Negative Spread Exposed: What Traders Risk When Markets Burn

Negative Spread Exposed: What Traders Risk When Markets Burn

In financial markets, where every trade carries hidden consequences, negative spread emerges as a silent yet potent threat—revealing how mispriced bets and liquidity pain can erode profitability. Negative spread occurs when the bid-ask spread widens to uncomfortable levels, often forcing traders to absorb losses or abandon positions mid-game. Unlike predictable volatility, this persistent spread pressure distorts price discovery and undermines risk management, turning routine trading into a costly challenge.

At its core, a spread is the difference between a buyer’s bid and a seller’s ask price—a standard component of market liquidity. When spreads narrow, traders execute orders efficiently; but when spreads turn negative—reflected in hunted asks or torn bids—market depth collapses, and transaction costs surge. Market microstructure plays a pivotal role: order imbalances, flash crashes, or sudden volatility spikes trigger widening spreads, transforming bid-ask logic into a liability rather than a facilitator.

For institutional players and retail traders alike, negative spread is not just noise—it’s a financial event with measurable impact. Consider a fixed-income trader executing a large bond sale during market stress. If leasing costs spike due to compressed ask prices, the effective spread could widen from a nominal 5 basis points to 200 basis points or more.

As one Chicago-based portfolio manager explained, “Normally, we plan spreads as part of our risk model, but during shocks, spreads don’t widen—they weaponize. We’re left absorbing hidden fees no forecast anticipated.”

Understanding negative spread demands insight into several interconnected mechanisms. First, market structure—whether a liquid deep market or an illiquid niche—dictates how spread behavior unfolds.

In thin markets, even modest order flow can push spreads into negative territory, turning routine transactions into loss centers.

How Market Frictions Trigger Negative Spread

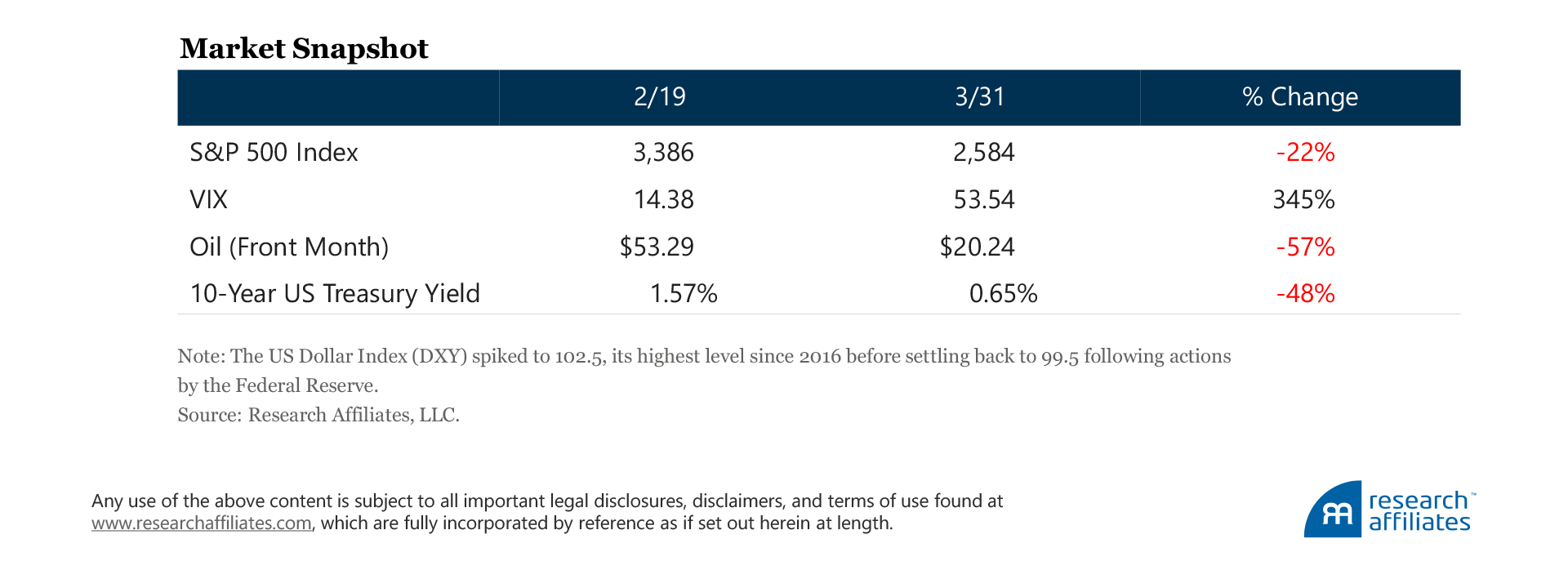

Market frictions—latent barriers to efficient execution—are the primary catalysts for negative spread. These include liquidity shortages, information asymmetry, and regulatory shifts, all of which disrupt normal price discovery.- Liquidity Dry-Ups: Periods of heightened volatility, such as the 2020 “dash for cash” or the Flash Crash of 2010, can rapidly deplete available bids or asks.

