North Iowa Community Credit Union: Your Trusted Local Financial Partner in Every Stage of Life

North Iowa Community Credit Union: Your Trusted Local Financial Partner in Every Stage of Life

For generations of residents across North Iowa, access to reliable, community-centered banking has meant more than just account services—it’s a promise of partnership. North Iowa Community Credit Union (NICCU) stands as the region’s enduring financial ally, rooted deeply in the communities it serves. More than a financial institution, NICCU operates as a locally owned cooperative where member success drives every decision—making it uniquely responsive, transparent, and deeply invested in the future of families, small businesses, and local enterprises.

---

More Than a Bank: A Community Built on Trust

Founded in 1938, NICCU began with a simple mission: to provide financial services that reflect the values of North Iowa’s people. Over nearly a century, the credit union has grown from a small rural credit union into a vital financial cornerstone, serving over 20,000 members across Clay, Chickasaw, versus, and Bremer counties. Its local ownership model— compartir decisions with members rather than distant investors—ensures money circulates within the community, funding local schools, farms, entrepreneurs, and neighborhood revitalization.“This isn’t just a bank you check into when you need a loan,” says Sarah Mitchell, Branch Manager at NICCU’s Vernon County location. “It’s a partner that walks alongside you—whether you’re opening your first savings account, launching a small business, or preparing for a home purchase. We know your story, and that’s how we deliver true financial support.” Member ownership differentiates NICCU fundamentally from larger, for-profit institutions.

Every decision—from loan approval processes to investment in local programs—is guided by a commitment to member well-being, not shareholder returns. This alignment fosters trust built on transparency and personal connection. ---

Financial Services Tailored to Real Needs

NICCU offers a comprehensive suite of financial products designed to meet members where they are—whether building credit, expanding a business, saving for education, or preparing for retirement.Partnerships with the North Iowa Economic Development Council amplify support to grow regional enterprise.

Community Impact: Investing in People, Not Profit

NICCU’s impact extends far beyond balance sheets. The credit union actively fuels North Iowa’s economic vitality through strategic community investments.\begin{itemize>

Personalized Service in a Digital Age

While embracing modern technology, NICCU remains committed to the personal relationships that define small financial institutions.Every member meets a banker who remembers their name, goals, and life stage. \begin{itemize>

Related Post

Unlocking the Silent Shortcut: How to Find the Pause-Break Key on HP Laptops

Tim Cowlishaw: Dallas Morning News Bio, Age, and the Genesis of a Media Icon under 40

Nishat Age The Henna Wars Age 16: The Battle for Tradition, Identity, and a Masterstroke of Resistance

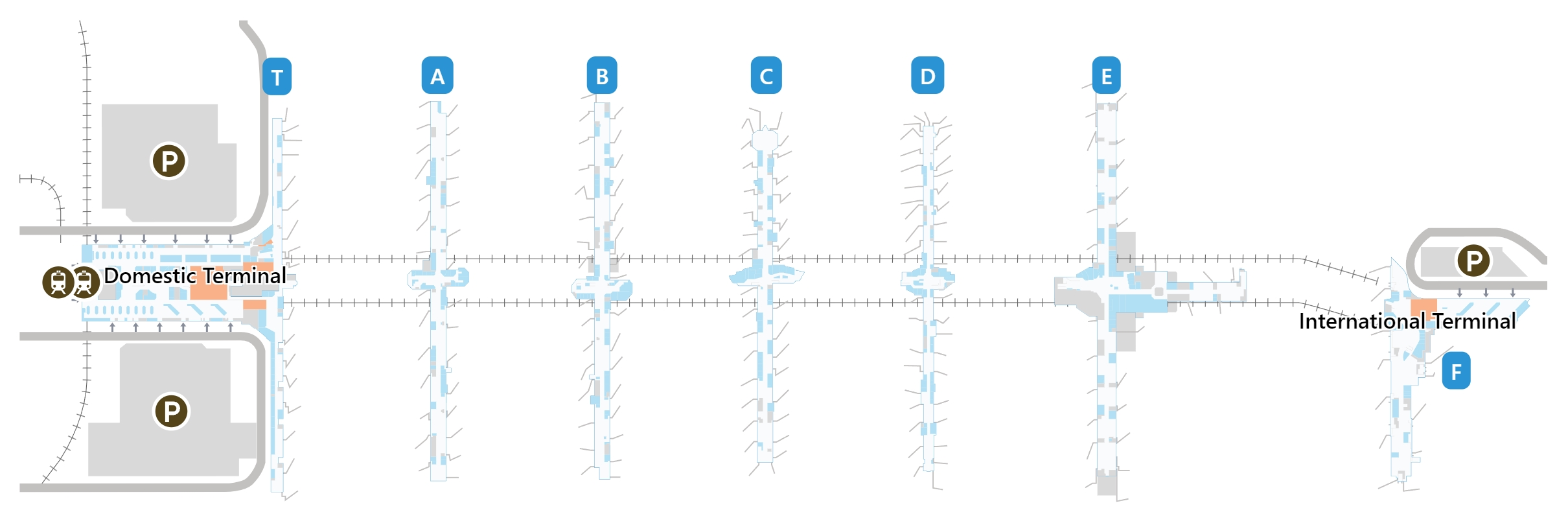

Atlanta Airport Terminal S: The Pulse of Southern Aviation