State Farm Make a Payment: Simplify Your Insurance Bill Payment Today

State Farm Make a Payment: Simplify Your Insurance Bill Payment Today

In an era defined by digital convenience and instant access, State Farm Make a Payment offers policyholders a streamlined, secure, and efficient method to manage insurance bills—turning what was once a cumbersome administrative task into a seamless, user-friendly experience. Whether through mobile apps, online portals, or voice-activated assistants, State Farm enables users to settle premiums with clarity and speed, reinforcing the insurer’s commitment to customer-centric service. At the core of State Farm’s payment process is a robust digital infrastructure designed around accessibility and reliability.

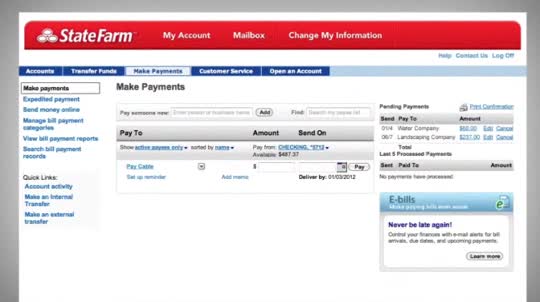

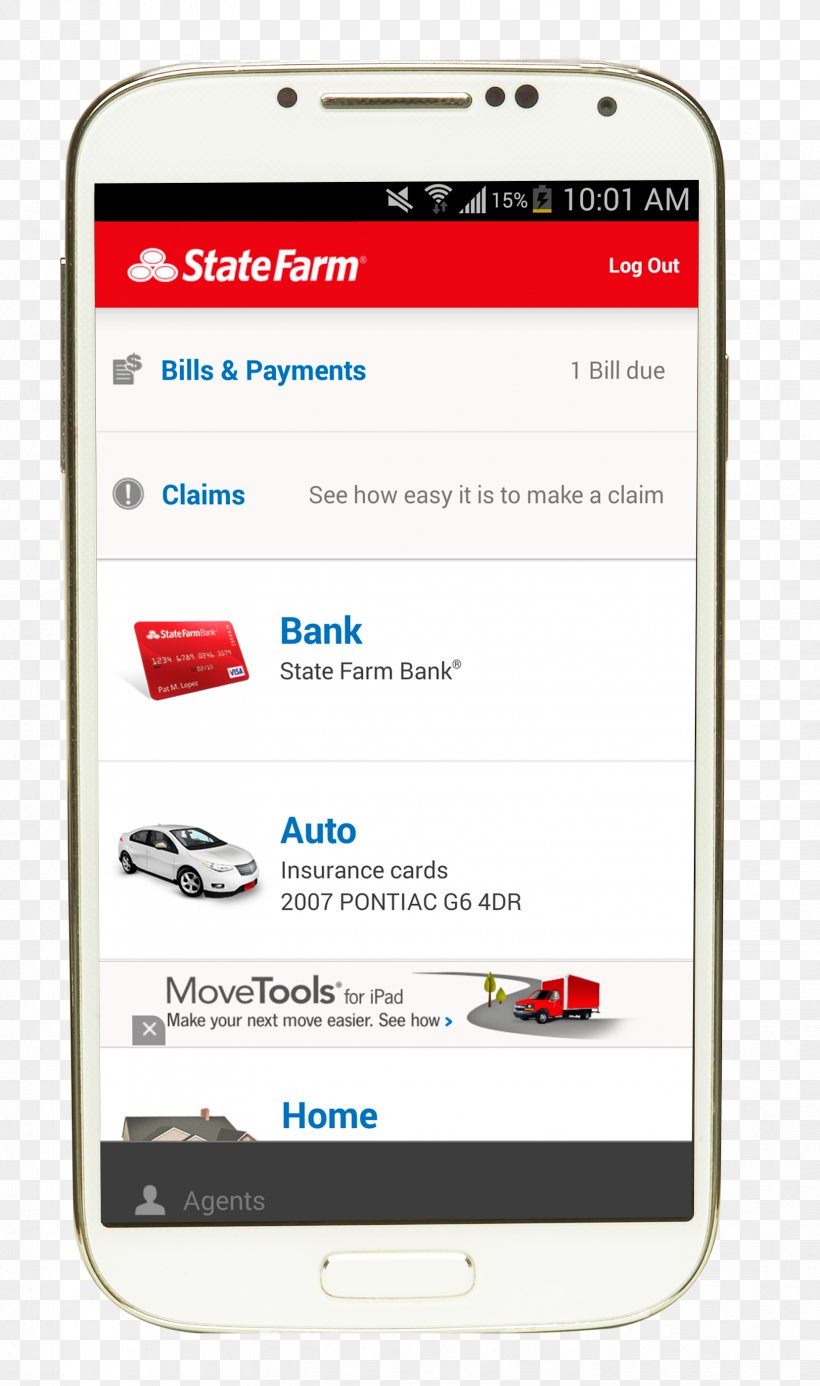

Customers can initiate payments from any device—smartphones, tablets, or computers—via State Farm’s official platform, which supports debit, credit, bank accounts, and even digital wallets. “Making a payment has never been easier,” notes a State Farm spokesperson. “Our system guides users step-by-step, ensuring accuracy and reducing the chance of errors from manual entry.”