As liquidity evaporates, surviving orders widen spreads, at times exceeding an instrument’s practical trading range.

- Order Imbalance and Predatory Behavior: Large block trades, especially when unsigned orders park off-exchange, create artificial spreads.机构 traders or algorithmic systems may exploit asymmetric visibility to widen spreads temporarily—a practice sometimes tantamount to short-term market manipulation.

- Systemic Stress and Regulatory Triggers: Circuit breakers, margin calls, or forced deleveraging amplify spread widening. For example, during the 2022 bond market turmoil, rising yields led to rapid portfolio rebalancing, compressing dealer inventories and widening spreads to historic levels.

Negative spread is not limited to equities; it permeates every asset class—forwards, options, currencies, and commodities. In foreign exchange, negative spreads often emerge during low-liquidity sessions, such as post-U.S.

market close, when bid-ask gaps between chronos nella and G10 currency pairs expand sharply. In futures, margin compression during sharp trend extensions can create wides spreads even on liquid contracts.

Measuring and Navigating Negative Spread Risk

Quantifying negative spread risk requires more than point-in-time analysis. Market participants must track dynamic liquidity indicators—such as Effective Spread, Amihud’s illiquidity ratio, and order book depth—to anticipate spread behavior.Advanced traders incorporate real-time volatility filters and liquidity heatmaps into their risk engines, enabling proactive position adjustments.

Effective spread—the average difference between 레 spiked ask and bid price—offers a practical metric. During calm markets, effective spreads rarely exceed 50–100 basis points; during stress, they may balloon beyond 300 bps.

Institutions increasingly rely on pre-trade analytics to simulate spacing scenarios, preserving margin resilience.

Beyond measurement, navigating negative spread hinges on strategic flexibility. Traders deploy several defensive tactics:

- Adaptive Position Sizing: Reducing exposure during high-spread regimes limits potential losses. “We’ve built risk filters that shrink positions automatically when effective spread crosses thresholds,” a London hedge fund manager noted, emphasizing automation’s edge.

- Dynamic Hedging: Using options, swaps, or futures to offset spread-related losses protects equity and fixed-income portfolios from wedge erosion.

- Time and Venue Discipline: Executing trades during peak liquidity hours and favoring major clearing venues reduces exposure to sudden spreads.

For retail traders, awareness is the first defense.

Many underestimate how microsecond order processing and hidden overnight liquidity gaps widen spreads overnight. Opening positions during sparse trading windows, such as intercontinental gaps, can trigger adverse pricing unless properly hedged.

Real-World Impact: Case Studies in Negative Spread Exposure

Consider the March 2023 tech selloff, when rising interest rates and recession fears triggered a cascade of margin calls. Bond traders executing large short positions found leasing fees spike: bid-ask spreads on 10-year Treasuries widened from 15 bps to 400 bps overnight.As one fixed-income analyst observed, “We expected volatility, but the spread itself became our worst cost—transforming a planned hedge into a hidden loss.” In equities, the 2021 GameStop short squeeze illustrated how structural fragility amplifies spread risk. As retail orders overwhelmed order flow, bid-ask spreads widened due to reluctant market makers, creating a volatility feedback loop. Traders on the wrong side faced cascading losses until circuit breakers halted trading.

These episodes underscore a critical insight: negative spread is not merely an anomaly but a structural market feature during stress. Its impact ripples through profitability, liquidity, and confidence—making it essential for all players to integrate spread awareness into risk frameworks.

Markets thrive on transparency and depth, yet negative spread reveals how quickly frictions can distort pricing and drain capital. Rather than viewing it as an inevitable cost, sophisticated traders treat it as a signal—prompting vigilance, adaptability, and deeper structural understanding.

In a world where milliseconds and liquidity define success, mastering negative spread is not optional: it’s the difference between surviving market storms and thriving within them.

Related Post

Ceeday’s breakthrough Girlfriend Face Reveal: A New Era in Relationship Virality

Arcane Season 2 Unleashes Unprecedented Financial Triumph: What the Numbers Reveal About Game’s Studio Backing

Discover Naples Zip Codes: The Gateway to Understanding South Florida’s Premier Community

Technology in Life: Inspiring Quotes & Insights That Redefine Human Progress

.jpg)