Indonesian Students at the Crossroads: Why Financial Literacy & Economic Education Are Crucial for Future Prosperity

Indonesian Students at the Crossroads: Why Financial Literacy & Economic Education Are Crucial for Future Prosperity

In a nation of over 200 million people, where youth make up more than 60% of the population, the preparedness of Indonesian students for real-world economic challenges hinges on the quality of financial literacy and economic education provided in schools. As digital finance grows and traditional jobs transform, equipping students with the knowledge to manage money, understand markets, and navigate economic systems isn’t just beneficial—it’s essential. Without deliberate action, a generation risks entering adulthood unprepared, potentially deepening inequality and hindering national development.

Emerging research and local initiatives confirm that strengthening financial education in Indonesian schools is not an extra-curricular luxury, but a strategic imperative for both individual success and collective economic resilience.

The Ticking Need: Why Financial Literacy Lags Across Indonesian Schools

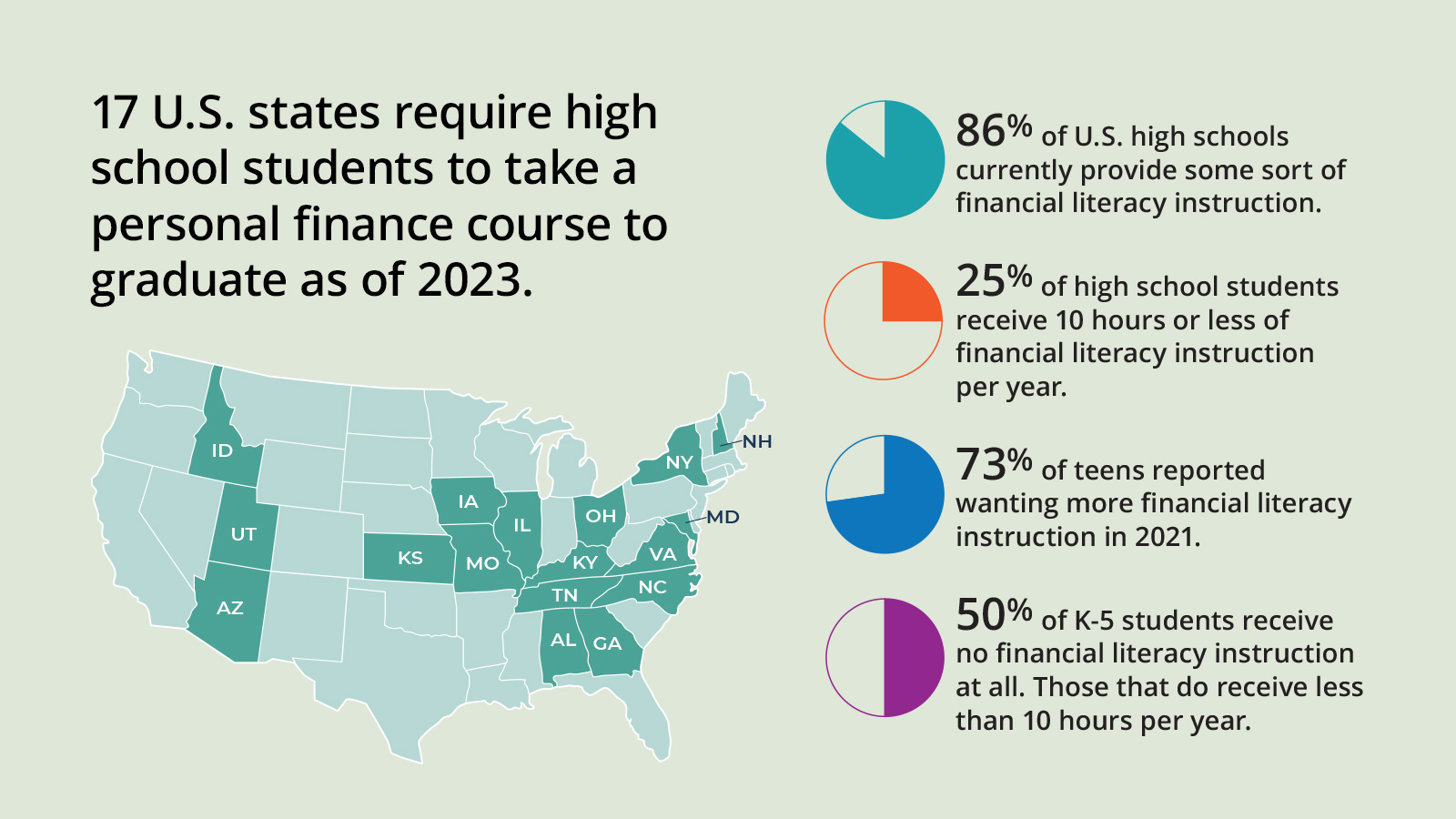

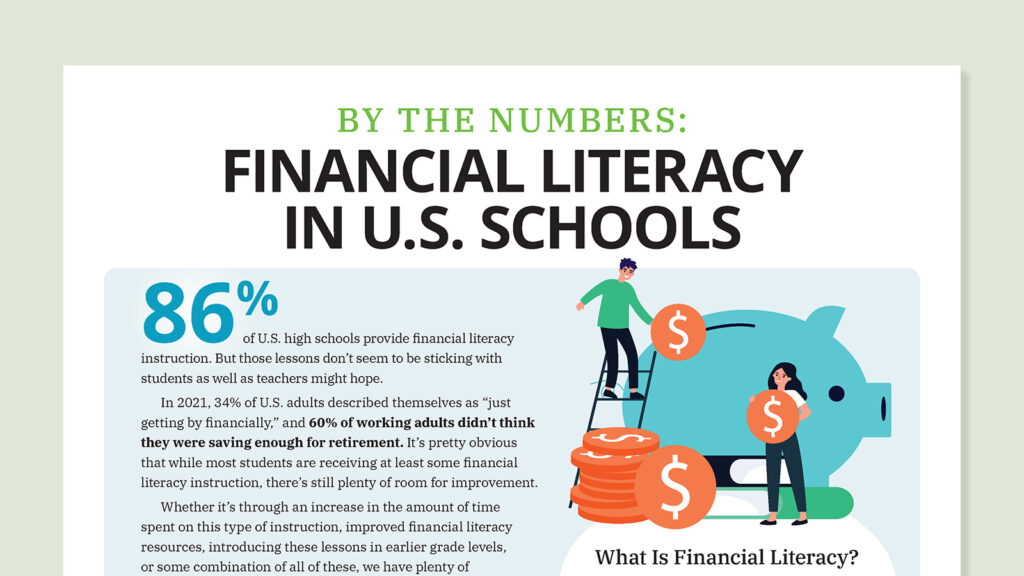

Despite Indonesia’s growing digital economy and increasing integration into global markets, financial literacy remains alarmingly underdeveloped in most public and private classrooms. A 2023 report by the Financial Services Authority (OJK) revealed that fewer than 30% of high schools deliver sustained, age-appropriate financial education, with many students finishing secondary school unable to read a bank statement, understand interest rates, or distinguish between sound financial advice and scams. This gap is especially pronounced in rural areas, where access to supplementary financial knowledge is limited.

This deficiency creates real-world consequences: a 2022 survey by Universitas Indonesia found that 58% of recent graduates lacked basic budgeting skills, while 42% admitted to making impulsive purchase decisions without understanding credit terms. Such vulnerabilities leave students exposed to debt traps and financial exploitation—issues previously confined to older, more experienced demographics are now infiltrating youth wallets. Economically, this translates into reduced household savings, lower creditworthiness, and slower personal wealth accumulation, all of which ripple through national economic growth.

