Master your Chase Credit Card Payments: The Definitive Guide to Autopay & Payment ID

Master your Chase Credit Card Payments: The Definitive Guide to Autopay & Payment ID

For millions of Chase credit card users, managing monthly payments without personal oversight is a daily challenge—until Autopay and the Chase Payment ID system step in. This streamlined, secure solution eliminates payment stress, reduces late fees, and ensures timely bill submission with minimal hassle. Designed for simplicity and control, Chase’s payment tools empower cardholders to take full control of their financial responsibilities—no technical expertise required.

This comprehensive guide reveals how Autopay and Payment ID work, their benefits, and how to use them with confidence and precision.

The Chase Credit Card Autopay & Payment ID combines automation with identification security, making it one of the most reliable payment systems in modern card services. Whether you’re managing a Chase Sapphire, Rewards, or Essential card, understanding how to enable and manage Autopay ensures your bills are paid on time—every time.

Unlike traditional payment methods requiring manual entry or mailing checks, this system integrates seamlessly into daily banking routines while maintaining robust fraud protection.

How Chase Autopay Works: Step-by-Step Automation Made Simple

Autopay transforms recurring credit card payments from a memory-based chore into an automated process. Once enabled, Chase handles the transaction on your designated due date, pulling funds directly from your linked bank account. This eliminates the risk of missed deadlines and late-stay penalties, which often carry interest rate hikes and credit point deductions.- Activation is straightforward: Access Autopay through the Chase mobile app or online banking dashboard under “Payments.” Select your credit card, choose “Set Up Autopay,” and designate the due date—typically the 5th or 15th of the billing cycle, though customization is possible.

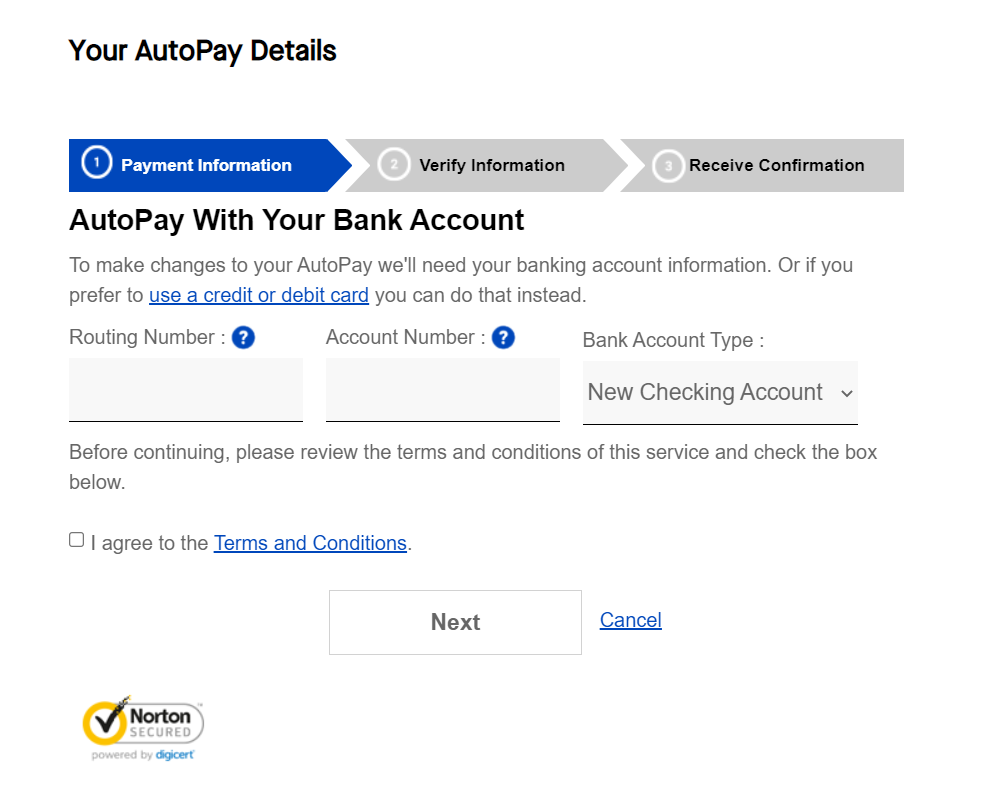

- Link your payment source: Provide routing and account numbers linked to your bank or digital wallet (e.g., via ACH). Chase verifies these details immediately, ensuring secure, real-time payment processing.

