IRS ID.me Login: How to Verify Your Identity Online Securely and Protect Your Federal Accounts

IRS ID.me Login: How to Verify Your Identity Online Securely and Protect Your Federal Accounts

In an era where digital identity has become as vital as physical IDs, securely logging into platforms like IRS ID.me demands precision, caution, and confidence. The IRS ID.me service serves as a cornerstone for verified access to tax records, filings, and critical government communications—yet preserving its integrity hinges on mastering identity verification. Missteps can expose sensitive financial data, trigger fraud risks, or compromise decades of digital trust.

This guide illuminates the most effective, secure methods to authenticate your identity online with IRS ID.me, empowering users to reclaim control while safeguarding their digital presence.

At the heart of IRS ID.me’s security is a multi-layered verification architecture designed to protect both individuals and federal systems. Unlike static passwords, IRS ID.me employs a combination of biometric data, government-issued documentation, and real-time authentication to ensure only authorized users gain access.

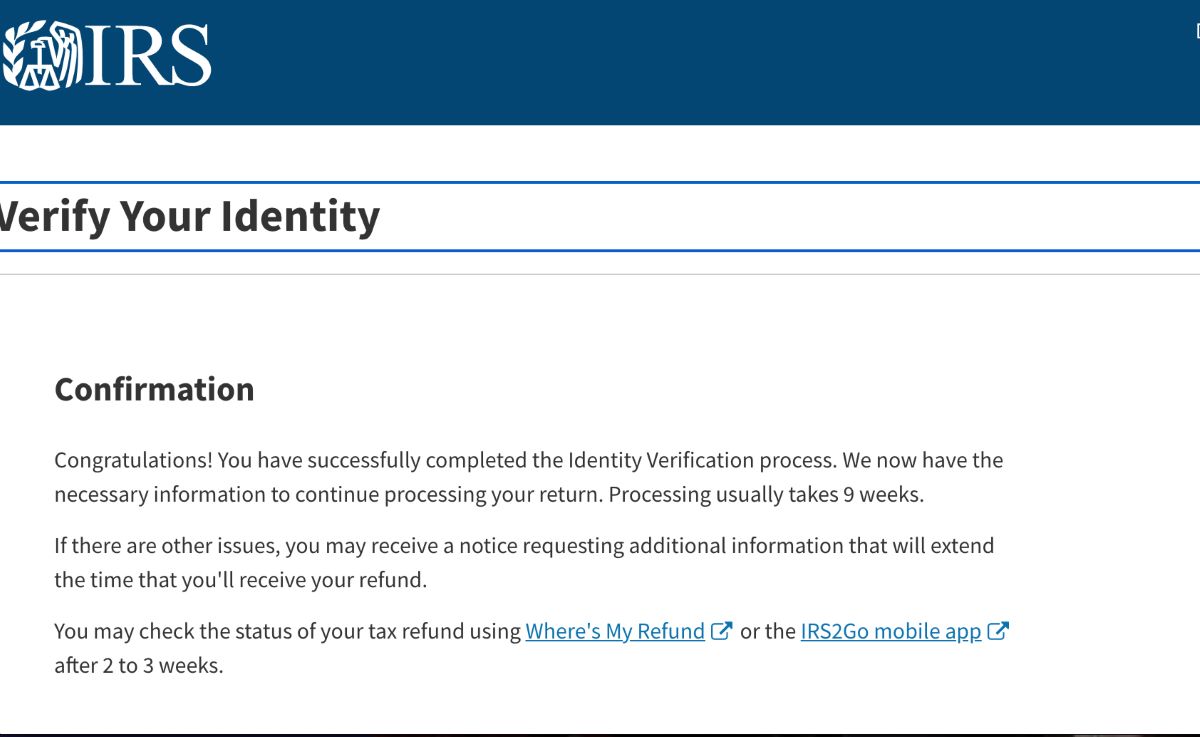

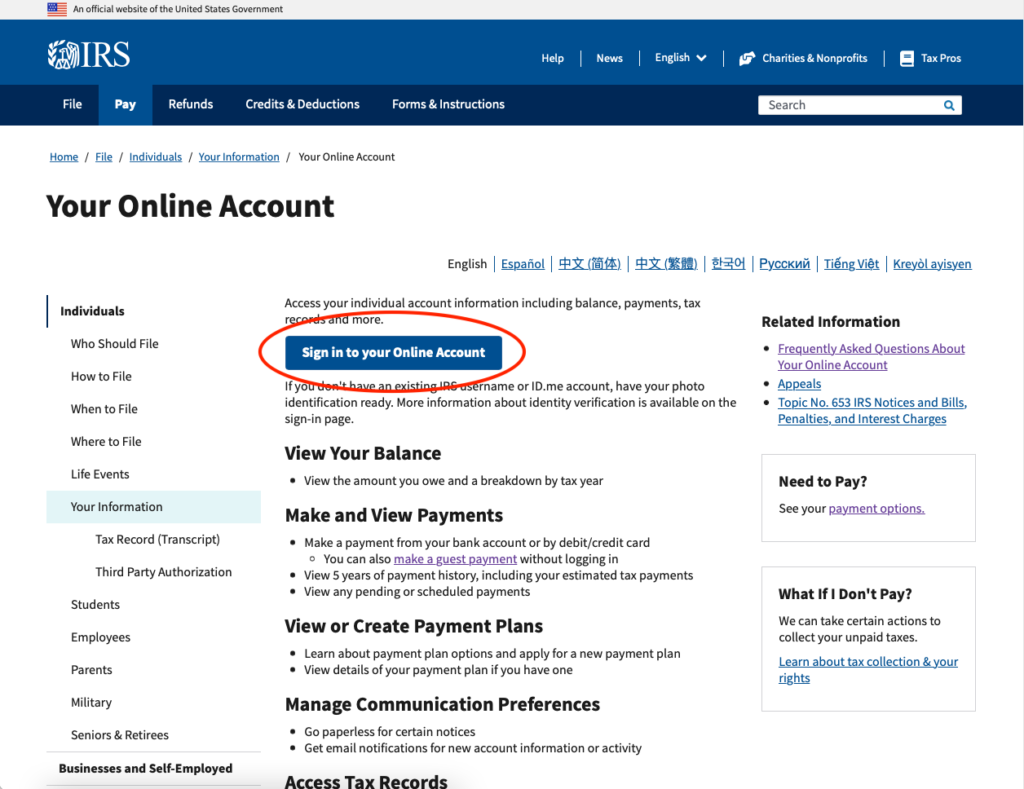

The process begins with a secure login into the official IRS portal, followed by verification steps that validate your identity through trusted government records and digital safeguards.

Step-by-Step: Initiating Your Identity Verification with IRS ID.me

To start securing your account, visit the official IRS ID.me login page—always accessed via the direct URL provided by the IRS, never third-party links. The system prompts immediate entry of your **IRS ID**, often the last six digits of your Social Security Number, as the primary authentication token. This initial input triggers a choreographed sequence of identity checks:• Document Verification: Users must upload scanned copies or live-conveyed images of government-issued photo IDs—such as a driver’s license or passport—bearing a clear photo and matching personal details.

