The Peruvian Sol: Peru’s National Currency in Context

The Peruvian Sol: Peru’s National Currency in Context

The Peruvian sol stands as the dynamic heartbeat of Peru’s economy, a currency shaped by history, stability, and evolving ambitions. From its origins tied to silver-based colonial finance to its modern role in international trade, the sol reflects both Peru’s heritage and its growing economic presence in Latin America. With careful policy management by the Central Reserve Bank of Peru, the sol balances purchasing power, exchange rate discipline, and financial inclusion, positioning itself as more than just legal tender — it is a symbol of national identity and economic resilience.

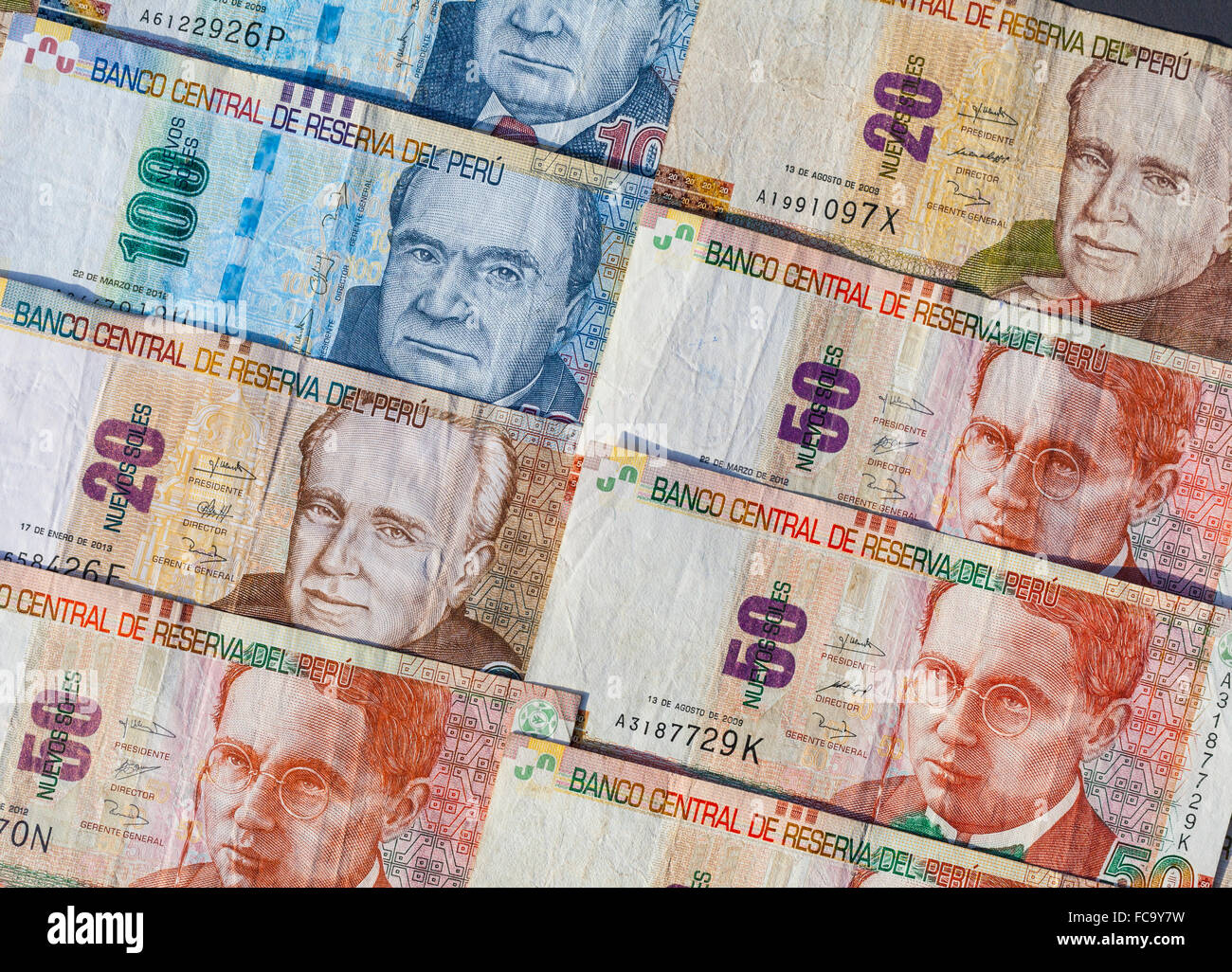

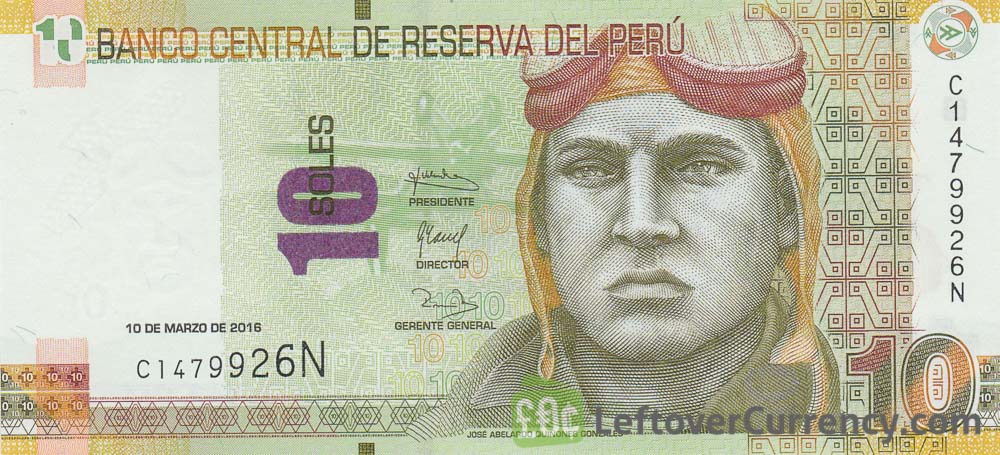

At its core, the Peruvian sol (PEN) functions as the country’s official currency, issued and regulated by the Central Reserve Bank of Peru (BCRP). The term “sol” itself derives from the Latin *solido*, echoing the currency’s historical roots in silver coins used during the Spanish colonial era. Today, the sol is subdivided into 100 centavos, with coins available in denominations of 1, 2, 5, 10, 20, 50 centavos, and 1 sol, while banknotes are issued in 5, 10, 20, 50, 100, 200, and 500 solen.

These physical forms, printed with intricate security features, are critical to daily commerce across urban centers and remote rural communities alike.

The Central Reserve Bank plays a pivotal role in maintaining the sol’s stability through proactive monetary policy. Since the 1990s, Peru has transitioned from high inflation and currency volatility to a relatively stable macroeconomic environment. Inflation targets, exchange rate flexibility, and prudent foreign reserve accumulation have allowed the sol to withstand external shocks and sustain investor confidence.

“The sol’s resilience reflects Peru’s institutional maturity and commitment to fiscal responsibility,” notes Dr. Elena Mendoza, economist at Lima’s Institute of Economic Analysis. Actual inflation over recent years has remained within single digits, a key factor reinforcing public trust in the currency.

Denominations and Circulation

The sol’s physical currency is designed to reflect Peru’s cultural identity and practical functionality.The 1-sol coin, often used in small transactions, features President Manuelgiore’s portrait on one side and traditional Andean motifs on the reverse. Larger denominations — 5, 10, 20, and 50 soles — incorporate iconic landmarks like the Huaca del Sol, the Sacred Valley, and diverse landscapes, blending history with national pride. The 200-sol coin, introduced only in 2020, addresses growing demand for higher value notes in digitalized payment systems.

In circulation, the sol flows through both traditional markets and modern banking channels. Small shops, street vendors, and formal retailers across Peru widely accept the sol, with digital payment platforms such as OLX, MercadoPago, and local banks’ apps increasingly complementing cash transactions. According to BCRP data, the sol accounts for over 60% of in-country monetary circulation, with strong penetration even in rural regions where access to electronic banking remains limited.<1> The currency’s durability and widespread acceptance underscore its role not just as a medium of exchange, but as a pillar of financial inclusion.

