Mastering Home Depot Credit Card Payments: Unlock Savings, Streamline Home Improvements, and Track Every Dollar

Mastering Home Depot Credit Card Payments: Unlock Savings, Streamline Home Improvements, and Track Every Dollar

For millions of U.S. homeowners, the Home Depot credit card isn’t just a payment tool—it’s a strategic partner in financing home renovations, DIY projects, and seasonal upgrades. Integrating credit card payments into a home improvement budget can dramatically reduce out-of-pocket costs when managed correctly.

Understanding how to leverage rolls, rewards, and tailored benefits transforms routine transactions into financial advantages, empowering users to finance projects while building long-term value.

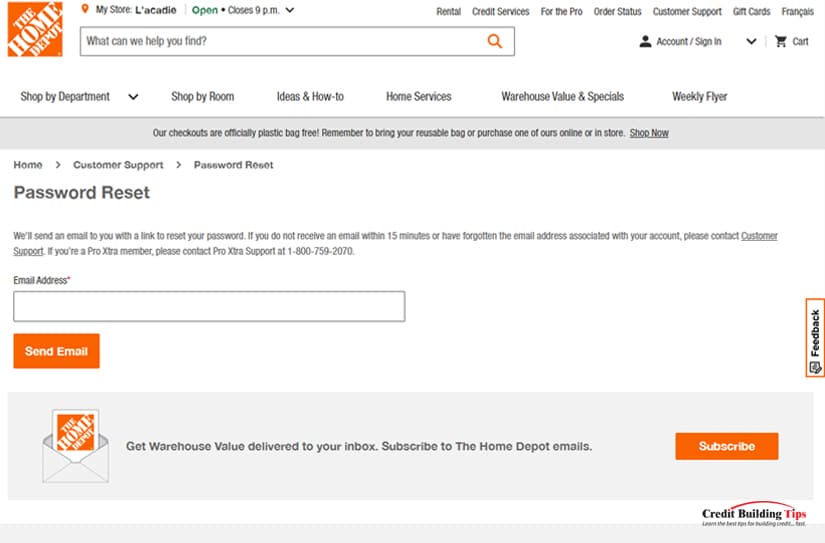

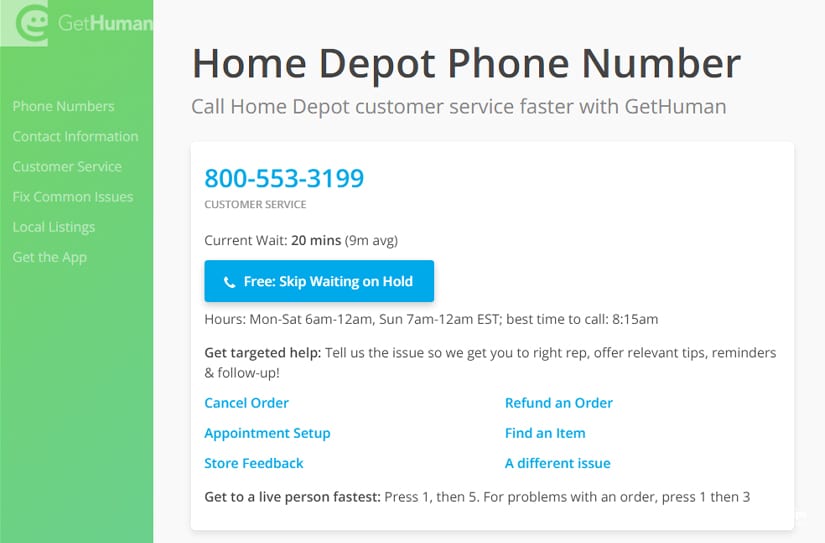

Home Depot’s credit card payment system supports a seamless, flexible experience designed to align with home improvement spending patterns. Most cardholders automatically receive elegant payment reminders, often integrated directly into the online store or mobile app.

