Opening vs Closing Price: The Critical Metrics That Shape Market Perception

Opening vs Closing Price: The Critical Metrics That Shape Market Perception

In the volatile world of financial markets, every number tells a story—but few carry as much weight as opening and closing prices. While both represent pivotal moments in a security’s daily price journey, they reveal fundamentally different dimensions of market behavior. Understanding the distinction between opening and closing prices isn’t just about defining data points—it’s about grasping how markets open and resolve each trading session.

This article dissects the core differences, explores their implications for traders and investors, and explains why these two benchmarks remain central to interpreting market trends.

At first glance, both opening and closing prices mark key transition points: the opening price reflects a security’s initial valuation when trading begins, while the closing price captures its final value before markets fall silent for the night. Yet beneath this surface clarity lies a nuanced divergence in purpose, timing, and influence.

The Opening Price: What Moves the Market Before the Bells Ring

The opening price—the price at which a stock, commodity, or index first trades upon market exposure—serves as the first sensory signal retailers, algorithms, and institutional players receive about a security’s valuation at daybreak.“It’s the market’s immediate reaction to news, earnings reports, earnings estimates, or broader macroeconomic shifts,” explains financial analyst Mark Reynolds. “Opening prices often set the tone for the rest of the session, especially in fast-moving markets where momentum can override fundamentals.” Multiple factors directly impact the opening price: - **Pre-market volatility** driven by overseas trading, particularly in global equities like Apple or European blue chips. - **Earnings surprise disclosures**, which can trigger rapid revaluation even before official results are released.

- **Geopolitical events** such as central bank speeches, trade policy announcements, or unexpected geopolitical tensions. - **Technical indicators** used by automated trading systems that detect breakout patterns or support/resistance levels. For example, during a earnings announcement, a stock trading at $150 pre-market may jump to $155 if outlooks are positive—or plummet to $145 if guidance misses expectations.

These shifts aren’t market closure events; they’re the first ripples of sentiment that shape Tages und Nacht perception.

Emerging markets often exhibit more pronounced opening price swings than developed markets due to thinner liquidity and heightened sensitivity to global capital flows. Conversely, large-cap stocks in the U.S.

S&P 500 typically show tighter opening price movement—yet remain far from static, revealing constant micro-adjustments based on real-time data feeds.

The Closing Price: Market Sentiment Wrapped Up at Day’s End

Closing price—the final traded value before markets halt for overnight settlement—functions as the official closing chapter of each trading day. “The close summarizes the day’s consensus valuation, reflecting all information exchanged until lantern light dims,” notes Reynolds. “It’s the definitive number that influences end-of-day reports, portfolio rebalancing, and risk management assessments.” The closing price crystallizes themes from the day’s session: - **Technical signals** such as key resistance or support levels tested.- **Fundamental catalysts** like new GDP data, interest rate decisions, or corporate announcements. - **Emotional shifts**—fear selling or confidence accumulation—that crystallize into traded volume and price action. Non-trading volumes and adjustive trades often sharpen the closing price after market close.

Unlike the open, the close is less volatile but more indicative of true market consensus. Missing or inaccurate closes—due to technical errors or after-hours adjustments—can distort trend analysis, making reliable close data essential.

A closing price of $265, for instance, confirms a bullish day even if the open began at $260, reflecting either robust buying pressure or the quietly accumulated strength of bullish momentum-walls tested throughout hours.

This snapshots the market’s mental close—its “final vote”—which institutional investors study to gauge trend sustainability.