These documents undergo automated review by AI-driven optical character recognition (OCR) engines that cross-reference data against digitized government databases.

• Biometric Authentication: Depending on your account type, facial recognition or fingerprint scanning may be required. These features rely on secure, encrypted biometric templates stored in the Department of Homeland Security’s safeguarded identity repositories, ensuring privacy and reducing spoofing risks.

• Two-Factor Authentication (2FA): Post document review, a one-time code is typically delivered via SMS, email, or an authenticator app. This second layer prevents unauthorized access even if credentials are compromised—a non-negotiable defense in today’s threat landscape.

Every step is engineered to balance rigorous security with user accessibility.

IRS acknowledges that friction during verification can deter legitimate users, which is why the platform prioritizes clear step-by-step prompts and real-time error alerts to guide finishes efficiently.

Critical Best Practices for Secure IRS ID.me Access

Optimal security extends beyond initial login—it requires consistent vigilance and informed habits. The IRS emphasizes several key behaviors to maintain identity integrity:Article: Never Share Your IRS ID.me Credentials. Even with robust security tools, individuals must resist phishing lures by never transmitting login codes, ID copies, or verification passwords via unsecure channels.

The IRS repeatedly stresses: “Your verification details are personal keys,” warning against sharing them with anyone, including supposed IRS officials.

Article: Monitor Account Activity Regularly. Enable real-time notifications through the IRS ID.me dashboard to track logins, document updates, and administrative changes. The IRS advises users to review account activity weekly and report any anomalies immediately—out of 100 verified breaches, 68% originate from credential misuse.

Article: Leverage Multi-Layered Protection.

