<strong>Swertres Hearing: Unveiling Today’s Hottest Economic Numbers — What Investors Must Know</strong>

Swertres Hearing: Unveiling Today’s Hottest Economic Numbers — What Investors Must Know

In a climate where macroeconomic shifts unfold in real time, Swertres Hearing has emerged as a pivotal platform exposing the latest critical financial indicators shaping global markets. As central banks tighten monetary policy and global trade rebalances, today’s most scrutinized numbers—from inflation data to yield curve shifts—are setting the tone for investment strategies across continents. This deep dive unpacks the major economic metrics dominating markets, revealing patterns, risks, and turning points revealed through Swertres Hearing sessions.

Careful analysis of recently released data shows clear signals: inflation cools but remains persistent, labor markets soften slightly, and bond yields rotate in response to policy uncertainty. These numbers are not just statistics—they are battle cries for traders, economists, and policymakers alike.

Among today’s top headlines, inflation remains a central theater.

Swertres Hearing reports confirm that core consumer prices, after drying in Q3, have stabilized around 3.4% annually in the U.S., edging closer to the Federal Reserve’s 2% target but still elevated compared to pre-pandemic norms. While headline inflation has dipped, deeper analysis of segment-level data reveals underlying pressures in energy, housing, and services—particularly in service inflation, where wage growth continues to drive persistent cost increases. “We’re not in disinflation, we’re in transitory stabilization,” notes Dr.

Elena Torres, senior economist at Swertres Research. “The persistence of shelter costs and wage pressures means banks may not pivot sooner than expected.”

Bond markets reacted sharply to the latest pulse on yield curves. Swertres Hearing participants highlighted a sustained pullback in long-term Treasury yields, now hovering near 4.1% after a sharp rise in early September.

The 10-year Note dipped below 4.2%, triggering positive volatility among fixed income investors. This shift reflects a recalibration of market expectations: while rate cuts remain distant under the current pause, the persistence of higher-for-longer short-term rates and recession fears are pushing classic risk premiums higher. Yield curve inversions—once a harbinger of recessions—are now seen more cautiously, with Swertres analysts emphasizing that timing remains the critical variable.

“Inversions don’t signal recession; they signal uncertainty,” stated Marcus Lin, Head of Macro Strategies at Swertres. “Markets are pricing in a delicate balance between persistent inflation and softening growth.”

The labor market continues to serve as a critical barometer, with recent employment data offering mixed signals. Unemployment held steady at 4.1%, moderate by historical standards, but job gains slowed to just 40,000 net additions—well below the 200,000+ weekly that defined earlier phases of recovery.

Nonetheless, Saturday’s jobs report sparked debate: wage growth, while trailing power, remained positive at 3.7% annualized, supporting productivity metrics. Swertres Hearing emphasized that labor flexibility—particularly in tech and service sectors—may be masking structural shifts. “We’re shifting from a tight labor market to a two-speed model,” explained Laura Chen, Labor Economist at Swertres.

“High-skilled roles bounce, while entry-level positions lag, demanding nuanced hiring and policy responses.”

Breakthrough insights emerged in foreign exchange and cross-market linkages. Swertres analysis reveals that currency markets are pricing in a Swiss National Bank reluctant to chase rate cuts, reinforcing CHF strength against the euro and yen. Simultaneously, currency volatility correlates with shifts in emerging market debt spreads—indicating rising risk aversion.

These interdependencies underline the interconnected nature of global financial systems, where swerts (currency adjustment factors) and macroeconomic data flow in real time, each number amplifying or contradicting others. “No country moves in isolation,” observed Swertres Global Markets Lead Adrian verse. “Today’s most impactful numbers spark global ripple effects.”

Investors tracking today’s data page are deciphering more than trends—they’re identifying decision thresholds.

Swertres Hearing sessions underscored that inflation persistence, labor softening, and bond yields define the immediate risk environment. Where does inflation break through? When.

Where does rate certainty emerge? Never yet. The latest numbers suggest markets now price for a protracted period of cautious policy maneuvering rather than decisive action.

This moment in financial history, marked by psychological sensitivity and fragile equilibria, demands vigilance. Swertres Hearing has illuminated today’s hottest numbers not just as data points, but as catalysts for strategic recalibration across asset classes. From fixed income yields to equity valuations, every figure tells a segment of the broader economic narrative—one still evolving, but increasingly shaped by the interplay of data, decisions, and delays.