Exchange Rate and International Standing

The Peruvian sol operates under a managed float regime, allowing its value to fluctuate within macroeconomic guardrails.This flexibility supports trade competitiveness and cushions the economy against external shocks. Over the past decade, the sol has generally maintained a stable value against major currencies such as the U.S. dollar (USD), with effective exchange rates fluctuating within a narrow band managed by the BCRP’s intervention strategies when necessary.<2>

Historically, the sol’s evolution mirrors Peru’s broader economic transformation.

Following high inflation in the 1980s and early 1990s, structural reforms — including trade liberalization, fiscal discipline, and privatization of state enterprises — laid the foundation for currency stabilization. By the mid-2000s, free-floating rates were introduced, and the sol gradually gained credibility on international financial markets. Today, the currency is a component of several emerging market indices, including the MSCI Emerging Markets Index, signaling growing global recognition.

Comparisons with peer currencies reveal that Peru’s inflation-controlled environment and robust Reserve Bank governance give the sol a competitive edge over more volatile regional counterparts.<3>

Challenges and Future Outlook

Despite notable progress, the Peruvian sol faces ongoing challenges. Informal economic activity remains significant, accounting for roughly one-third of GDP, which limits the central bank’s ability to fully anchor monetary behavior. Additionally, infrastructural gaps in digital payment systems hinder the transition toward a less-cash society, particularly in less urbanized zones.Yet, the BCRP continues to advance financial innovation through regulatory support for fintechs, digital wallets, and cross-border payment integration.<4>

Moving forward, the sol’s evolution will hinge on sustaining inflation control amid global economic uncertainty, enhancing financial inclusion through digital infrastructure, and expanding Peru’s integration into regional and global value chains. “The sol is not just currency—it’s a tool of national development,” says economist Dr. Eduardo Rojas.

“Its strength lies in stability, but its future potential depends on building a more inclusive, digital, and resilient financial ecosystem.” With deliberate policy and growing demand for trustworthy value, the Peruvian sol endures as a symbol of economic maturity in an ever-changing world.

Related Post

Map of Shrines in Breath of the Wild: Your Guide to Every Sacred Waypoint

Ricky Bottalico: The Resilient Right-Handed Force Behind Philadelphia’s Hockey Promise

Kunyuk 3 Ex Covid19 Buat Kamu: How Poor Households Faced the Third Wave with Ingenuity and Resilience

How to Write Electron Configuration: Master the Syntax That Powers Cross-Platform Desktop Apps