IcicinetBanking: Revolutionizing Corporate Finance with Real-Time, Secure Banking Intelligence

IcicinetBanking: Revolutionizing Corporate Finance with Real-Time, Secure Banking Intelligence

In a digital economy where milliseconds determine profitability and data integrity is non-negotiable, Icicinetbanking emerges as a pioneering force redefining corporate treasury operations. This integrated banking intelligence platform drives efficiency, security, and insight across financial workflows—transforming how enterprise finance teams manage liquidity, payments, and risk. By merging real-time transaction analytics with intelligent automation, Icicinetbanking equips organizations with actionable intelligence that turns raw banking data into strategic advantage.

At the core of Icicinetbanking’s value proposition lies its seamless integration with enterprise resource planning (ERP) systems and core banking networks. Unlike traditional banking solutions, which often operate in silos, Icicinetbanking functions as a centralized nerve center, aggregating and analyzing financial data from multiple sources with precision. This integration enables a holistic view of cash flows, account balances, and transaction patterns across global operations—critical for multinational corporations navigating complex financial landscapes.

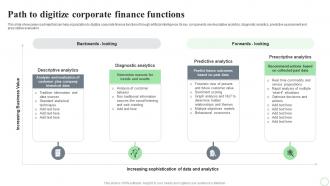

Turning Raw Data into Strategic Insight

Icicinetbanking leverages advanced analytics and machine learning to parse petabytes of transactional data, identifying trends, anomalies, and opportunities invisible to manual review.For instance, the platform detects irregular spending patterns across departments, flags suspicious transfers, and forecasts shortfalls before they impact operations. “We moved from reactive reporting to proactive financial management,” says a senior treasury manager at a Fortune 500 logistics firm. “Icicinetbanking provides not just transaction history, but predictive insights that shape our liquidity strategy.”

Key capabilities include: - Real-time cash visibility across all accounts, including correspondent and foreign currency holdings - Automated reconciliation engines that reduce processing time by up to 70% - Customizable dashboards tailored to executive, controller, and cash management needs - Enhanced fraud detection through behavioral analytics and AI-driven alerts These functions collectively reduce operational risk while sharpening decision-making precision—particularly vital in volatile markets where timely liquidity management can mean the difference between resilience and disruption.