Building Blocks: What Modern Financial Education Should Include

To bridge this gap, Indonesian schools must shift from rote memorization to dynamic, practical learning models.

Experts emphasize a curriculum that integrates real-life scenarios, technology, and interdisciplinary connections. Key components include:

- Foundational Financial Skills: Budgeting, saving, banking concepts, and understanding currency. These basics form the cognitive toolkit students need to manage daily expenses and avoid debt.

- Investment & Risk Management: Exposure to stock markets, bonds, and risk diversification helps students appreciate long-term wealth building.

Tailored modules—such as simulating portfolio decisions—enable hands-on decision-making in controlled environments.

- Digital Finance Literacy: With mobile banking rising rapidly—over 70% of Indonesians now use e-money—understanding apps, cyber threats, and digital payment security is non-negotiable.

- Entrepreneurship & Income Generation: Teaching students how to start small ventures, assess feasibility, and manage cash flow fosters innovation and resilience, particularly in underserved communities.

- Ethics & Consumer Awareness: Critical evaluation of advertising, recognition of predatory lending, and awareness of financial rights protect students from exploitation.

Programs piloted in West Java schools demonstrate success: introducing a semester-long “Finance in Action” module boosted student confidence in budgeting by 63% and credit-related knowledge by 49%, according to teacher evaluations.

Success Stories: Innovations Shaping Economic Education in Indonesia

Across the archipelago, forward-thinking institutions are redefining financial education. In Jakarta, a joint initiative between local universities and fintech startups launched *“Mata Uang Membawa”* (Money Moves), a gamified e-learning platform combining quizzes, real-time budget simulations, and peer challenges. Over 15,000 students have engaged with the tool, reporting improved understanding of compound interest and credit scores.

In rural East Nusa Tenggara, community-based financial clubs—supported by microfinance organizations—train students not only in basic finance but also in micro-savings and cooperative lending, directly linking classroom knowledge to rural development. Teachers note that these clubs have reduced impulsive spending and increased family savings rates by up to 30% in participating communities.

National efforts also gain momentum: the Ministry of Education announced a revised national competency framework integrating financial literacy across math, social studies, and life skills courses, aiming for universal coverage by 2030.

Barriers to Progress: Challengein the System

Despite these advancements, significant obstacles persist.

Teacher preparedness remains a critical bottleneck—only 38% of educators receive formal training in financial concepts, limiting effective instruction. Many schools lack digital infrastructure, making tech-enabled learning nearly inaccessible in remote regions.

Cultural attitudes further complicate progress: in some regions, money remains a taboo topic, discouraging open classroom discussions.

Time constraints in increasingly packed curricula often relegate financial topics to minimal coverage, if included at all. Without coordinated policy support, equitable resource allocation, and sustained teacher training, scaling quality financial education will remain elusive.

The Path Forward: Empowering Indonesian Youth for Economic Agency

For Indonesian students to thrive in a rapidly evolving economy, financial literacy and economic education must transition from optional electives to mandatory, structured components of every student’s academic journey. The benefits extend beyond individual empowerment—they fuel broader economic stability, reduce inequality, and cultivate a generation of informed consumers, savers, and innovators capable of driving sustainable growth.

Governments, educators, and private sector partners must collaborate to scale evidence-based programs, invest in teacher development, and leverage digital tools to reach every corner of the country. Indonesia’s future prosperity depends not only on its macroeconomic policies but on ensuring that every student enters adulthood equipped not just with degrees, but with the financial wisdom to build meaningful, secure lives. In this vision, economic education is not a side note—it is the foundation of national resilience.

Related Post

Unveiling The Mystery Of The Black Dress Girl In The Viral Car Video That Swept Twitter

Climbing Arrows: The Unsung Language of Mountain Routes and Spatial Awareness

The Hidden Power of Instagram Not Logged In: Unlocking Engagement Without Authentication

Indiana University Graduation 2022: A Capitol of Achievement and Innovation