IPpay Minimum Wage Hike in 2025: Your Essential Guide to What’s Changing and What It Means for Businesses and Workers

IPpay Minimum Wage Hike in 2025: Your Essential Guide to What’s Changing and What It Means for Businesses and Workers

The year 2025 marks a pivotal moment for labor policy in the U.S., as major supermarket chains, including IPpay partners, prepare to implement mandated minimum wage increases. Effective January 2025, IPpay-subsidized businesses across key markets must raise hourly wages, adjusting annual payrolls and reshaping worker compensation at scale. This change, driven by state-level wage reform efforts, affects not only frontline employees but also operational costs, staffing strategies, and competitive dynamics in retail.

For employers and employees alike, understanding the rules, eligibility thresholds, and broader economic ripple effects is essential.

IPpay’s minimum wage hike in 2025 is part of a coordinated push by several states to elevate low-income workers’ earnings, with the federal benchmark currently at $7.25 per hour. While that national rate has remained unchanged for over a decade, state and regional mandates now surpass it significantly—reaching as high as $15.50 in jurisdictions like California, Washington, and New York.

IPpay, which supports merchant transactions across these high-minimum-wage regions, is aligning its network payrolls to comply, reflecting a growing trend where payment platforms become key enforcers of wage policy.

The Policy Shift: What’s Driving the 2025 Minimum Wage Increase

The push for higher minimum wages stems from long-standing concerns about wage stagnation, cost-of-living pressures, and income inequality. Between 2010 and 2020, real wages for low-wage workers grew by less than 2% nationally, according to Economic Policy Institute data—far outpaced inflation and rising housing and healthcare costs. In response, cities and states taking the lead, often in the absence of uniform federal changes, have enacted aggressive wage hikes, with retail—characterized by high proportions of hourly and entry-level roles—emerging as a primary focus.Key Drivers: - Persistent wage stagnation: Real earnings for frontline workers have eroded despite decades of growth in productivity. - Political momentum: Public sentiment increasingly supports fair pay for essential service workers; state legislatures are acting accordingly. - Economic urgency: Rising poverty and housing costs in urban centers compel local action.

- Corporate accountability: Retailers and payment networks like IPpay are embracing higher wages as part of broader social responsibility goals. “In 2025, we’re not just raising wages—we’re helping rebuild economic dignity for millions of workers who’ve been left behind by decades of progress,” noted Emily Torres, labor analyst at the National Retail Labor Coalition.

For IPpay-affiliated employers—ranging from regional grocery chains to specialty food retailers—the 2025 wage floor rise introduces a multi-faceted challenge: recalibrating payrolls, training staff on new thresholds, and adjusting scheduling and bonus structures without compromising service quality.

Unlike federal mandates, minimum wage increases here vary not only by city but by county and even by sector, requiring precise mapping of wage tiers.

Key Specifics of the 2025 IPpay Minimum Wage Rollout The 2025 IPpay minimum wage adjustment does not apply as a single national standard. Instead, it follows a granular, region-specific rollout designed to reflect local economic realities: - **Effective date:** January 1, 2025 - **Base increase:** Most covered states mandate a minimum hourly rate between $13.00 and $15.50, with hourly workers earning above $10.00 required to see a jump. - **Tiered thresholds:** Different rates apply in urban cores (e.g., $15.50 in San Francisco, $14.75 in Seattle) versus suburban or rural zones (ranging from $12.00 to $13.50).

- **Employee classification:** The rule extends to full- and part-time hourly workers, including seasonal staff and shift-based laborers common in retail. - **Overtime implications:** For employees earning near the new threshold, overtime eligibility becomes more critical, with pay rates typically bumping up at faster hourly increments under the updated wage ladder.

For instance, a grocery checkout clerk in Denver earning $11.50 annually under the prior rate now faces a $13.25 baseline for 2025, an increase comparable to a 15% raise when adjusted for inflation.

In contrast, a store associate in a lower-cost Midwestern town may transition from a $12.50 to $14.00 hourly minimum, reflecting regional affordability differences.

The Ripple Effects on Businesses and Workers For employers supported by IPpay, the minimum wage hike introduces transformative pressures and opportunities. On one side, labor costs are increasing—estimates suggest a 5–10% uptick in hourly payroll expenses across covered sectors. Yet, this shift carries long-term benefits: reduced employee turnover, enhanced morale, improved retention, and stronger public image in communities valuing fair wages.

