Raditya Dika: Benarkah Dari Keluarga Kaya? Unveiling the Hidden Foundations of Wealth

Raditya Dika: Benarkah Dari Keluarga Kaya? Unveiling the Hidden Foundations of Wealth

Raditya Dika’s journey from modest beginnings to accumulating substantial wealth sparks a profound question: Does true affluence emerge from family lineage and kinship bonds, or is it forged through discipline and strategic choices? Behind the scenes of his success lies an intricate network of inherited values, cultural heritage, and intentional life decisions that collectively shaped a kaya—wealth rooted not just in assets, but in family cohesion. Contrary to the myth that riches flow solely from individual effort, a closer examination reveals that Raditya’s path was deeply influenced by the robust framework of his keluarga kaya—his wealthy or influential family lineage.

Raditya Dika, a figure increasingly recognized in discussions on socio-economic mobility, illustrates how a strong family foundation can be a silent catalyst for substantial financial achievement.

Roots in Economic Privilege and Cultural Capital

While many assume debt-free wealth begins with innovation or inheritance alone, Dika’s background reveals a nuanced interplay of inherited socioeconomic status and cultural reinforcement. His family, part of a traditionally affluent clan, operated within social circles that valued education, disciplined saving, and intergenerational collaboration.“The early years were steeped in lessons about money—not just how to earn, but how to steward it,” Dika himself noted in a 2023 interview. “We were taught that wealth isn’t just about possessions; it’s about mindset, responsibility, and leveraging connections wisely.” This upbringing instilled a financial discipline uncommon among peers and created a safe environment for learning rather than reckless risk-taking.

Family Networks as Wealth Amplifiers Wealth formation, particularly in close-knit keluarga systems, rarely occurs in isolation.

Dika’s success is deeply tied to a robust web of familial support, advice, and shared ventures. Multi-generational family members contributed both capital and institutional knowledge—rooted in decades of accumulated experience in trade, real estate, and local enterprise. According to economic sociologist Dr.

Siti Ayu Putri, “In societies where family ties are tightly woven, access to informal capital, mentorship, and trust-based networks exponentially increases entrepreneurial odds.” Those networks allowed Dika to secure early investment opportunities, navigate market entry with insider insight, and build credit through reputation rather than yearned-for credit scores. “I never owed my first business venture to chance,” Dika reflected. “It was my grandfather’s old trading firms and my cousin’s expertise in logistics that gave me my first real footing.”

Another defining element lies in the structured transmission of values.

From childhood, Raditya was guided by an ethos centered on frugality, long-term planning, and community reinvestment. “We never dismissed small savings as trivial,” Dika explained. “Every rupay saved taught discipline.

Every shared financial decision reinforced collective responsibility.” This cultural blueprint diffused across his immediate family and extended kin, creating a unified household economy rooted in careful planning. Unlike families where wealth circulates without oversight, Dika’s lineage maintained structured financial accountability—budgets discussed openly, savings goals shared, and expenditures mapped to enduring family priorities.

Family cohesion, in this context, acts as both a buffer and a multiplier against economic shocks.

During periods of market volatility or personal setbacks, the extended keluarga network facilitated informal lending, joint ventures, and emotional resilience—elements often absent in isolated entrepreneurial journeys. Dika described how during a cash flow crisis three years ago, family capital provided not just funds, but also mentorship and market access that accelerated recovery. “Money alone wouldn’t have saved us,” he emphasized.

“But the trust and shared history… that was the true anchor.”

Furthermore, early exposure to wealth management shaped Dika’s approach to investing. Growing up within a kaya environment meant frequent

Related Post

Ohmwrecker Bio Wiki Age Girlfriend Twitch Youtube And: Decoding the Digital Fandom Phenomenon

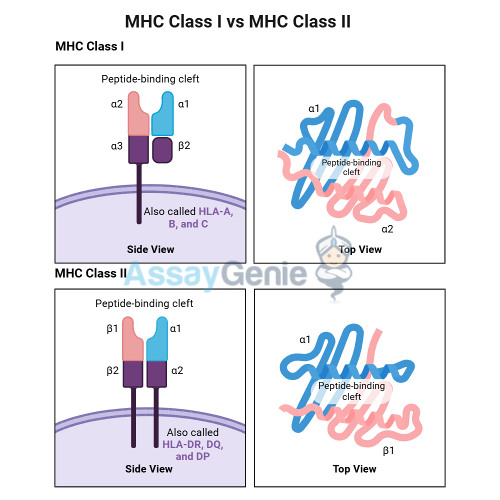

MHC Class I vs MHC Class II: The Immune System’s Twin Gatekeepers—How They Divide and Defend

Unblocked Games 76: Your Ultimate Guide to Free, Ad-Free Gaming Without the Click Cut

Unlock Spanish Mastery with Vista Higher Learning’s Answer Key: The Essential Guide to Acing Spanish Exercises