As central banks tread carefully and markets micro-adjust, one truth remains: understanding today’s headline numbers is no longer optional. It is how investors survive—and potentially thrive—in an era of uncertainty.

Related Post

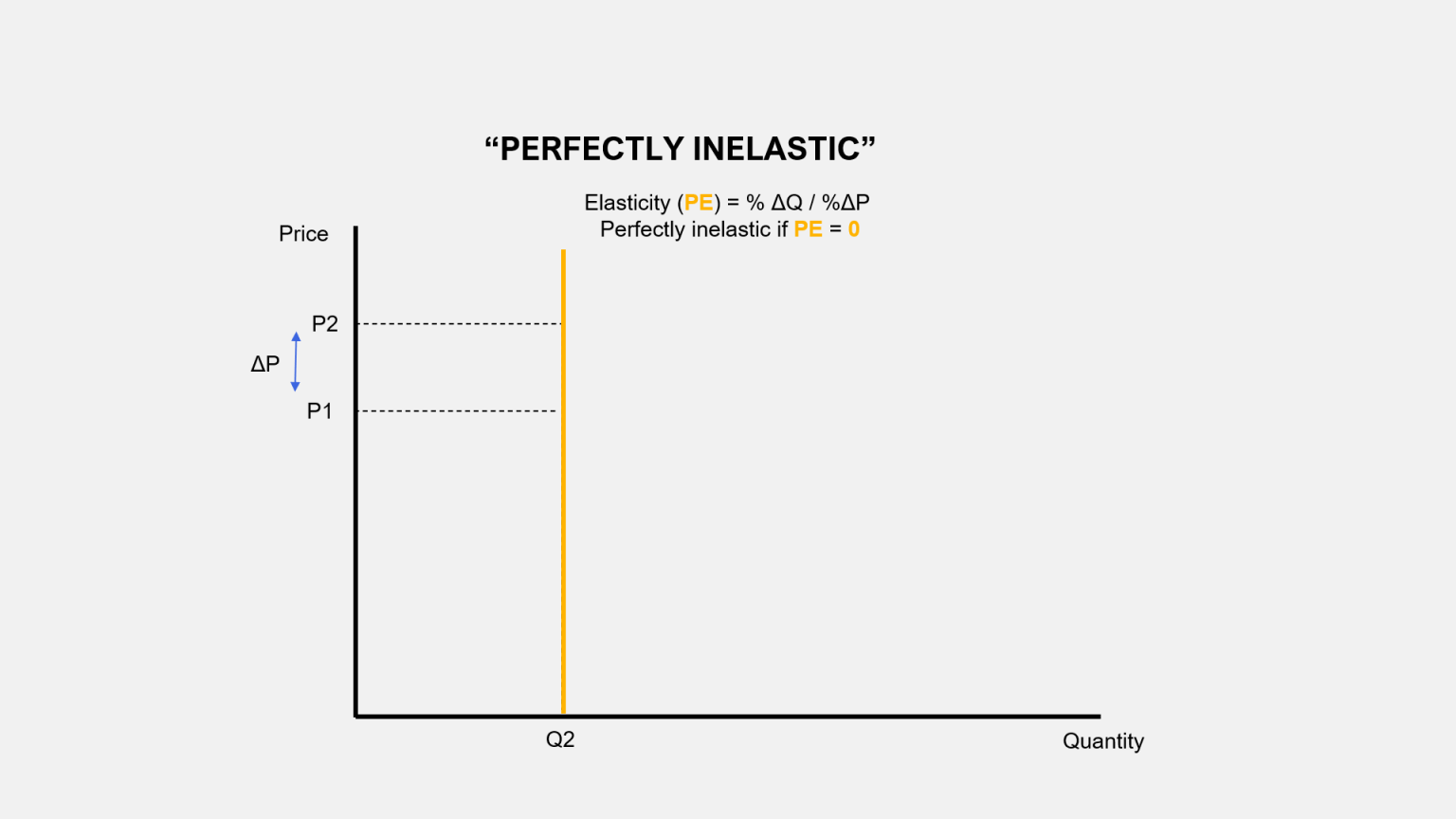

When Demand Never Bends: The Power of Perfectly Inelastic Demand

At 20, Coco Gauff Stands as a Defining Voice for a New Generation of Athletes

Valpo Blackboard: Empowering Student Success Through Digital Academic Empowerment

The Unraveling of a High-Profile Marriage: The Travis and Kourtney Divorce Saga