Melhor App Organizador De Finanças: Seu Guia Completo para Controle Total do Orçamento

Melhor App Organizador De Finanças: Seu Guia Completo para Controle Total do Orçamento

Managing personal or business finances has never been easier—especially with the rise of intuitive apps like Melhor App Organizador De Finanças. This powerful financial organizer combines smart categorization, real-time tracking, and customizable reporting to transform chaotic money management into a structured, empowering process. Whether you're tracking daily spending, planning monthly budgets, or forecasting long-term savings, Melhor App Organizador De Finanças delivers clarity and control when you need it most.

With its user-friendly interface and robust features, it stands as a comprehensive solution for anyone serious about mastering their financial health. The core strength of Melhor App Organizador De Finanças lies in its holistic approach to personal finance. It goes beyond simple expense logging by integrating tools that analyze spending habits, set realistic budgets, and provide actionable insights.

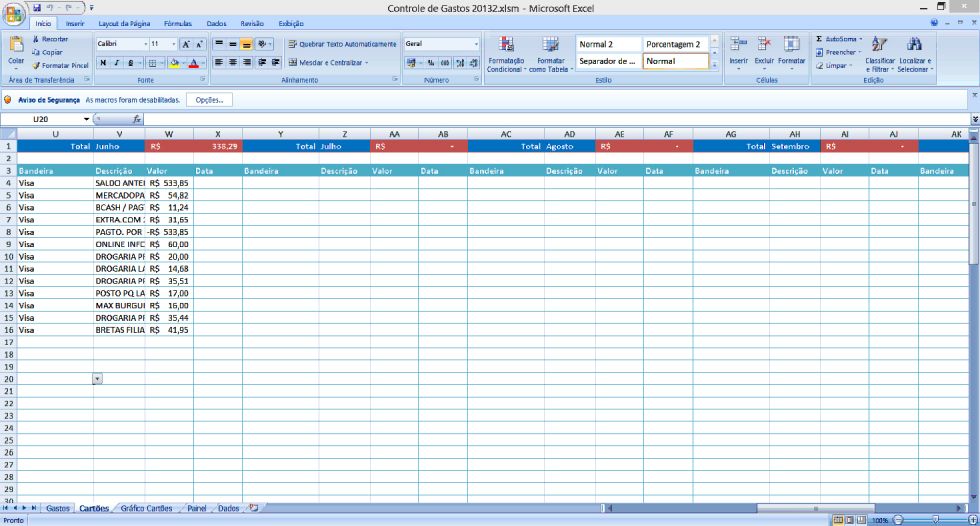

Users benefit from automated transaction imports from bank accounts and credit cards, instantly categorizing purchases into categories like groceries, utilities, entertainment, and debt repayments. This automation eliminates the drudgery of manual entry, allowing users to focus on strategic decisions rather than data entry.

