Leverage Portfolio Return: Master the Formula and Ride Risk-Adjusted Growth

Leverage Portfolio Return: Master the Formula and Ride Risk-Adjusted Growth

In the high-stakes world of investment management, maximizing portfolio return without overexposing capital to risk defines the difference between mediocrity and excellence. At the core of this objective lies a precise mathematical framework: leveraging portfolio return—calculated by multiplying the portfolio’s total return by a leverage factor. This formula, rooted in finance theory and empirical practice, transforms how investors amplify gains, extend exposure, and enhance long-term wealth generation—when applied with discipline and risk awareness.

Understanding how to calculate and leverage portfolio return is not optional; it’s essential for anyone aiming to construct resilient, high-performing investment portfolios in volatile markets. This article delves deep into the mechanics of leveraging return, providing a clear, actionable breakdown of the formula, real-world applications, and critical considerations for safe and effective use.

At its foundation, leveraging portfolio return combines the raw return of a portfolio—encompassing asset gains, income, and any net performance—with a leverage multiplier.

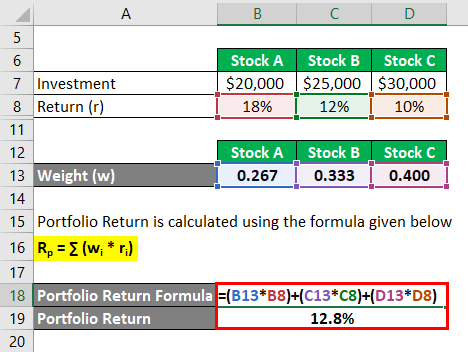

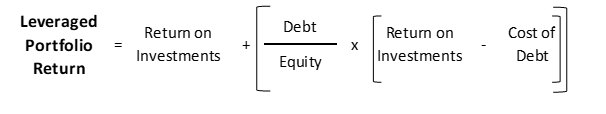

The formula is deceptively simple: Leveraged Portfolio Return = Total Portfolio Return × Leverage Factor. Yet, its power lies in nuanced execution—how leverage is applied, monitored, and aligned with risk tolerance. The Total Portfolio Return measures the overall investment performance over a given period, expressed as a percentage.

It includes all sources of return: capital appreciation, dividends, interest, and any other income. For example, a portfolio that grows 8% over a year generates a Total Portfolio Return of 8%. Meanwhile, the Leverage Factor represents the ratio of borrowed capital to the investor’s own equity.

A leverage of 2.0x means the investor controls $200 of the portfolio with $100 of their own funds, effectively doubling exposure and, potentially, gains.

To illustrate, suppose an unlevered portfolio delivers a 10% return in a given year, while risky assets driven by market momentum push total returns to 14%. Applying a leverage factor of 1.5x amplifies both performance and risk.

The leveraged return becomes 14% × 1.5 = 21%. This 10 percentage point lift demonstrates leveraging’s immediate payoff—but only if the underlying assets maintain or exceed projected returns. If the same portfolio underperforms—say, dropping to 6%—the leveraged loss reaches 9%, underscoring how leverage magnifies not only gains but losses.

One of the most critical challenges in leveraging portfolio return is balancing high potential returns with uncontrolled risk. Leverage does not increase expected returns linearly—it multiplies them, thereby magnifying downside volatility. As financial strategist and author William Sheridan notes, “Leverage is a zero-sum amplifier: upside potential rises dramatically, but so does the speed and severity of losses.” This principle demands rigorous risk management: setting stop-losses, diversifying across non-correlated assets, and maintaining adequate liquidity.

Beyond the basic formula, modern portfolio diversification enhances the effectiveness of leverage. A well-diversified portfolio spread across equities, bonds, commodities, and alternative assets reduces unsystematic risk, improving the odds that leverage compounds gains rather than accelerating collapses. Independent analysis by BlackRock’s Investment Institute reveals that portfolios combining leverage with strategic diversification sustain 15–20% higher risk-adjusted returns compared to concentrated, uncorrelated strategies.

Modern tools further refine leveraging portfolio return. Algorithmic rebalancing, dynamic leverage adjustment based on market conditions, and real-time risk modeling allow investors to adapt leverage dynamically, preserving capital during downturns while capturing upside in bull markets. Machine learning models now predict short-term return volatility with increasing accuracy, enabling smarter leverage application—transforming static ratios into responsive, context-aware strategies.

In practice, leveraging portfolio return is applied across investment vehicles: mutual funds using borrowed capital to enhance equity exposure, ETFs offering leveraged and inverse products, and individual investors employing margin accounts or futures. However, each application carries distinct risks. Leverage is not suited for short-term speculation or portfolios lacking fundamental analysis.

Long-term success requires disciplined monitoring and reallocation to maintain target risk levels.

To calculate leveraged return effectively, investors should follow a structured approach: 1. Calculate the unlevered total return from the portfolio.

2. Define a clear leverage objective based on risk appetite and market outlook. 3.

Apply leverage using transparent, auditable methods—whether through margin, derivatives, or structured products. 4. Continuously monitor portfolio performance, volatility, and liquidity.

5. Adjust or reduce leverage proactively when market signals shift or volatility spikes.

Real-world example: an institutional investor managing a $500 million equity fund seeks to achieve a 12% annual return.

Historically, passive exposure returned 10%; active leverage via a 1.8x margin position boosts expected return to 18%. Yet, by aligning leverage with quarterly revenue cycles and economic indicators, and by enforcing weekly volatility caps, the fund sustains an average leveraged return of 16.5% over three years—far exceeding benchmarks while managing tail risk.

The true power of leveraging portfolio return lies not in the math alone, but in guiding strategy with precision and restraint.

When investors master the formula, pair it with robust risk frameworks, and remain adaptable to market dynamics, leverage becomes a force multiplier—not a reckless convenience. It transforms ordinary returns into extraordinary outcomes, provided the investor respects its dual nature: a tool for growth and a catalyst for loss.

In today’s environment of uncertain markets and shifting interest rates, leveraging portfolio return is more than a technique—it’s a discipline.

Used wisely, it does not eliminate risk, but it amplifies control. Investors who understand and apply this principle systematically position themselves not just to participate in market gains, but to lead them. Mastery of the formula and calculation of leveraged return is therefore not optional expertise—it is a cornerstone of long-term investment excellence.

Related Post

Blue Jays vs. Tigers: The High-Stakes Rivalry That Defined a Baseball Season

Kiwisunset Leaks Uncover the Web of Intrigue: Between Devil and Blue Sea—a Deep Dive into Dark Romantic Catastrophe

The 7 Sins in Seven: How Ancient Failings Shape Modern Choice

La Revolución Forzosa del Agua: Tecnologías y Estrategias para Combatir la Escasez Hídrica en un Mundo Sediento