- Payment schedule: Once active, funds are deducted automatically on the scheduled due date. You receive a confirmation notification post-transaction and can view your payment history anytime in the app.

- Modify or pause quickly: If plans change, updating or temporarily pausing Autopay takes minutes—no manual paperwork.

Adjustments sync instantly across all Chase banking platforms.

Understanding the Chase Payment ID: Secure Access with Confidence

Controlled access is at the core of Chase’s Payment ID system, a security-enhanced method that simplifies payment initiation while protecting sensitive data.Unlike storing full card details, Payment ID uses a unique, encrypted token tied to your account—eliminating the need to re-enter numbers or zip codes each time. How Payment ID Works: When enabled, the Payment ID function generates a personalized identifier that connects your Chase account securely. During checkout or payment setup, instead of traditional card input, Chase references this token, validating identity through multi-layered encryption and biometric or PIN-based verification.

The benefits are twofold: speed and security. Foundationally, Payment ID reduces friction—log in once, complete a transaction swiftly without repetitive data entry. For security, tokens are never stored on third-party servers or exposed during transactions, minimizing exposure to fraud risks.

Chase emphasizes this system aligns with industry-leading best practices in digital authentication, offering peace of mind whether paying online, via mobile, or at partner retailers.

Key Advantages of Payment ID: - ✅ Faster Payments: No manual form-filling; transactions complete in seconds. - ✅ Enhanced Security: Encryption and tokenization prevent data theft and identity misuse. - ✅ Cross-Platform Consistency: Accessible on mobile, web, and in-person via Chase’s unified ecosystem.- ✅ Error Prevention: System validation reduces typo-related failures, ensuring legitimate payments are processed smoothly.

Using Autopay and Payment ID Together: A Unified Payment Experience When Autopay and Payment ID are used in tandem, Chase credit card users gain a seamless, fortified payment environment. Autopay ensures on-time execution; Payment ID safeguards the process with advanced security.

Here’s how to activate this powerful combination: 1. Access integration: In your Chase account dashboard, navigate to Payments > Add a Payment Method, then select “Set Up Autopay with Payment ID.” 2. Token issuance: Chase immediately issues a secure Payment ID tied to your card.

Verify authentication steps using your preferred method—fingerprint, facial ID, or 6-digit PIN. 3. Schedule with confidence: Choose your due date, confirm linking between Payment ID and card, and activate.

4. Monitor and adjust: Track every transaction and modify settings instantly via the app or online portal. This integration eliminates the tension between reliability and safety.

For frequent travelers, weekend spenders, or anyone managing multiple cards, the synergy ensures constant on-time payments without compromising confidentiality.

Indeed, Chase’s integration of Autopay and Payment ID represents a paradigm shift in personal finance management. By merging automation with encryption, the bank delivers a tool that adapts to real-world demands—minimizing human error, maximizing security, and reducing friction in monthly budgeting.

For users prioritizing both time and peace of mind, these features are not just convenient—they’re essential. Whether you’re new to Chase’s payment ecosystem or seeking to refine your banking habits, enabling Autopay with Payment ID transforms obligation into automation, risk into trust, and stress into control. It’s a system built not just to function, but to protect and simplify.

In a world where digital payment efficiency is expected, Chase’s solution stands out as a model of usability and integrity. By understanding and leveraging Autopay and Payment ID, cardholders take definitive action toward smarter, safer, and stress-free financial management—one automated payment at a time.

Related Post

KTv Bars In The Philippines: Your Ultimate Guide to Rooftop Lifestyle & Nightlife Magic

Is Eugenia Cooney Dead? The Truth Behind the Rumors Swirling Around the Pop Star

The Enduring Legacy of King Nasir: Architect of Reform and Visionary Leadership

Catherine Bach: The Timeless Icon Who Defined the Bold Spirit of the 1970s and 1980s