Nasdaq vs. Us100: Is This Financial Saga Still Worth Your Grip?

Nasdaq vs. Us100: Is This Financial Saga Still Worth Your Grip?

The battle between Nasdaq and the broader U.S. equity benchmark the U.S. 100 (often referenced through indices like the S&P 500 or Dow Jones) underscores a critical turning point in modern markets — where growth-driven tech stocks on Nasdaq clash with a consensus view rooted in stability and diversification.

While the U.S. 100 reflects a blend of blue-chip industrial and financial names, the Nasdaq Composite—dominated by NASDAQ-listed technology and innovation leaders—has repeatedly tested whether speculative momentum can sustain long-term value. This article dissects the core dynamics, performance history, and true strategic relevance of both indices in today’s volatile financial landscape.

The Nasdaq Composite and the U.S. 100 represent fundamentally different philosophies in market participation. Nasdaq, historically the home of high-growth technology firms, measures the performance of 225 leading innovator companies, including household names like Apple, Microsoft, Amazon, and Meta.

In contrast, the U.S. 100—a composite typically associated with the S&P 500 basket—involves broader sector representation but often draws comparisons to the cyclical resilience of established industrial, financial, and consumer staples stocks. As Nasdaq’s weighting grows with tech’s economic influence, questions emerge: can hype justify sustained outperformance, or does it reflect temporary speculative fever?

Historical trends reveal a powerful cycle: Nasdaq has delivered exceptional long-term returns, especially during tech bull markets. From 2010 to 2020, Nasdaq Composite posted an annualized return exceeding 15%, driven by exponential gains in software, cloud computing, and AI innovation. By contrast, the U.S.

100—anchored by more stable, dividend-paying gazelles—averaged roughly 7–9% annually over the same period, with lower volatility but limited upside during tech-led surges. This divergence raises a key question: does Nasdaq’s volatility offer outsized rewards, or does its unpredictability undermine long-term security?

Performance metrics highlight the contrast.

Nasdaq’s sensitivity to growth sentiment amplifies both gains and losses. For example, during the 2020 market rebound, Nasdaq surged over 40%—driven by massive inflows into tech granitors—while the broader U.S. 100 gained just under 25%.

Conversely, in 2022, rising interest rates and tech selloffs cut Nasdaq by nearly 30%, though it soon rebounded strongly on AI optimism. These swings underscore a central tension: Nasdaq rewards conviction and timing, but demands tolerance for emotional and financial risk.

Beyond returns, liquidity and investor composition differ sharply.

Nasdaq’s heavy concentration in a few mega-cap tech firms limits diversification, potentially exposing portfolios to single-sector risk. The U.S. 100, by including over 100 companies across sectors—from utilities to finance—offers broader risk mitigation, appealing to conservative allocators and institutional stewards.

Yet Nasdaq’s dynamic nature continues to draw disproportionate attention, fueling narratives of a “new economy” reshaping value investing.

Market structure plays a critical role. Nasdaq operates as a self-contained ecosystem governed by electronic trading, algorithmic momentum, and global capital flows—making it highly responsive to news, earnings surprises, and macro shifts like Fed policy.

The U.S. 100, embedded in older trading conventions and valuation benchmarks, tends to react more slowly, appealing to fundamental investors who prioritize stability over disruption. Yet recent years show increasing convergence: as AI and pharma innovation attract both tech giants and legacy players, Nasdaq’s tech casing expands, while the U.S.

100 incorporates growth stocks once considered too speculative.

Investor behavior reveals deeper patterns. Nasdaq’s fanbase skews younger, more digitally native, and often tilted toward growth-at-any-cost mentalities.

The U.S. 100, meanwhile, attracts longer-term, diversified investors seeking balance. This behavioral split influences market perceptions: Nasdaq’s dips may trigger panic selling among risk-averse participants, while its rallies feed speculative optimism.

Moreover, institutional holdings show a growing reallocation toward Nasdaq-linked ETFs and index funds, reflecting strategic shifts toward innovation-driven growth.

Metric comparisons offer clarity. Nasdaq Composite’s current price-to-to-fundamentals ratio—driven by elevated tech valuations—often exceeds sustainable levels by modern benchmarks.

Yet its forward-looking composition ensures it captures emerging trends. The U.S. 100 trades at a more reasonable multiple but lacks the disruptive momentum that defines Nasdaq’s appeal.

Investors must weigh whether growth premiums justify elevated risks—or if stability and resilience remain priceless.

In essence, Nasdaq and the U.S. 100 do not compete on equal footing.

Nasdaq Embodies the future: fast, volatile, innovation-driven, and concentrated in frontier technologies. The U.S. 100 reflects the present: balanced, diversified, and rooted in enduring economic pillars.