Missing a deadline risks late fees and credit score impacts, but timely payments unlock eligibility for exclusive rewards and discounts. “Timely credit card use with Home Depot builds more than credit—it builds trust between retailer and homeowner,” says financial advisor Maria Chen, CPPA, certified in consumer finance. “It’s about treating the card as a financial extension of your home improvement plan, not just a payment method.”

One of the core strengths of the Home Depot credit card lies in its suite of cashback rewards and spending incentives.

Members often earn 5%—sometimes up to 10%—back on eligible home improvement-related purchases, including tools, flooring, paint, fixtures, and even contractor services. These rebates compound over time, effectively reducing project costs without requiring extra effort. Cashback earns aren’t just symbolic; they directly lower net spending.

For example, a $1,500 investment in kitchen remodeling tools and materials could generate $75–$150 in cashback alone, a meaningful offset when budgets are tight.

This generous structure is enhanced by rotating bonus categories, such as cash back on protocol devices, supplier invoices, or specific renovation categories like “outdoor living” or “benchHardware.” Home Depot frequently boosts categories tied to seasonal projects—think fall patio upgrades or summer pool maintenance—making card usage highly targeted. Cardholders who plan purchases around bonus periods strategically accelerate savings.

“Rather than spending impulsively,” notes home improvement expert James Tran, “you schedule kitchen backsplash tiles or HVAC filters during bonus cycles to maximize rebates.”

Beyond rewards, the card’s payment flexibility supports practical financial habits. Rotating between the credit card and debit option helps manage cash flow during major projects. Using the credit card for larger, milestone-spending items—like a new furnace or custom cabinetry—delays hard cash outlays while preserving liquidity.

Simultaneously, staying on top of minimum payments and on-time deadlines ensures credit health remains strong. “Balance tracking is critical,” advises Chen. “Transform the card into a budgeting ally, not a liability.

Most users see best value when payments are consistent, rewards are claimed proactively, and spending stays aligned with renovation timelines.”