Quantitative and Functional Differences Between Opening and Closing Prices

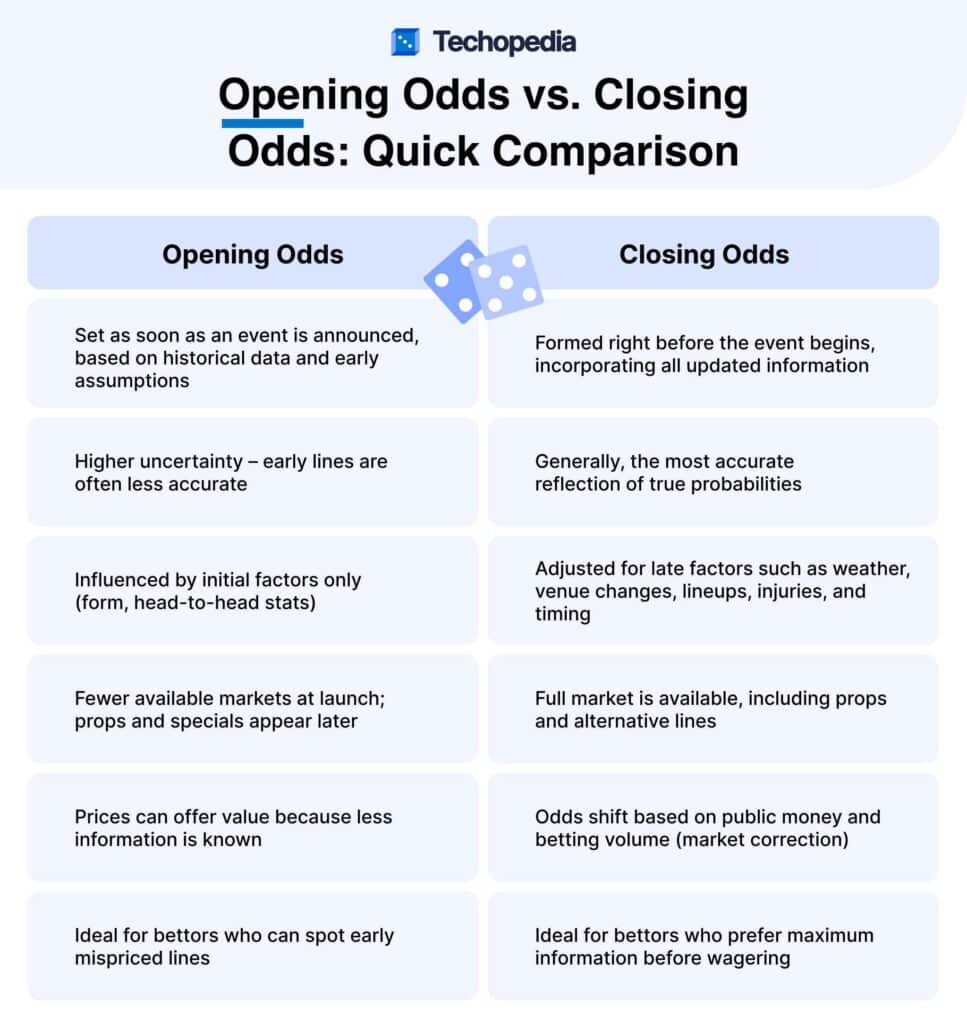

While both prices anchor a security’s daily valuation, they serve distinct analytical purposes. The opening price highlights sensitivity to real-time global news and technical triggers, often revealing the market’s immediate reaction. In contrast, the closing price reflects the full-day interplay of all flow—market participants’ cumulative decisions crystallizing into a single, certified number.| Aspect | Opening Price | Closing Price | |-----------------------|---------------------------------------|-------------------------------------| | Timing | First trade of the day | Final traded value before close | | Market Influence | Momentum-setting, reactive | Consensus finalization, interpretive | | Data Volatility | High, driven by global or intraday news | Lower, but subject to evening volume adjustments | | Primary Use Case | Trading desks, pre-market analytics | Portfolio rebalancing, performance reporting | | Psychological Role | Opens the narrative | Closes the chapter on sentiment | Market participants rely on both: traders use open swings to capture momentum; risk managers depend on close stability for valuation and loss assessment. The open is data’s starting gun; the close is the final scoreboard.

Real-World Examples That Highlight the Divide

Consider the volatile trajectory of stocks during Federal Reserve meetings.Let’s take Microsoft’s shares in late 2023. Just before markets opened at $328.50, USD yield announcements signaled tighter monetary policy, causing the open to close at $319.98—a 2.3% intraday drop. Yet after GDP data showed stronger-than-expected soft budge indicators, the closing price rebounded to $329.20 by market’s end, reflecting renewed confidence in tech resilience.

This swing—from open to close—embodied how opening prices capture immediacy, while closing prices resolve trust. Another case: Tesla’s X (TSLA) in Q1 2024, where a surge in AI partnership rumors pushed the open to $245. By closing at $267, the stock confirmed a shift from skepticism to optimism.

Without the opening sharpness, the closing would lack context; without the close, the momentum would remain unverified.

Crunch time at red-hot sectors like cryptocurrencies further illustrates the contrast: Bitcoin’s open price may spike on news of a major exchange approval, while its close determines whether volatility-driven bears or bulls gain momentum. Traders gauge both—but risk analytics hinge on the final signal.

Why Both Prices Matter in Market Strategy

For retail investors, understanding opening and closing prices transforms passive observation into active insight.Open swings expose entry windows and market sentiment shifts, enabling tactical moves via day orders or Stop-Loss placements. Close stability or volatility, meanwhile, validates trend strength for longer-time strategies like buy-and-hold or swing trading. \mathbf“Institutional traders don’t just watch one—they triangulate open and close across multiple periods,”} says financial strategist Elena Cho.

“Opening price identifies rejection levels; closing price confirms adoption. The gap between them reveals momentum strength, risk dispersion, and narrative traction.” Quantitative models integrate both data points to predict breakouts, reversals, and volatility clustering. Portfolio managers use daily closing data to rebalance risk exposure; algorithmic systems flag opening anomalies before they propagate.

Even by-chart analysis increasingly overlays open/close relationship patterns to anticipate trend continuations. The distinction isn’t academic—it’s operational. One price opens the market’s story; the other closes it with authority. Both are essential, both are revealing—but never interchangeable. In fast-moving, emotion-driven markets, the difference between opening and closing price rules not just perception, but precision. h3>Mastering Opening vs Closing Price: The Key to Smarter Trading Decisions In summary, opening and closing prices are not merely bookkeeping entries—they are dual lenses through which market psychology, information flow, and technical behavior converge. The open reveals sensitivity, reaction speed, and real-time contestation; the close encapsulates synthesis, consensus, and final acceptance. Navigating financial markets with clarity demands fluency in both. Whether you’re executing a high-frequency trade, managing a pension fund, or simply tracking personal savings, understanding these two benchmarks transforms data into decision-making power. In a world where a fraction of a cent can shifted fortunes, knowing when and why price opens versus when it closes may just be your edge.

Related Post

Luis Urias Pioneers a Data-Driven Framework to Redefine Modern Business Resilience

Gatorade Parent: Transforming Hydration for Active Families

Fixing Your Garmin Sport PRO Collar Problems: Solve Common Issues Before They Stop You

Ion On Dish: Revolutionizing Dishwashing with Smart Precision