Master RBC Online Banking: Your Ultimate Digital Banking Powerhouse

Master RBC Online Banking: Your Ultimate Digital Banking Powerhouse

Access your finances, manage accounts, and transfer money seamlessly from nearly anywhere—right through RBC Online Banking. More than just a digital wallet or mobile app, it’s a comprehensive financial nerve center designed to deliver speed, security, and control at your fingertips. Located at the forefront of modern banking innovation, RBC Online Banking combines intuitive design with advanced security features to transform how Canadians – and now global users — interact with their money.

With over 5 million active users, the platform proves itself as a trusted partner in daily financial management, offering tools that go far beyond traditional banking.

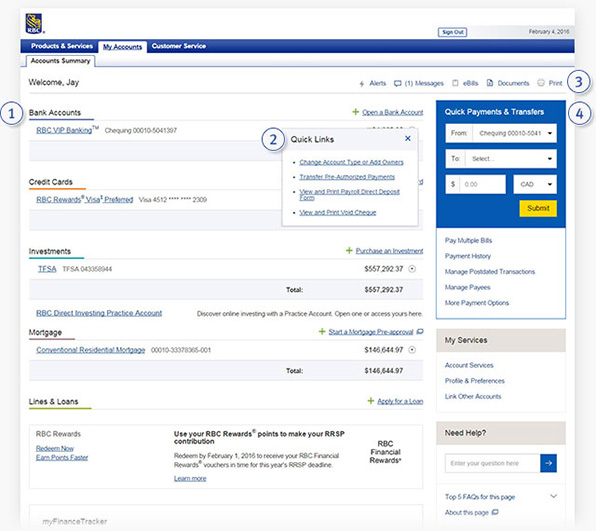

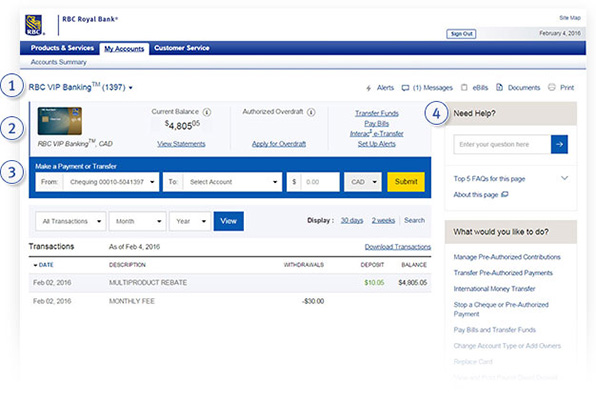

At the core of RBC Online Banking’s value proposition is accessibility: banking anytime, anywhere, without the need to visit a branch. Using a secure web browser or the official RBC mobile app, customers instantly log in to view account balances, track transactions, and initiate fund transfers—all within moments.

But the system’s strength goes beyond convenience. The interface is meticulously crafted for usability, featuring personalized dashboards, real-time alerts, and customizable budgeting tools that empower users to make informed decisions. From monitoring spending patterns to setting automatic savings goals, the platform turns data into actionable insights, bridging the gap between passive account holding and proactive financial stewardship.

Breaking Down the Features That Define RBC Online Banking

A full-service digital banking experience requires robust functionality, and RBC Online Banking delivers across multiple critical banksmanship dimensions:Secure Access and Modern Authentication Security is non-negotiable.

RBC’s platform employs industry-leading encryption, biometric login (fingerprint or face ID support), and multi-factor authentication to safeguard accounts. Even with evolving cyber threats, RBC maintains a near-zero compromise rate, reassuring users that their data remains protected. The bank also issues real-time alerts for logins, large transactions, or unusual activity, enabling immediate response to potential fraud.

These layers of defense have earned steadfast trust—RBC consistently ranks in Canada’s top banks for digital security.