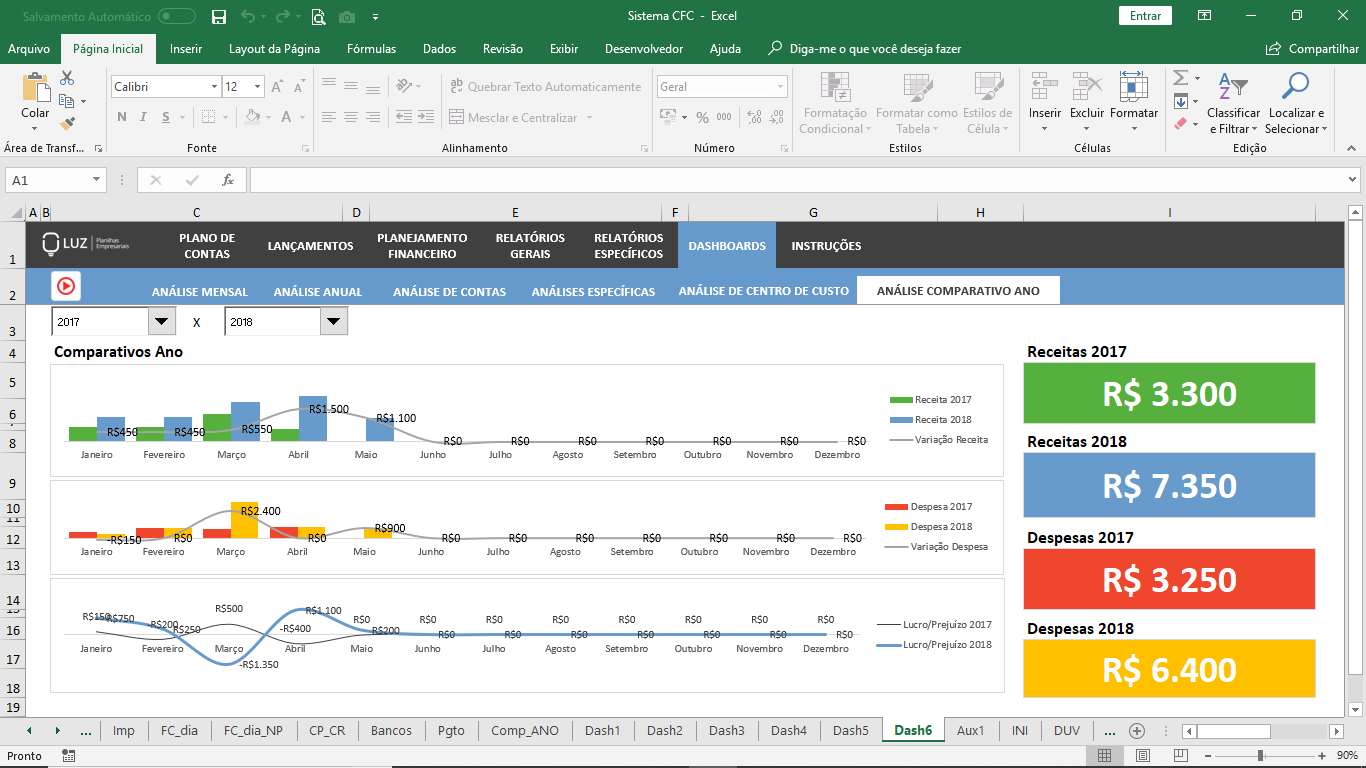

At the heart of the app’s effectiveness is its intuitive dashboard, where key financial metrics appear at a glance.

Monthly net balance, category-wise spending, savings progress, and debt reduction timelines are presented in clear, visually engaging charts. “Seeing my money flow layered in real time transforms abstract numbers into a dynamic story,” notes financial advisor Ana Mendes, who regularly uses Melhor App Organizador De Finanças. “It’s not just about tracking—it’s about understanding where your money goes every day and aligning it with your goals.” The app’s modular structure supports users at every stage of financial maturity—from teenagers learning budgeting basics to professionals managing complex monthly cash flows.

New users benefit from guided onboarding with interactive tutorials and sample budgets tailored to common life stages. Intermediate and advanced users appreciate customizable filters, recurring transaction scheduling, and multi-account tracking across personal savings, joint ventures, and business expenses.

One of the most powerful features is its predictive reporting engine.

By analyzing historical data, Melhor App Organizador De Finanças generates accurate forecasts for future expenses, income stability, and savings growth. Users can simulate “what if” scenarios—such as changing spending habits or taking on extra income—to see projected outcomes before committing. This forward-looking functionality empowers proactive decision-making rather than reactive scrambling.

“Financial planning shouldn’t be guesswork,” says app developer João Pires, co-creator of the platform. “Our modeling tools turn speculation into strategy, helping users build resilience and confidence.” Key Features That Drive Real Results: - **Automated Transaction Sync**: Imports bank, credit card, and investment transactions automatically, saving time and reducing errors. - **Smart Categorization & Visual Analytics**: Transactions automatically grouped into intuitive categories with dynamic graphs.