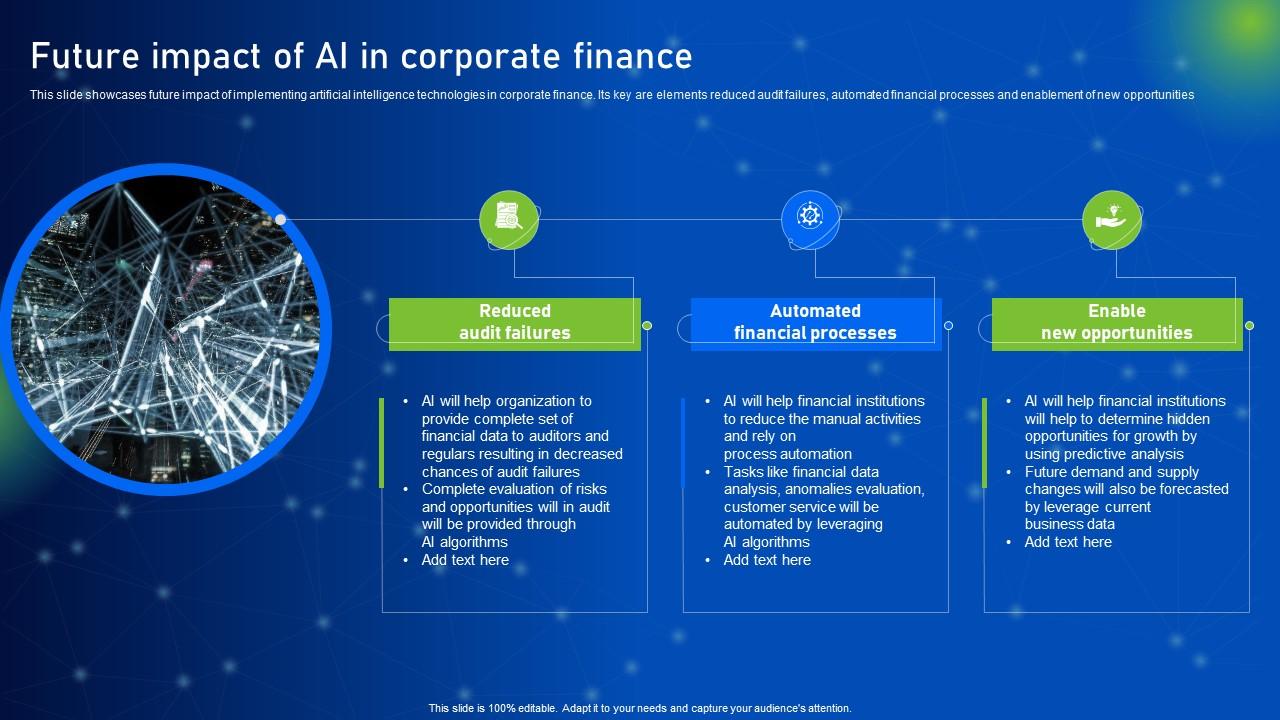

Driving Efficiency Through Intelligent Automation

One of Icicinetbanking’s standout attributes is its ability to automate repetitive, high-volume banking tasks. From schedule creation and payment initiation to reconciliation and reporting, thousands of manual steps are streamlined through intelligent workflows. This automation frees finance teams to focus on strategic analysis rather than data entry or crisis resolution.For example, when a supplier invoice arrives, Icicinetbanking automatically matches it against purchase orders and delivery receipts, validates conditions, and triggers payment—all without human intervention. “Before Icicinetbanking, we spent entire days resolving payment discrepancies,” notes a finance director from a manufacturing conglomerate. “Now, those errors are flagged in seconds, and payments execute in minutes—cutting months of backlog into days.”

Automation extends to compliance as well.

The platform enforces internal controls and regulatory requirements in real time, generating audit trails and segregation-of-duty checks automatically. This reduces the risk of fraud, errors, and non-compliance—critical in an era of tightening financial regulations and heightened scrutiny.

Securing a Modern Banking Frontier

In banking, security is not optional—it’s foundational.Icicinetbanking addresses cyber and financial threats head-on by combining end-to-end encryption, role-based access controls, and continuous monitoring. Every transaction and data access is logged and auditable, providing an immutable record that protects sensitive financial information and supports strict compliance frameworks like GDPR and SOX.

The platform also deploys behavioral biometrics and anomaly detection to safeguard against compromised credentials.

Unexpected login attempts, unusual transaction volumes, or deviations from standard spending behavior trigger immediate alerts and lockdown protocols. “We’ve reduced successful phishing attempts by over 90% since implementing Icicinetbanking,” reports a global payments manager. “Our finance team trusts the system as their first line of defense.”

Moreover, Icicinetbanking integrates with enterprise security ecosystems, ensuring that banking data remains protected even as organizations scale across cloud environments and digital platforms.

Transforming Treasury Strategy Across Geographies

Multinational enterprises face unique challenges: fluctuating exchange rates, cross-border payment delays, divergent regulatory landscapes, and divergent banking infrastructures. Icicinetbanking dissolves these barriers by delivering a unified, localized approach to global treasury management.For multinational manufacturers, the platform enables real-time transfer pricing analysis across subsidiaries, optimizing tax efficiency.

In emerging markets, it supports multi-currency liquidity monitoring, minimizing FX exposure risks. Real-time settlement capabilities across diverse banking networks reduce dependency on delays, improving working capital efficiency.

Consider a global consumer goods company operating in 15 countries.

Prior to Icicinetbanking, managing cash positions was a fragmented, reactive process burdened by local banking differences. Post-implementation, finance leaders access a single source of truth: synchronized accounts, automated FX management, and integrated liquidity forecasts. “We reduced cross-border payment processing time from days to hours,” says CFO of a leading conglomerate.

“What once required a dedicated team now runs on integrated systems with minimal oversight—freeing our talent to drive growth.”

The platform’s global network—powered by partnerships with major financial institutions—ensures seamless connectivity across corridors, from Asia’s digital payment corridors to Europe’s real-time gross settlement systems.

Beyond Banking: Integrating Financial Ecosystems

Icicinetbanking is not merely a banking tool—it’s a financial ecosystem enabler. Its design supports integration with ERP systems like SAP S/4HANA, Oracle, and Microsoft Dynamics, allowing finance teams to unify accounting, reporting, and treasury functions.This integration eliminates data silos and fosters cross

Related Post

Master Math Solving with Dash Mathplayground: Real-Time Insights That Transform Problem-Solving

Master Your Tundra: The Complete Oil Change Step-by-Step Guide for Maximum Performance

Suriya Sethupathi Age: A Deep Dive Into the Life and Career of a Tamil Cinema’s Defining Star

Ray Llewis: The Formulaic Architect Behind Modern Energy Risk Modeling