Tesla Price Target Slashed: JP Morgan Slaps Nervous Market with Bearish Revise, Calls $250 Signal Overconfidence

Tesla Price Target Slashed: JP Morgan Slaps Nervous Market with Bearish Revise, Calls $250 Signal Overconfidence

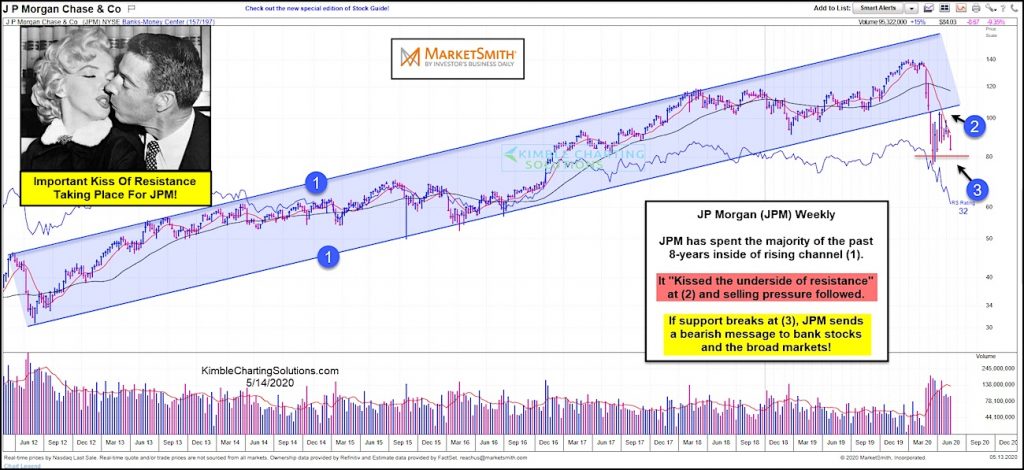

A sharp and unwelcome warning has arrived from one of Wall Street’s most influential voices: JP Morgan has slashed Tesla’s price target, citing overconfidence in the company’s growth trajectory and downgrading expectations to $250 per share—down from a prior $300–$330 range. The investment bank’s suspension of optimism reflects deepening skepticism at a moment when Tesla’s valuation has repeatedly stretched against fundamentals, prompting renewed debate over whether the electric vehicle giant’s pricing power still justifies premium investor confidence. ### What Triggered JP Morgan’s Downgrade?

At the heart of JP Morgan’s decision lies a stark mismatch between Tesla’s soaring stock performance and its operational and market realities. In recent quarters, Tesla delivered what market watchers described as underwhelming growth: deliveries grew, but not at the pace analysts anticipated; free cash flow remained constrained, raising concerns about reinvestment capacity; and margins contracted under aggressive pricing moves to sustain demand. JP Morgan’s research team highlighted several key concerns in their latest security analysis: - “Tesla’s aggressive price cuts—now averaging over $2,000 in rebates—are eroding brand equity and signaling desperation in a now-competitive EV landscape.” - Revenue growth, while positive, failed to outpace rising R&D costs and capital expenditures required to scale battery innovation and global manufacturing.

- “The market has priced in fast-moving disruption; Tesla’s historically dominant cost curve is under pressure from rivals like BYD and legacy automakers pivoting to electrification.” This recalibration comes after JP Morgan had previously maintained a “Neutral” rating, acknowledging Tesla’s pioneering role but warning of increasing volatility in execution and market reception. ### The $250 Selling Price: Industry Implications and investor Reaction JP Morgan’s target of $250 reflects both a risk mitigation and a mirror to prevailing market sentiment. For context, shares closed near $240 at publication, suggesting current prices are already priced in cautious optimism.

Slashing to $250 indicates a median view among major banks that Tesla’s near-term upside is overestimated. This downward revision has rippled through investor forums and trading desks. Short-term traders expressed leaning away, with options data showing declining call volume and rising protective put positioning.

Meanwhile, institutional investors are reevaluating exposure, factoring in a more probabilistic outlook. Market analysts note that Tesla’s premium valuation has long relied on growth-at-all-costs narratives, but recent shifts reveal a recalibration: - EV demand growth in key markets like the U.S. and Europe is unionizing around affordability and profitability, not scale alone.

- Tesla’s expanding model lineup (Cybertruck, next-gen platform) faces delays; Beta testing delays and production bottlenecks especially raised red flags. - Regulatory shifts, notably in Europe’s stricter emissions rules and trade policy uncertainty, add complexity to global expansion plans. As JP Morgan’s chief note puts it, “Tesla’s market cap no longer comfortably supports a $300–$325 range—fungibility in growth stocks demands alignment with sustainable earnings.” ### What This Means for Tesla’s Valuation and Future Path Tesla’s price target slash underscores a broader recalibration of expectations.

The company’s stock, once a beacon of tech-driven disruption, now trades amid skepticism about whether it can maintain leadership in an increasingly crowded and cost-sensitive EV ecosystem. Key implications include: - **Investor Caution:** Buy-and-holdists may reevaluate beta exposure, favoring companies with clearer paths to profitability and resilient cash flows. - **Management Response:** Tesla faces increased pressure to restore margin discipline and product differentiation—critical in a segment where margins are squeezed and differentiation scarce.

- **Market Sentiment Shift:** The slash signals growing alignment between Wall Street’s Bayesian updating model and real-world execution data, reminding all participants that high innovation takesteps require consistent results. JP Morgan’s assessment, though bearish, avoids wild conjecture: “We’re not writing Tesla off—growth potential remains—but the era of effortless premium multiples is ending. A rational target is $250, grounded in discipline, not despair.” As Tesla navigates this recalibration, its ability to rebuild margin strength, innovate at speed, and defend market share will determine whether it recalibrates back to premium or settles into a more grounded valuation regime.

Markets watch closely—because in the world of high-growth stocks, prices reflect not just dreams, but deliverables. And in Tesla’s case, deliverables are now measured in earnings, not just electric mileage.

Related Post

Elon Musk: Decoding His Speaking Secrets That Make Us Listen

Unlocking The Power Of Valpo Blackboard: Transform Student & Faculty Success in Higher Education

celebrities with Noonan Syndrome: Inside the Lives of Public Figures Navigating a Rare Genetic Condition

Gratiela Brancusi, Tom Robbin, and the Curious Case of Age, Height, and Legacy