Las Vegas Property Tax: Your Complete Roadmap to Clark County’s Fiscal Landscape

Las Vegas Property Tax: Your Complete Roadmap to Clark County’s Fiscal Landscape

In the sun-drenched corridors of Clark County, where skyscrapers pierce the desert sky and resorts cascade in mega-footage of entertainment, one constant shapes every resident’s financial reality: property taxes. For homeowners, renters, investors, and city planners alike, understanding Clark County’s property taxation system is not just a legal obligation—it’s a key to navigating one of the fastest-evolving real estate markets in the United States. With Las Vegas’s population growth, booming tourist economy, and shifting economic dynamics, property taxes influence everything from budget planning to investment returns.

This comprehensive guide unpacks the intricacies of Las Vegas property tax, how it’s calculated, who pays what, and what future changes may reshape the fiscal terrain.

Decoding Clark County’s Tax Structure: How it All Works

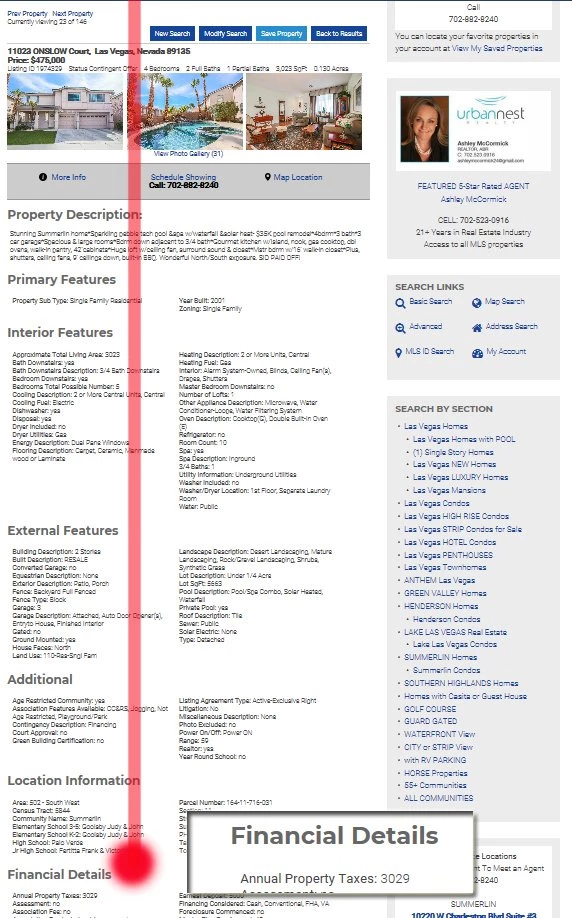

Clark County’s property tax framework rests on three core principles: assessed value, millage rates, and equitable distribution funded by local services. The process begins with property assessment—an official valuation conducted by the Clark County Assessor–Collector Department, which evaluates real estate values based on market trends, property condition, and location.Unlike some states that assess homes annually, Clark County updates valuations every three years, allowing fluctuations in market prices—such as the tight supply and rising prices seen post-2020—to be reflected in tax obligations over time. Properties are taxed at a **millage rate**, expressed in dozens (e.g., 10 mill = $1 per $100 of assessed value). The combined rate across Las Vegas and its municipalities averages roughly 1.04 millages, though cities like Henderson and North Las Vegas impose slightly higher rates due to differing service demands.

Each property owner declares their primary residence or investment property, triggering different rate structures and potential exemptions. The assessed value for primary residences benefits from a homestead exemption, currently capped at $70,000, reducing taxable holdings and easing burdens on homeowners. Investment or vacation properties face full market value assessment, making property taxes a deliberate cost of ownership.

This calibrated approach seeks balance: funding essential services while promoting housing stability.

According to the Clark County Assessor–Collector, “Our mission is to ensure fairness and transparency. Every dollar contributed supports schools, public safety, roads, and infrastructure—services that directly enhance community value and long-term property health.”

Who Pays — And Who Benefits: The Motor of Clark County’s Public Investment

Las Vegas’s property tax revenue fuels over 60% of local government expenditures, ranging from K–12 education and fire protection to transit systems like the Regional Transportation Commission (RTC) and massive infrastructure projects such as the $700 million expansion of McCarran International Airport.Approximately 70% of the county’s budget derives from real estate taxes, with the remainder from business taxes, fees, and sales revenue. Homeowners might find tax rates varying by district—Las Vegas proper carries higher rates than master-planned communities like Green Valley due to differing service demands. Multifamily units and commercial properties are taxed at거나 a premium proportional to market value and usage.

Crucially, under Nevada law, property taxes serve a dual role: funding public services while enabling proactive urban development and economic diversification. “Property taxes are the backbone of our city’s growth,” emphasizes city finance director Rebecca Lopez. “They finance not just roads and schools, but the sustainable development that makes Las Vegas a diverse and resilient metropolis.”

Resident advocates stress that equitable assessment remains a priority.

Recent audits reveal over 5% of properties experienced valuation mismatches, prompting calls for enhanced transparency—efforts already underway to digitize assessment data and expand public review periods.

Navigating Your Obligations: Rates, Filing, and Relief Programs

To calculate your Clark County property tax, start by determining assessed value—usually 30–40% of market value—using public parcel maps or forms available through the county portal. From there, apply the current millage rate using this basic formula: Assessed Value × Millage Rate ÷ 1000 = Annual Tax. For a typical Las Vegas single-family home valued at $500,000 with a 3% assessed value and 1.06 millage rate, annual taxes approach $1,663—before exemptions.Primary homeowners may qualify for multiple relief programs: - Homestead exemption: Reduces taxable base by $70,000. - Senior Citizen exemption: Additional $15,000 valuation reduction, crucifying taxable value near $350,000. - Veteran and disabled homeowner tax credits further lower liquidity strain.

For renters and investors, property taxes remain a fixed cost to property owners, passed through via rent adjustments or embedded in cap rates. A 2023 study by the University of Nevada, Las Vegas noted that rental properties in high-growth zones absorb approximately 18–22% of tax increases through rent hikes, preserving net operating-income stability. Residents file returns via the county’s online portal or paper forms, with payment due by June 1 annually.

Late payments incur penalties of 5% per month, up to 25% total, emphasizing timely compliance.

Prepayment options, including a 5% discount for full annual payment by April 15, offer strategic savings. Financial advisors recommend budgeting meticulously—property taxes in Clark County average $600–$1,200 per month depending on location, rhythm more than volatility.

Trends Shaping the Future: What’s Next for Las Vegas Taxpayers

Emerging economic shifts and policy proposals are reshaping the landscape of Clark County property taxation.With housing affordability in sharp focus, state legislators periodically evaluate tax caps and reassessment frequency. In 2022, Assembly Bill 230 scaled homestead exemptions and mandated biennial reassessments—m

Related Post

WhatsApp Video: The Powerful Communication Revolution Reshaping Modern Life

Richmond VA Zip Codes A Quick Guide: Master Your Neighborhood Code

Unlock Geometry’s Secrets: Mastering the Mathplayground Cubeform of Object Geometry

How Old Is The Weeknd? Uncovering the Legacy Behind the Icon