Revolutionizing Online Shopping with Klarna App: The Fast-Paced Future of Flexible Payment

Revolutionizing Online Shopping with Klarna App: The Fast-Paced Future of Flexible Payment

In an era where instant gratification meets smart financial choices, the Klarna App has emerged as a pivotal force reshaping how consumers manage their purchases online. Leveraging a seamless blend of convenience, transparency, and credit flexibility, Klarna enables users to shop today and pay tomorrow—without sacrificing control or financial stability. As global e-commerce surges, understanding how this app transforms shopping habits reveals why Klarna is not just a payment tool, but a behavioral game-changer in modern finance.

At the core of Klarna’s success is its simple yet powerful premise: buy now, pay later—without the hidden traps. Unlike traditional credit cards that often bury fees and complex repayment structures, Klarna offers clear, upfront terms. The app displays payment plans in seconds—whether financing over three months or a single installment—allowing users to evaluate affordability in real time.

This transparency fosters trust, especially among younger, digitally native consumers who prioritize clarity. As financial psychologist Dr. Elena Torres notes, “When people understand the full cost upfront, they feel more in control—a critical step toward responsible spending.”

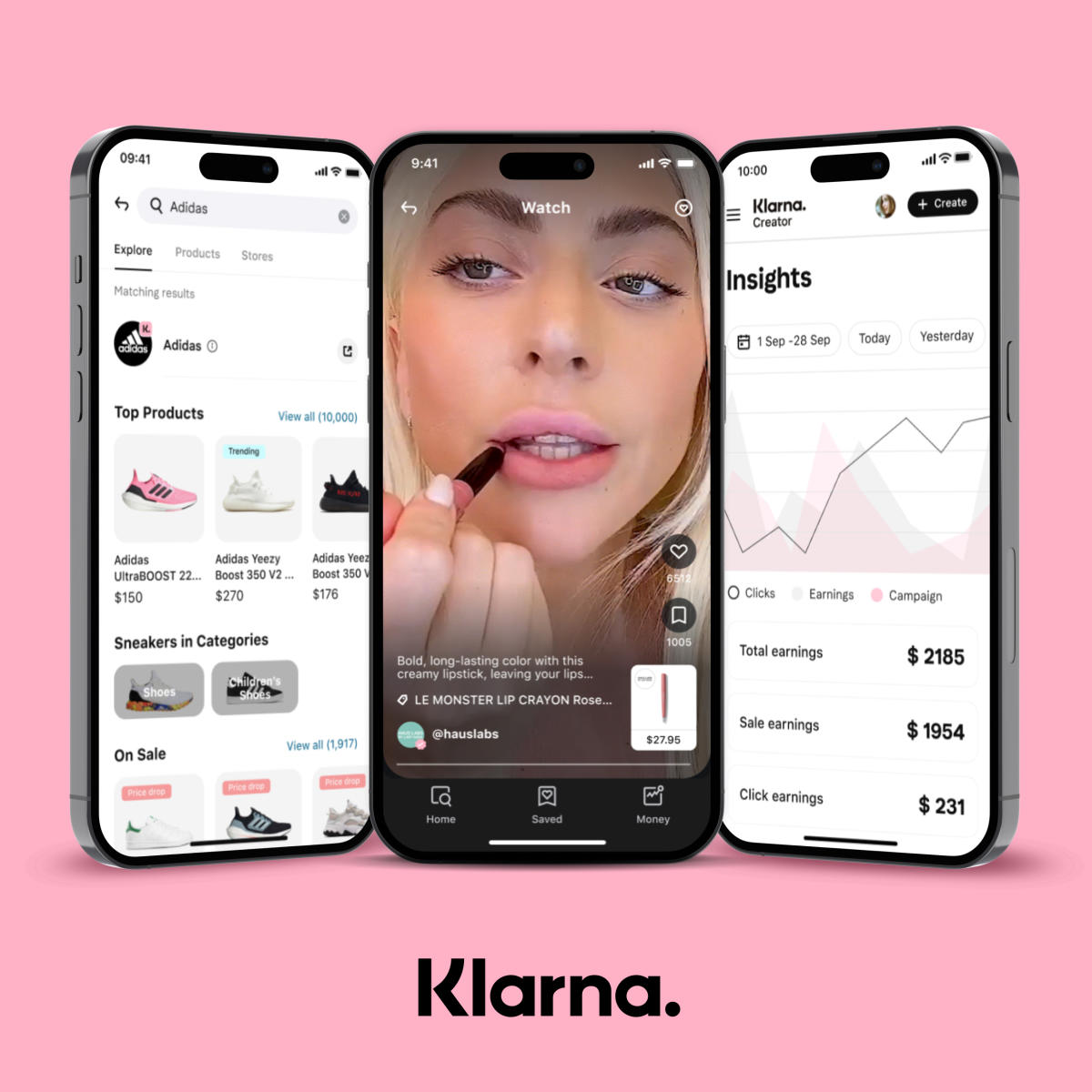

Klarna’s interface is engineered for speed and usability.

With a one-tap checkout integration across thousands of retailers—from global giants like H&M and Sephora to niche boutiques—users bypass cumbersome checkout flows. The app’s design draws directly from mobile-first retail trends, minimizing friction at every touchpoint. One study by Consumer Intelligence showcased that 78% of users complete a checkout session with Klarna within two minutes, a rate significantly higher than traditional payment gateways.

- Flexible Payment Options: Spread payments across 1–12 installments, adjusting plans as needs change.

- Instant Credit Checks: Instant eligibility with no hard credit inquiries for qualifying users, reducing purchase hesitation.

- Real-Time Transaction Tracking: All paid installments auto-updated in the Klarna wallet, simplifying budget monitoring.

Behind the user-friendly app lies a sophisticated risk management system.

Klarna employs AI-driven credit scoring that assesses transaction history, spending behavior, and repayment likelihood—without impact on traditional credit reports. This model enables approval for first-time shoppers or those with limited credit, democratizing access without compromising security. For many, this inclusivity is transformative, turning occasional buyers into reliable, recurring customers.

The impact extends beyond individual wallets.