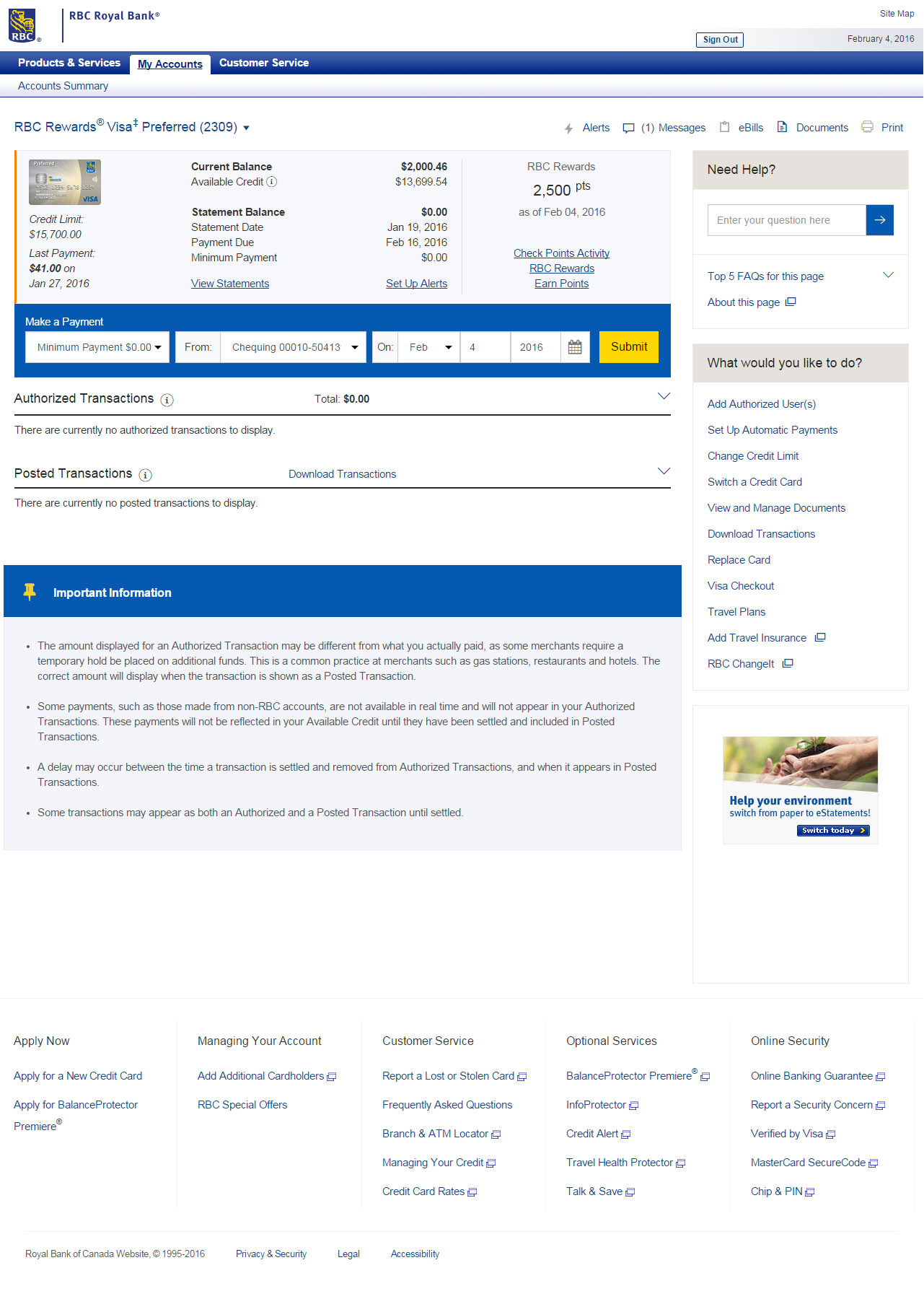

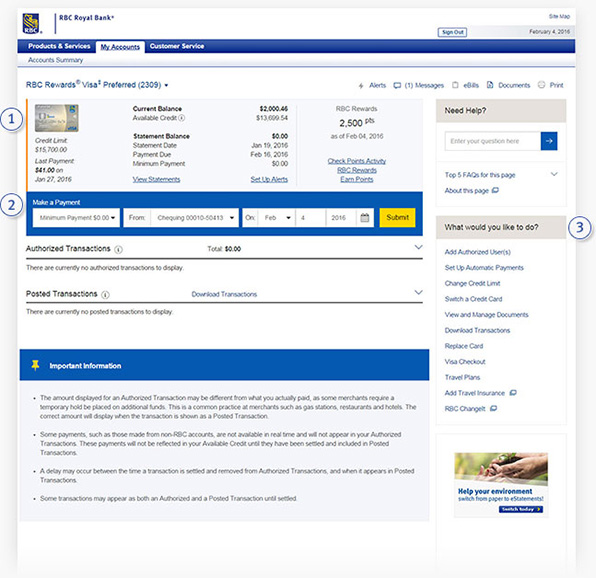

Comprehensive Account Management RBC Online Banking consolidates all core banking products in one secure environment—checking, savings, term deposits, mortgages, and investments. Users can monitor every account simultaneously, reconcile balances instantly, and access detailed transaction histories. Linking foreign accounts and managing multiple currencies is straightforward, making the platform indispensable for both everyday users and international customers.

The app’s transaction categorization system classifies spending automatically, generating neat monthly summaries that reveal where money flows—highlighting spending trends and helping refine budgeting strategies.

Seamless Money Transfers and Payments From splitting a restaurant bill to transferring funds to a new bank account, RBC’s payment tools are built for efficiency. Same-day transfers (shared via clearing cycles) ensure money moves instantly, while scheduled payments automate recurring bills—utility, loan, or subscription charges—eliminating late fees and missed deadlines. For external transfers, the platform supports wire transfers, Beneficiary Notes, and payee-linked services with zero hidden fees.

The ability to set up recurring payments and remember trusted contacts streamlines routine finance, reducing friction and administrative overhead.

Smart Financial Tools and Budgeting Support Going beyond transaction processing, RBC Online Banking integrates advanced financial intelligence. Dashboard analytics display spend distribution across categories—food, transit, entertainment—with visual charts that clarify overspending patterns. Users set custom budgets and receive automated notifications when nearing limits, turning abstract goals

Related Post

Unlock Authentic Exploration: How Super Stroll Redefines Urban Wanderlust

CRGO Steel Giants of China: Forging the Backbone of Modern Infrastructure

Zamindars: The Powerful Landlords Who Shaped Empires Across World History

Dominate The Ladder in Arena 15: Master the Best Clash Royale Decks for Unbeatable Arena 15 Performance