Both have justified their place in portfolios, but their roles diverge sharply. Understanding this distinction is not merely academic—it’s essential for constructing resilient, forward-looking investment strategies in an era of structural market transformation.

The real deal lies in recognizing that neither index alone offers a universal formula for success.

Instead, the future belongs to discerning investors who harness Nasdaq’s optionality in innovation while anchoring portfolios in the enduring stability of wider markets. In a world where change accelerates, that balance may be the most valuable asset of all.

Related Post

Exploring The Life And Career Of Clarisse Mouratoglou: Architect of Innovation in Tech and Finance

Another Word For Good: Transforming Challenges Into Meaningful Change

The Lakers’ Mad Dog Era: Inside Mark Madsen’s Myth of the Franchise’s Defining Moment

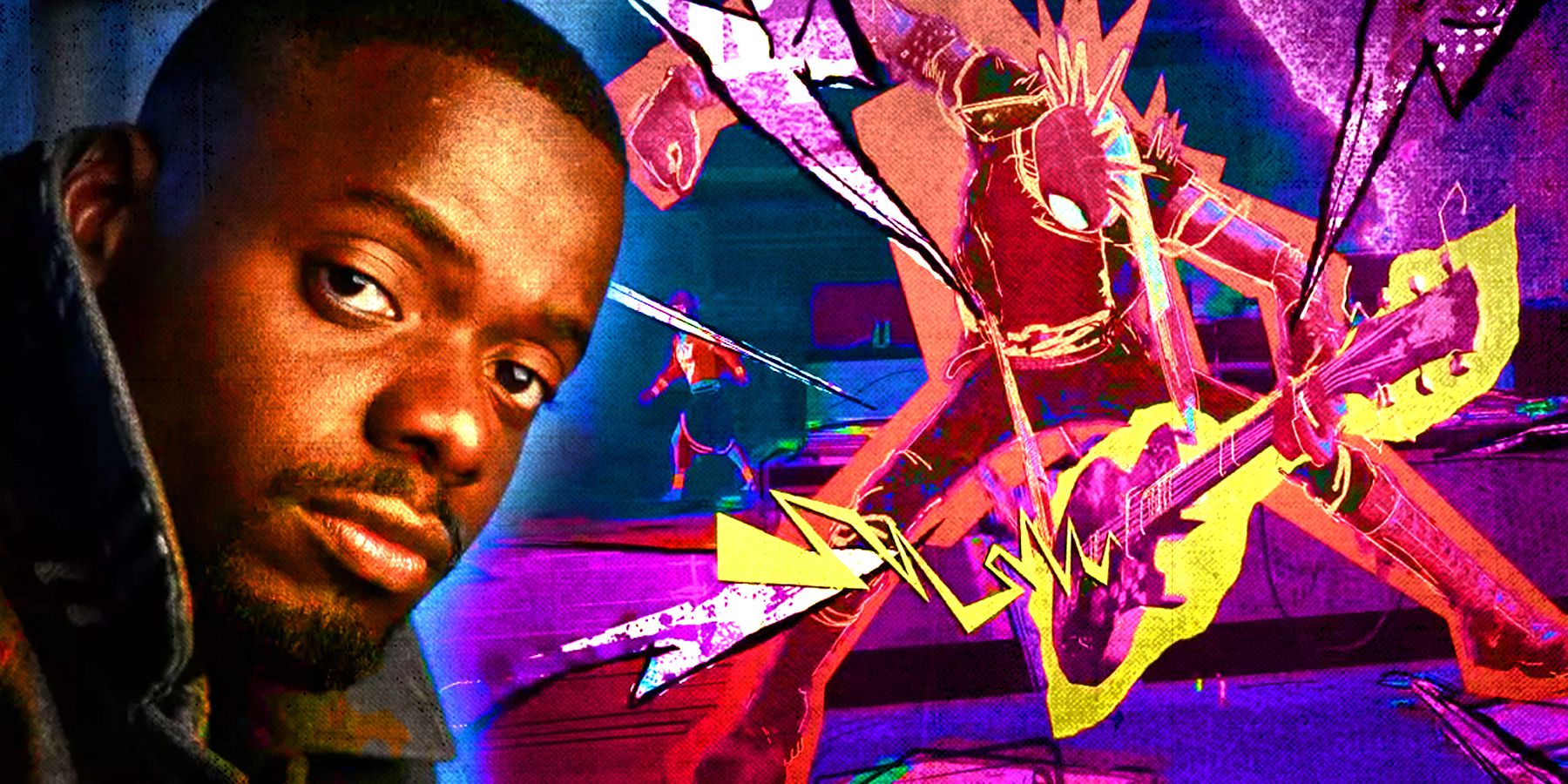

Spider-Man Across The Spider-Verse: The Voice Actors Behind the Multiverse’s Iconic Hero