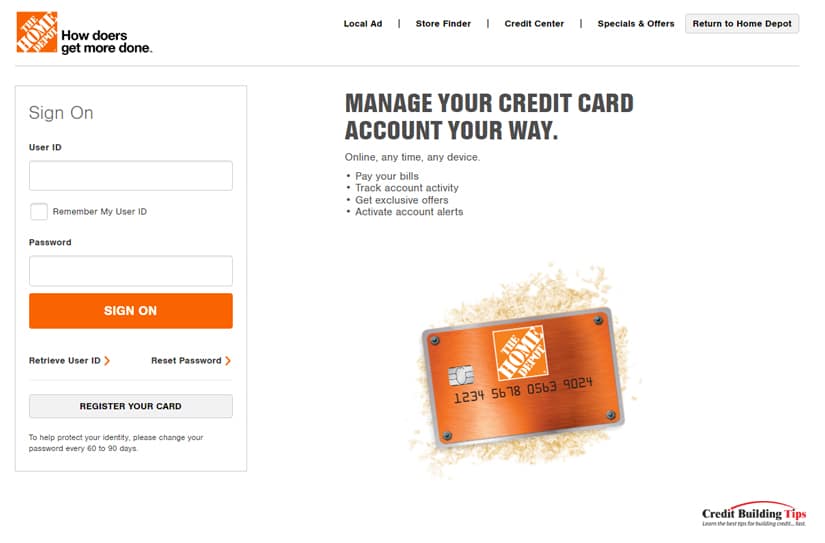

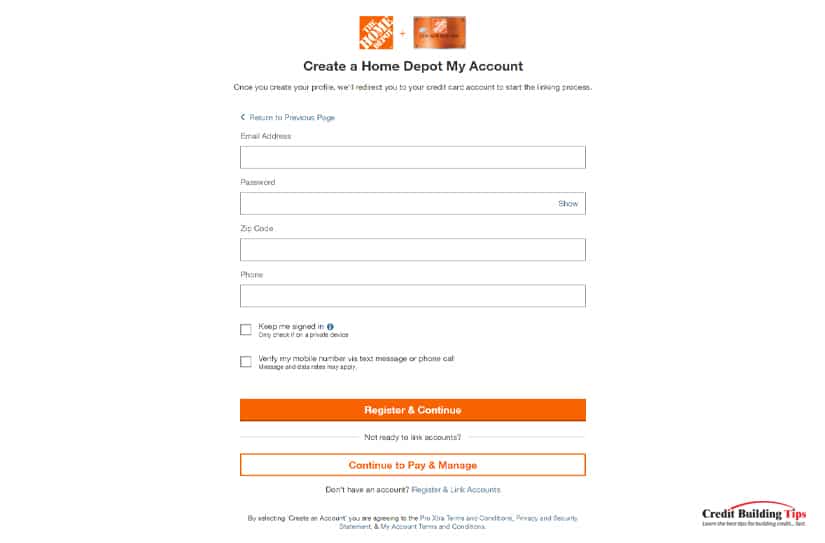

The tech behind Home Depot’s payment experience elevates usability further. Integrating the credit card into the official app, online portal, and in-store POS systems creates a unified ecosystem. Users enjoy real-time transaction alerts, detailed spending analytics by category, and instant access to offer codes or printable receipts.

The system automatically applies cashback to a dedicated rewards balance, which can be redeemed for gift cards, statement credits, or cash—giving full control over how credit gains materialize.

A key consideration is payment timing and strategy. While credit scores benefit from consistent on-time payments, users should avoid carrying balances to charge interests.

projection: a 30-day grace period (standard with new cardholders) allows full payment before interest applies, but automating full-balance repayment each month maximizes interest-free status and reinforces responsible habits. For seasonal projects, budgeting mid-month to coincide with bonus categories can multiply savings—turning routine purchases into strategic financial moves.

Maximizing Benefits: Tips for Home Depot Credit Card Payment Success

To optimize home improvement financing with the Home Depot credit card, consider these actionable strategies: - **Use the card for all renovation-related spending**—from tools and fixtures to labor and delivery fees.This ensures cashback and bonus benefits apply broadly across your project. - **Set automatic payment reminders** to avoid late fees and missed rewards. Home Depot’s app sends notifications tied directly to your purchase history.

- **Leverage bonus categories** by timing major purchases—major appliance upgrades in Q2, HVAC installations in fall—to capture higher rebates. - **Track rewards progress monthly** through the online portal or mobile app. Seeing tangible rebate growth reinforces disciplined use.

- **Combine credit card credentials with debit flexibility** for large fixed costs, preserving liquidity while using the card’s bonus-driven savings elsewhere. Home Depot’s credit card is more than a payment method—it’s a financial partner in home ownership. When used with intention, it delivers immediate rewards, long-term savings, and streamlined budgeting, making home improvement dreams more attainable.

By embracing its robust features—cashback on renovation essentials, timely payment benefits, and category-specific bonuses—homeowners transform recurring expenses into strategic investments, building not just projects, but lasting equity. In an era where smarter home ownership demands smarter financial tools, the Home Depot credit card stands out as a reliable, rewards-powered option. Its payment mechanics, designed around the rhythms of home improvement spending, reward users who approach their credit with discipline and strategy.

For those tackling landlords, sellers, and DIY enthusiasts alike, integrating this card into project planning means more than reducing payment hassles—it means growing home value, one well-charged transaction at a time.

Related Post

Doja Cat Steps Into the Spotlight in Shadow-Blushing Bikini Style

Sandra Smith’s Ascent to Fox And Friends: A Rising Star’s Breakthrough Moment

Gazeta Do Povo Breaking News: Ghana Protests Deepen Amid Constitutional Crisis and Economic Unrest

The Jellyfish as Ocean Messenger: Decoding Jellyfish Symbolism in Modern Discourse