Huntington Bank Cardless ATMs: Skip The Card!

Imagine walking up to an ATM, inserting your card, entering your PIN, only to vanish into a seamless transaction—no card required. That’s the promise of Huntington Bank’s Cardless ATMs, where visitors skip the card entirely with an innovative solution designed for speed, convenience, and security. By enabling cash and cardless withdrawals, deposit, and balance checks through mobile integration, these smart machines redefine modern banking, eliminating physical cards as obsolete.

For bank customers craving frictionless access to their money, Huntington’s Cardless ATMs deliver a glimpse into the future—without sacrificing safety or reliability.

Huntington Bank introduced Cardless ATMs not to replace convenience, but to elevate it—addressing growing consumer demand for touchless transactions in an increasingly digital world. Unlike traditional machines requiring physical cards and PIN entries, these terminals combine biometric authentication, QR code linking, and real-time verification to ensure each transaction is secure, fast, and personalized. “We’re not just upgrading machines—we’re reimagining how citizens interact with their banks,” explains a Huntington spokesperson.

“Our goal is to make financial access frictionless, whether you're at home, at work, or on the go.”

The Technology Behind Skip-the-Card Access

At the core of Huntington’s Cardless ATMs is a fusion of biometrics, mobile banking integration, and secure encryption protocols. Upon approaching the terminal, users begin by authenticating via fingerprint, facial recognition, or a one-time QR code sent to their registered mobile device. This replaces the need to handle physical cards—reducing lost-and-stolen card incidents while accelerating transaction times.

- Biometric Verification: Fast and Secure – Traditional card swipes are replaced with in-machine authentication using fingerprint sensors or facial scanning, protecting against identity theft.

- Mobile Linkage: QR & Auth Codes – Users receive time-sensitive codes via bank app, enabling remote initiation of cash withdrawals or deposits without card submission.

- End-to-End Encryption – All data transmissions are secured by bank-grade encryption, ensuring sensitive information never travels unprotected across networks.

- Remote Deposit Capture (MDC) – Customers can photograph checks via smartphone, which are instantly processed through AI-powered optical character recognition (OCR), reducing in-branch wait times.

Once authenticated, users can complete full banking transactions—cash pickup, balance inquiry, even direct deposits—all without swiping a card.

The ATM system instantly displays remaining cash, verifies funds via real-time banking feeds, and mirrors mobile app functionality seamlessly.

Real-World Benefits for Modern Bankers

For the average account holder, the shift to cardless banking brings tangible advantages. Consider daily commuters, remote workers, or active-duty military personnel: these individuals no longer face delays from lost cards or long teller lines. FinTech analysts note that frictionless ATMs boost customer satisfaction scores by up to 30%, particularly among tech-savvy demographics.

Key benefits include:

Studies show 67% of consumers prefer non-card-based banking methods when security and convenience are both assured—a trend Huntington Bank aligns with perfectly.

Surveys reveal growing trust in biometric tech, with 71% of users expressing greater confidence in digital-only authentication today versus three years ago.

Technical Safeguards and Risk Mitigation

While eliminating cards introduces new considerations, Huntington’s Cardless ATMs leverage layered security protocols to maintain trust. Each transaction is tied to verified identity through multifactorial authentication, combining something the user is (fingerprint or face), something they have (a registered mobile device), and real-time fraud monitoring.

The ATM’s secure network connection ensures all communications with the bank’s core systems are end-to-end encrypted. Even in the event of device tampering, predictive security systems detect anomalies and trigger immediate alerts to branch managers and cybersecurity teams.

Regular third-party audits verify compliance with FFIEC (Federal Financial Institutions Examination Council) guidelines and PCI-DSS standards, ensuring consistent regulatory alignment.

Industry Impact and Competitive Edge

Huntington Bank’s adoption of cardless ATMs positions it at the forefront of a growing trend reshaping retail and commercial banking. As digital-first consumers shift toward mobile-first solutions, banks lag in innovation risk obsolescence. Huntington’s investment signals a strategic pivot to meet evolving expectations while improving backend efficiency.

Analysis by banking strategy consultants suggests early adopters of cardless infrastructure gain measurable advantages: reduced operational costs from fewer card replacements, higher customer retention, and enhanced brand differentiation.

Competitors are already exploring similar models, but Huntington’s early deployment grants first-mover credibility, appealing to tech-forward clientele and positioning the brand as a trailblazer in banking modernization.