Business Adaptation Strategies: - **Packaging compensation packages:** Employers are balancing raises with non-wage supports—flexible scheduling, transit subsidies, and skill-building programs. - **Technology integration:** IPpay’s platform now emphasizes automated payroll tracking, real-time wage verification, and compliance alerts to reduce administrative strain. - **Workforce planning:** Predictive analytics help forecast hiring needs and labor budgeting amid rising wage floors, particularly during peak retail seasons.

Workers, meanwhile, stand to gain significantly. Monthly take-home pay for eligible employees will rise steadily: a full-time worker earning full-time hours could see income jump from roughly $26,000 to $32,000 annually, improving household financial stability. However, analysts caution that wage gains alone cannot offset systemic costs unless paired with living wage benchmarks and broader labor protections.

IPpay emphasizes that its role extends beyond processing transactions—it’s now a partner in shaping equitable workplaces. “We’re helping bridge compliance with compassion,” stated a company spokesperson. “Technology meets human impact to ensure no worker is left at the mercy of stagnant wages.”

Looking Ahead: Implications for 2025 and Beyond The 2025 IPpay minimum wage hike signals a turning point in how retail wage policy evolves across the U.S.

It sets a precedent for tech-enabled retail networks to proactively support living wage standards, even where laws lag. Beyond immediate paychecks, the change underscores growing recognition that fair compensation is foundational to sustainable business and thriving communities. Industry forecasts suggest similar regional wage increases will follow, creating a patchwork of pay floors requiring nuanced compliance.

For IPpay and its merchant clients, adaptability, transparency, and investment in workforce solutions will define success in this new era. Ultimately, the 2025 mantle of elevated pay—driven by policy, platforms, and public demand—offers a clearer path toward economic fairness for hundreds of thousands of essential retail workers. How advanced wage-tracking tools are reshaping retail employment in 2025

Related Post

Unlocking the Future: How Kindle Online Reshapes Reading in the Digital Age

Hill Harper And Melody Holt: Shaping the Modern Voice of Thought and Influence

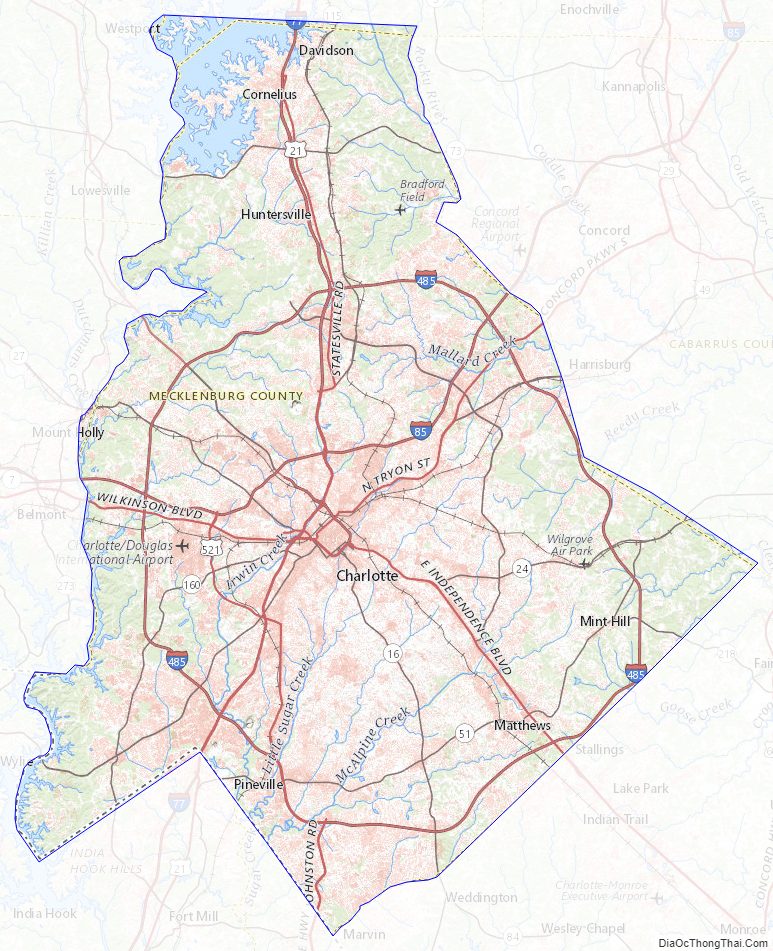

North Carolina Mugshots in Mecklenburg County: Gripping Glimpses Behind the Lens