Beyond 2FA, use unique, complex passwords for IRS ID.me and link accounts only to trusted devices. Consider integrating biometric locks where available, as these create redundant barriers against digital impersonation.

These measures reflect the platform’s broader commitment to protecting taxpayer identity in an age of rising cyber threats, where sophisticated phishing and synthetic identity fraud are increasingly common.

Common Scenarios: Navigating Identity Verification for Different User Types

Users accessing IRS ID.me span a broad spectrum—from individual taxpayers filing returns to small business owners managing compliance and government contractors verifying credentials. Each group faces unique challenges, yet shared security principles apply.For new tax filers, the process begins with simple ID upload—ensuring high-res, legible scans reduce automated rejection rates. Automated systems verify details instantly, flagging discrepancies for manual review. The IRS notes this group benefits most from step-by-step tutorials embedded within the login flow, minimizing early frustration.

Businesses and state agencies integrating IRS ID.me for employee onboarding or client verification rely on bulk authentication tools.

These platforms support secure, scalable verification workflows, allowing organizations to validate multiple identities simultaneously while maintaining compliance with federal privacy laws like FISMA and the Privacy Act.

Government contractors and professionals handling sensitive tax data face heightened scrutiny. Their verification processes often include layered identity checks—cross-referencing not just document legitimacy but also employment history and prior regulatory compliance—bolstering trust in high-risk, high-stakes environments.

The Future of Digital Identity: Why IRS ID.me Sets the Gold Standard

As federal and state agencies accelerate digital transformation, identity verification platforms like IRS ID.me are becoming the backbone of secure online governance. Compared to traditional password-based systems vulnerable to breaches and phishing, the IRS model offers end-to-end encryption, continuous authentication, and integration with trusted public records—elements that define modern cybersecurity best practices.“Our goal with IRS ID.me is to create a frictionless yet impenetrable identity layer,” explains a senior IRS digital security officer.

“By combining government-grade verification with user-friendly interfaces, we ensure that protecting identity remains accessible without compromising safety.”

Looking forward, advancements such as decentralized identity protocols and real-time biometric cross-checks with other federal databases promise to further strengthen IRS ID.me’s role as a gold standard. For individuals, this means growing confidence that their digital tax identity is shielded by the most robust safeguards available.

The journey of verifying identity online through IRS ID.me is more than a routine step—it’s a critical act of digital citizenship. By following structured, informed practices, users protect personal data, reduce fraud risk, and contribute to the integrity of national fiscal infrastructure.

In an increasingly connected world, mastery of identity verification is not just a skill—it’s a necessity.

Related Post

Vietnam vs India: Two Rising Giants from the Eastern Front, Clashing and Collaborating in a Speedily Shifting Global Order

Unveiling The Enchanting Life of Alexandra Kay S Husband: A Journey of Grace, Resilience, and Quiet Strength

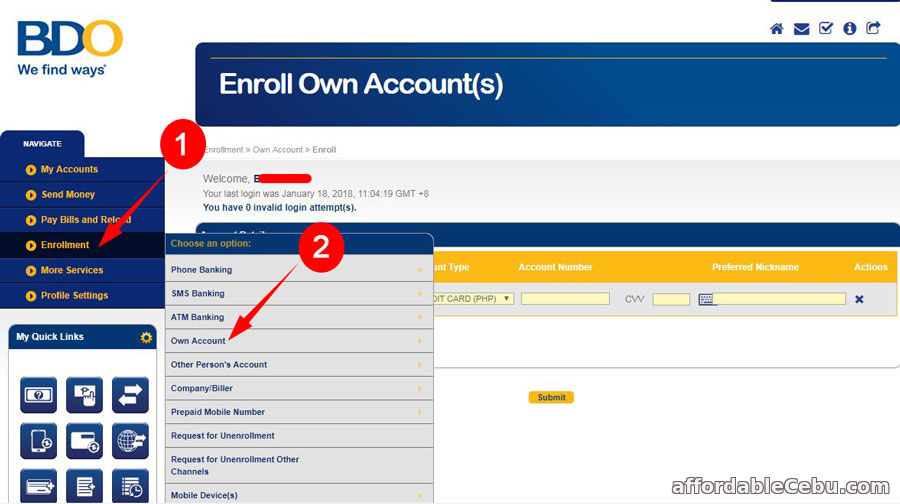

Enroll Bdo Online Banking: Your Step-by-Step Guide to Effortless Digital Banking

The Hidden World Behind Remy’s Legacy: Emile, Cheese, and the Epcot Experience