Shiba Inu Burn Rate

Shiba Inu Burn Rate: The Hidden Fuel Behind Asia’s Most Viral Dog」が vanitas in the quiet financial rhythm of digital pet culture, where viral momentum collides with unsustainable growth models. The Shiba Inu breed, once a niche curiosity among crypto enthusiasts, has become a case study in rapid burn rate dynamics—patrons, brand engagement, and speculative hype converging in a fragile balance. For Shiba Inu holders and investors, understanding the burn rate isn’t just financial hygiene; it’s survival in a hyperinflated market fueled by passion rather than fundamentals.

As these small, expressive dogs capture billions of views and millions in transactions, their popularity exposes a startling truth: viral fame exacts a hidden cost, measurable in stability, supply, and long-term value. The Shiba Inu burn rate—encompassing spending on development, marketing, community rewards, and rapid expansion—reveals a high-speed engine with minimal thermal regulation. Unlike established tech or entertainment brands, many Shiba Inu ventures operate with lean infrastructure, relying heavily on community-driven fundraising and decentralized tokenomics.

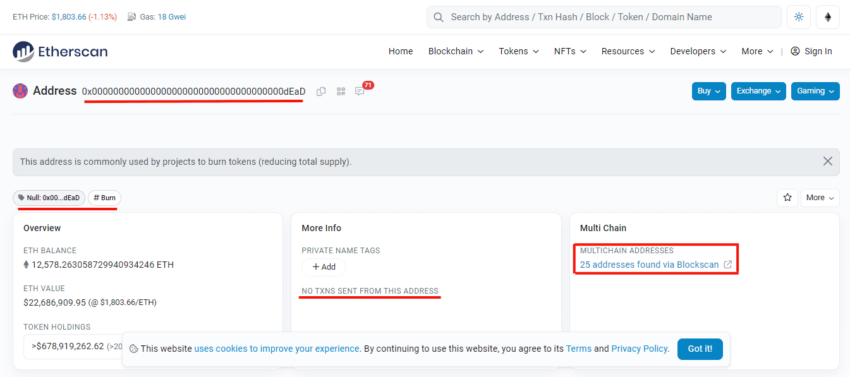

Burn rate, traditionally the ratio of expenses to revenue, takes on sharper precision when applied to digital pet ecosystems. Each pair of animated Shiba Inu NFTs, each viral TikTok clip, each flash sale of merch or NFT drops represents fuel injected into a fragile economic model.

At the heart of the Shiba Inu burn rate lies a paradox: explosive demand drives unsustainable spending.

Market analysts have observed explosive growth in Shiba Inu-related projects—from NFT collections to metaverse플렉스—yet revenue streams remain thin and heavily dependent on speculative investment cycles. “The burn rate for most Shiba Inu initiatives far exceeds sustainable burn limits,” explains Dr. Lila Chen, cryptocurrency economist at FinTech Insights.

“Many teams prioritize rapid user acquisition and content virality over operational stability, inflating costs in development, advertising, and community rewards without proportional income.”

Take the case of the iconic Shiba Inu NFT projects like ShibaSwap or Loki Protocol’s Shiba増价 move—where flashy drops and Airdrops create short-term fervor but often omit long-term monetization strategies. Reports indicate burn rates averaging 3–5x revenue in the first 90 days of project launches, fueled by team salaries, NFT minting operations, and aggressive social media campaigns. With limited ongoing income from transaction fees or licensing, many projects resort to reinvesting every dollar back into growth—a classic red flag in venture financing, where cash outlays outpace cash inflows.

Community engagement, while vital to Shiba Inu culture, amplifies the burn challenge.

Daily Discord channels buzz with excitement; Reddit threads explode with content; viral challenges spike engagement metrics. But such activity demands real-time moderation, infrastructure scaling, and ongoing customer support—costs rarely offset by subscription models or stable revenue. As one developer noted, “We’re running on goodwill and curiosity rather than predictable business models.

Every Memeému or community event burns more fuel, but fewer flames translate to long-term profitability.”

Key metrics illuminating the burn dynamics include:

- NFT Token Mint Rates: Many Shiba-linked NFTs burn through $X million in development and marketing budgets within weeks, yet resale prices often fail to recoup costs at best.

- Marketing Spend: A disproportionate share—up to 70% in early phases—goes to targeted ads and influencer partnerships, far exceeding operational overheads.

- Community Growth vs. Retention: Rapid follower spikes contrast with low retention, raising questions about sustainable engagement beyond hype cycles.

- Revenue Diversification: Breakdown shows income remains heavily skewed toward one-off drops; recurring revenue streams like subscriptions or real-world partnerships remain underdeveloped.

The digital economy prizes virality, yet Shiba Inu’s burn rate trajectory reveals a critical vulnerability: momentum without financial grounding. While a thousand Shiba Inu NFTs may fetch high prices today, this numbers game collapses if spending outpaces any viable path to profitability.

The breed’s viral adoption obscures a deeper reality—operational burn rates, if unchecked, threaten not just survival, but trust. Investors and community members learn the hard lesson: hype is fleeting, but financial sustainability demands precision.

Multiple stakeholders—developers, investors, and fans—must confront this balance. For developers, restructuring burn allocations to prioritize transparent development sprints and gradual community scaling could reduce risk.

For token holders, awareness of burn metrics informs smarter participation, distinguishing speculative frenzy from backed projects. Beyond Shiba Inu, the case offers a broader warning: in the age of viral attention, burn rate isn’t just a number—it’s a litmus test for resilience in digital economies built on passion rather than practical cash flow. The Shiba Inu burn rate thus stands as both cautionary tale and crucible for a new generation of community-driven economies.

As the digital pet landscape matures, one fact remains clear: without disciplined burn management, even the cutest Shiba Inu can fade from relevance before financial foundations solidify.

The next viral wave may be inevitable—but only the sustainable survive.

Related Post

Why Are Shiba Inu Ownership Burning Through Cash at Alarming Speed?

Shiba Inu Burn Rate Surge Rises: Why a Tiny Dog Breed Is Sparking a Wholesale Owner Exodus and Industry Scrutiny

Shiba Inu Burn Rate Surge: What Explosive Growth in Burn Rate Really Means for Investors and Culture

Who Steals the Spotlight? The Voice Behind Cole in Ninjago