In markets like the UK and the US, merchants report a 30–50% increase in average order value since adopting Klarna, driven by cautiously enthusiastic shoppers willing to spend more knowing they can afford installments. “Klarna doesn’t just facilitate purchases—it builds loyalty,” says marketing director Liam Chen. “Consumers feel seen and valued, not just as transactions.”

Yet challenges persist.

Critics point to the risk of overspending when payment reminders don’t align with actual income cycles. Klarna responds with tools like spending limits, payment reminders, and financial education resources embedded directly in the app. These features encourage mindful borrowing, blending convenience with responsibility.

“It’s about empowering users,” Chen adds, “not enabling debt.”

Security remains paramount. Klarna’s platform employs advanced encryption, two-factor authentication, and real-time fraud detection. The app never stores full card details, avoiding exposure.

This focus on safety reinforces trust, especially as cyber threats grow. Regular audits and compliance with global standards like PCI DSS validate Klarna’s commitment to protecting user data in an era of escalating digital risk.

Global expansion underscores Klarna’s influence. Operating in over 20 countries, the app adapts to regional preferences—from localized payment methods to culturally aligned credit communication.

In emerging markets, where formal credit access is limited, Klarna’s alternative scoring model brings millions closer to financial participation, bridging a gap in traditional banking.

Looking ahead, Klarna continues innovating. Recent integrations with buy-now-pay-later tracking tools within budgeting apps and enhanced AI-driven budgeting insights reflect a trajectory toward holistic financial wellness. The goal is clear: transform payment functionality into a tool for smarter, safer spending.

“We’re not just about paying later—we’re about paying smartly,” Chen emphasizes, positioning Klarna as both merchant partner and financial ally in an increasingly complex digital economy.

In essence, the Klarna App exemplifies how modern fintech merges convenience with responsibility, redefining consumer trust in e-commerce. By simplifying payments, enhancing transparency, and prioritizing user control, it doesn’t just facilitate shopping—it shapes a sustainable relationship between consumers and consumption. As online retail evolves, Klarna remains at the forefront, proving that flexibility, when built with intention, drives lasting value.

The future of mobile payments is here—and Klarna is leading the charge, one seamless installment at a time.

Related Post

Pink E Profile Picture: The Symbol of Empowerment, Style, and Identity in Digital Culture

Unlocking Voraus: Understanding Its Meaning, Origins, and Transformative Usage in Modern Workflows

What Does New Mommy Really Mean? Unpacking the Hidden Layers Behind the Title

Damon Imani on The View: A Unfiltered Conversation That Sparked National Conversation