenges—the people it represents.”

Economic and Fiscal Impact: Property Tax as a Pillar of City Funding

Property tax revenue forms nearly 30% of New York City’s general fund, underpinning critical investments in infrastructure, public safety, education, and healthcare.Without this consistent revenue stream, efforts to maintain Mills Street highways, staff public schools, or fund NYPD patrols would face severe constraints. Beyond direct funding, the system influences broader economic behavior. High tax rates in certain zones can spur development buffers or rezoning incentives, while low-density areas may face targeted relief to encourage growth.

The DFFT’s data-driven approach allows policymakers to calibrate rates regionally, balancing growth and fiscal sustainability. Market analysts note that predictability in tax rates and valuations contributes to long-term investor confidence. “A stable, fairly assessed property tax regime helps anchor real estate decisions across Manhattan, Brooklyn, and

Related Post

<strong>London Heathrow Airport Time: The Global Heartbeat That Keeps Flights Running on Schedule</strong>

Lindsey Halligan’s Husband Among Trump Legal Circle: Who’s James Trusty and What’s the Broader Legality Drama?

The Muscle Fiber’s Hidden Engine: How Sacromeres Power Every Contraction

Inside the World of the Painted Bird: Fascinating Facts Revealed in a Compelling Photogallery