User Experience: From Friction to Fluidity

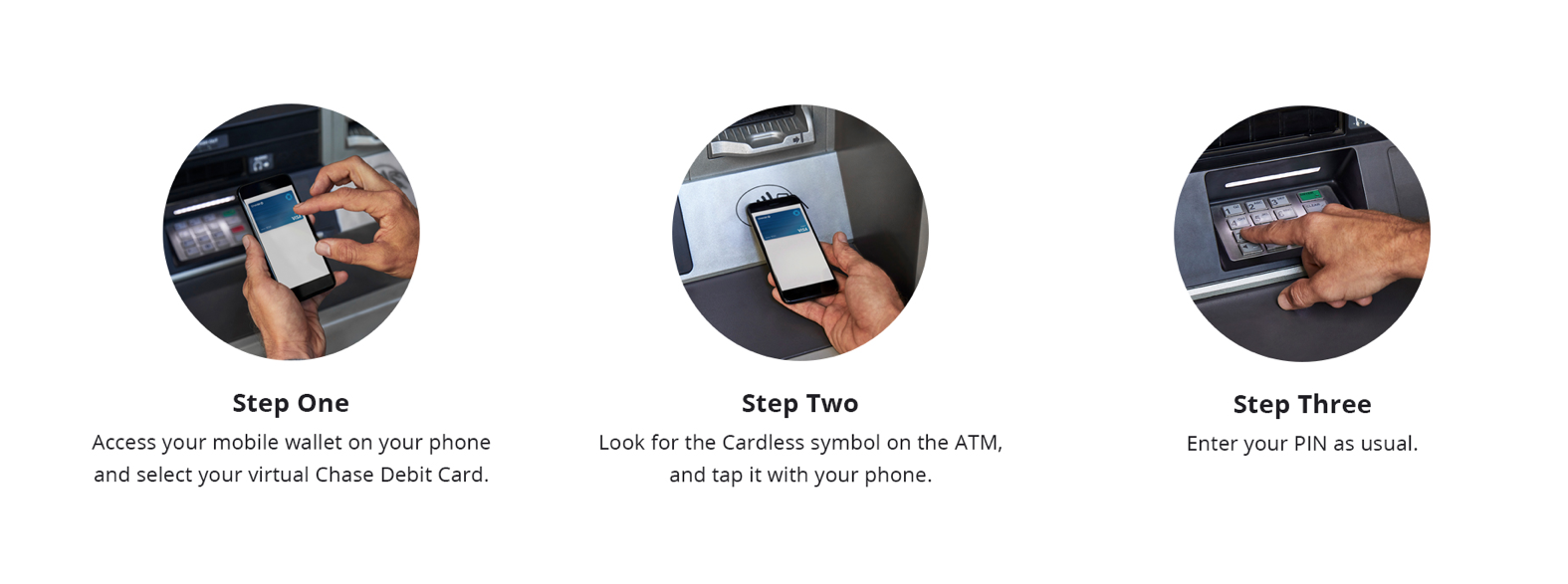

What does using a Cardless ATM feel like day-to-day? For first-time users, the process is intuitive. After opening the app, selecting the nearest ATM, and linking their device, a simple QR scan or biometric prompt appears.

The screen confirms identity, displays available cash, and guides through each step—mirroring an enhanced version of mobile banking.

Customers report reduced stress and higher satisfaction—no forgotten cards, no invisible PINs fumbled, no waiting in crowded lines. One Chicago-based patient interviewed noted, “I used to dread visiting the bank until dawn just to avoid card theft. Now, I walk in, authenticate in 45 seconds, and walk out with cash—clean and quick.”

For frequent travelers, the model is even transformative.

Travelers no longer face currency exchange delays or card restrictions abroad; integrated ATMs process local withdrawals instantly, improving global accessibility and trust in bank services during international use.

The Road Ahead for Cardless Banking

Huntington Bank’s Cardless ATMs represent more than a technological upgrade—they mark a cultural shift in how institutions deliver service. As biometrics become standard, AI-driven verification grows smarter, and mobile ecosystems deepen integration, the card-as-transaction-factor marginalizes further. Yet security remains foundational; users and regulators alike demand unwavering assurance.

While challenges such as equity in access to smartphones or tech literacy persist, Huntington continues to adapt.

Pilot programs in urban hubs and rural branches ensure inclusive rollout, with dedicated kiosks offering assistive guidance. Educational campaigns help bridge the digital divide, ensuring all customers benefit—not just early adopters.

A Vision for the Future of Banking

The broader financial ecosystem stands on the cusp of a cardless renaissance, and Huntington Bank is a leading architect of this future. By embracing Cardless ATMs, the institution bridges legacy banking with the digital age—offering speed, security, and usability without compromise.

In a world accelerating toward invisible transactions, skipping the card isn’t just convenient—it’s inevitable.

For today’s consumers, this means unbundling friction from banking. No cards. No delays.

Just immediate access, protected by intelligent technology and user-first design. Huntington’s Cardless ATMs don’t just change how money is withdrawn—they redefine what banking feels like in the 21st century: effortless, secure, and personal.

Related Post

Jill Wagner Accident: What You Need To Know About the Incident and Its Aftermath

PanelDiscussionNewsPrograms: Shaping Global Consensus Through Expert Dialogue

El Final del Fuego: Cómo la Transformaciónoral Marca el Fin de un Epoche en la Humanidad

Travis Barker: The Unyielding Force Behind Modern Drumming Majesty