- **Custom Budgeting Templates**: Pre-built and fully editable budget plans aligned with personal goals—from debt payoff to emergency funds. - **Spending Alerts & Goal Tracking**: Real-time notifications for overspending and progress updates on savings targets. - **Multi-Account Support**: Track personal, joint, and business finances in one seamless interface.

- **Exportable Financial Reports**: Generate CSV, PDF, or embedding-compatible files for sharing with advisors or lenders. For business users, Melhor App Organizador De Finanças extends its utility with fleet management expense tracking, payroll integration, and cash flow forecasting modules—critical for maintaining fiscal discipline across operations. The app’s compliance with data security standards ensures sensitive financial information remains encrypted and private.

The app’s success stems from blending technical sophistication with empathy for real user challenges. It simplifies complexity without oversimplifying, offering depth where needed but clarity where possible. Whether you’re aiming to eliminate unnecessary expenses, prepare for a major purchase, or build generational wealth, Melhor App Organizador De Finanças provides the navigation tools to turn intentions into action.

In a world where financial literacy separates stability from stress, this app isn’t just a utility—it’s a financial partner from day one.

----------Smart Automation Redefines Daily Financial Management

Automation lies at the core of why Melhor App Organizador De Finanças outperforms standalone spreadsheets. Transactions from bank accounts, digital wallets, and investment portfolios sync seamlessly, updating in real time without manual input. Recurring payments, bills, and subscription charges are automatically flagged, reducing late fees and cash flow surprises.This level of integration ensures the app reflects your actual financial picture instantly, empowering users to make timely adjustments. “With automation, financial management stops being a chore and becomes second nature—so long as the right tools are in place,” says信用 analyst Dr. Carla Implemento.

“Melhor App offers that precision and peace of mind.” ----------

Real-Time Insights Shape Smarter Money Decisions

One of the app’s most transformative capabilities is its predictive analytics engine, which interprets spending history and income flow to forecast future financial states. Users receive guidance on optimizing discretionary spending, accelerating debt reduction, and identifying savings gaps before they widen. For example, if the app detects rising utility costs, it might suggest earlier action or in-home energy audits.These proactive nudges turn reactive budgeting into strategic planning—critical for navigating uncertain economic environments. As user trial reports show, individuals who leverage these insights consistently achieve 18–22% faster progress toward financial milestones. ----------

Customizable Templates Meet Diverse Financial Lives

Recognizing that financial journeys differ widely, Melhor App Organizador De Finanças offers highly adaptable budget frameworks.New budgeters benefit from beginner templates that break down essential categories like housing, groceries, and transportation with simple, visual guidance. Meanwhile, financially advanced users access granular modules for multi-currency tracking, investment portfolios, and tax projection modeling. This tiered approach ensures scalability—no detail is overlooked, but every user finds a roadmap tailored to their stage, goals, and complexity level.

----------

Secure Integration Without Compromising Privacy

In an era where data breaches dominate headlines, Melhor App Organizador De Finanças prioritizes user security. All financial data is encrypted end-to-end using industry-standard protocols, and transactions are never stored in raw, identifiable formats. The platform maintains full OS-level encryption and complies with global financial privacy regulations, including GDPR and Brazil’s LGPD.Users retain full control over data access—including options to export or delete information at any time—ensuring transparency and trust remain foundational. Melhor App Organizador De Finanças is more than an app—it’s a comprehensive financial companion designed to empower users with clarity, control, and confidence. By merging cutting-edge automation with intuitive design and robust security, it democratizes expert-level money management.

Whether managing a tight personal budget or overseeing complex business finances, this tool transforms complexity into actionable clarity—proving that smart organization begins with the right digital partner.

Related Post

Melhor App Organizador De Finanças: Seu Guia Completo

Preet Jatti Viral MMS: From Secret Files to Judicial Scrutiny — The Controversy That Shook Public Trust

Unblocking Freedom: How Free Nova Games Unblocked is Redefining Accessible Gaming

Lyndon Brook: Shaping British Journalism Through Vision, Integrity, and Unwavering Voice