State Farm’s payment system stands out due to its integration with common insurance management tools.

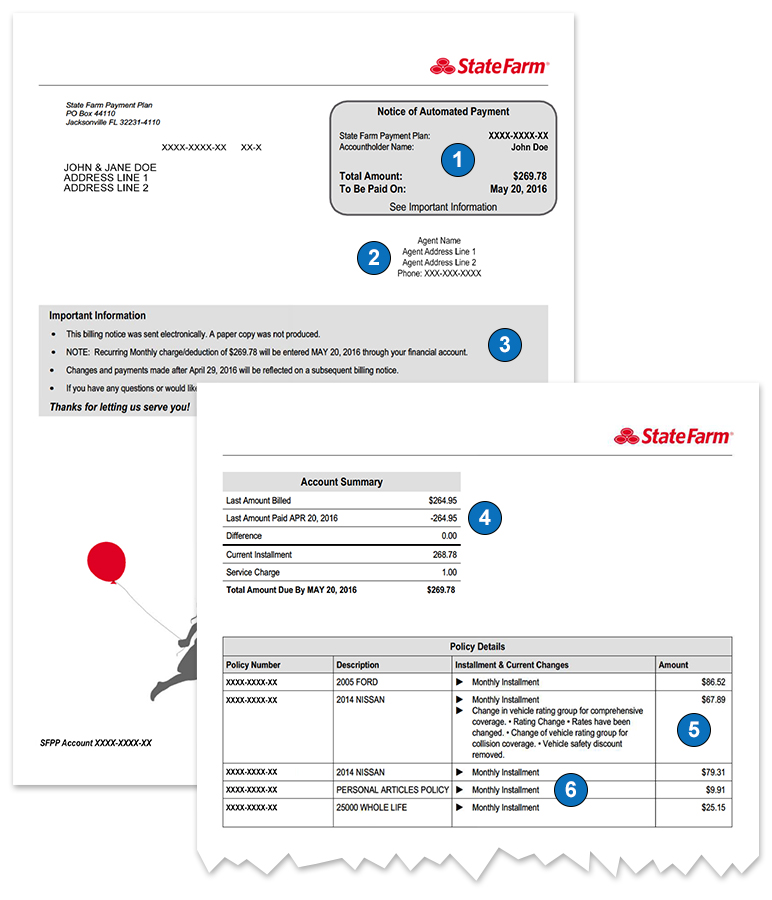

Policyholders receive detailed payment confirmations in real time, with transaction histories automatically logged within their accounts. This transparency helps users track due dates, verify payments, and stay fully informed—a critical advantage in maintaining insurance coverage without gaps. Additionally, mobile payments often include optional scan-and-learn features, allowing users to pay by uploading a photo of a check or receipt without downloading separate forms.

For those favoring familiar methods, State Farm maintains broader payment options beyond digital. Customers can request paper checks, schedule automatic debit transfers, or submit payments by mail—each processed with the same level of promptness and accuracy. This multi-channel approach ensures inclusivity, accommodating preferences and technological comfort levels across a diverse customer base.

Subscribers who enable recurring payments enjoy added peace of mind, as premiums deduct automatically on agreed dates, eliminating missed deadlines and late fees.

Security remains a top priority in State Farm’s payment model. Each transaction is encrypted using industry-standard protocols, protecting sensitive financial data throughout the process. State Farm employs multi-factor authentication, including one-time codes sent via SMS or email, adding a critical layer of defense against unauthorized access.

“We understand that entrusting payments to a digital platform requires confidence—and with State Farm, policyholders don’t have to,” says the official statement. “Our systems are designed not just for convenience, but for protection.”

Beyond individual transactions, State Farm’s digital payment ecosystem supports broader financial wellness. Users receive personalized reminders based on due dates, payment history insights, and proactive alerts should a payment attempt fail.

This intelligent layering of service helps users remain proactive, reducing stress and fostering a sense of control over long-term financial obligations. For business policyholders, multi-user access allows teams to manage expenses efficiently, streamlining group accounts and vendor relations without intermediaries.

The transition from paper-based or in-person payments to State Farm’s digital solution reflects a deliberate shift toward smarter, faster financial interactions.

The impact is measurable: faster settlement times, fewer errors, and enhanced customer satisfaction. Studies show that streamlined payment systems correlate with higher retention—State Farm leverages data to continuously refine the user experience, ensuring the process evolves with customer needs. For instance, voice-activated payment through compatible smart home devices and integration with popular virtual assistants signals State Farm’s forward-thinking approach to financial accessibility.

Adopting State Farm Make a Payment is more than choosing a method—it’s embracing a modern way to protect what matters. With intuitive design, ironclad security, and flexible options, users gain real control over their insurance obligations. In a world where convenience and confidence are paramount, State Farm delivers not just a tool, but a trusted partner in managing predictive financial responsibility head-on.

Related Post

Survive Any Mad Island: Mad Island Survival’s Ultimate Wiki Map Guide

Nichole Galicia: A Rising Star in Film, Marriage, and Personal Growth — Age, Husband, and Her On-Screen Legacy

Jacksonville Wyoming: A Hidden Gem of High Plains Resilience and Rural Appeal

Duncan Butler III Dallas: A Leader Redefining Urban Impact and Strategic Influence