From £349 to Us Dollars: The Precise GBP to USD Exchange at Today’s Forex Rates

From £349 to Us Dollars: The Precise GBP to USD Exchange at Today’s Forex Rates

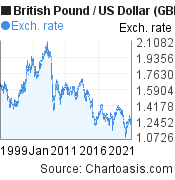

Today’s global forex market reveals a straightforward yet critical exchange: converting 349 British pounds to U.S. dollars hinges on the fluctuating GBP to USD rate—currently standing at 1.2715, though subject to minute daily swings. This value determines how far 349 GBP stretches across American banks, online services, and international transactions.

Understanding this conversion is essential for travelers, expats, and traders navigating currency exchange with precision. The present exchange rate—set at 349 GBP equaling approximately $444.00 USD—reflects real-time market dynamics driven by economic indicators, central bank policies, and geopolitical events. For instance, the U.S.

Federal Reserve’s monetary decisions and UK inflation data directly influence the pound’s strength against the dollar. Market participants monitor these shifts closely, as even a 0.1% change can affect the purchasing power of a 349-pound sum across borders.

The Mechanics of GBP to USD Conversion: What Drives the Rate?

The conversion from British pounds to U.S.dollars is governed by supply and demand, fundamental economic principles, and the interplay of macroeconomic forces. At its core, the USD functions as the world’s primary reserve currency, underpinning global trade and finance, which reinforces its status and stability relative to other currencies. Key factors shaping the GBP/USD exchange include: - **Interest Rate Differentials**: Higher yields in the U.S.

financial markets tend to attract foreign capital, strengthening the dollar. When the Federal Reserve raises rates, USD typically appreciates against weaker currencies like the pound. Conversely, UK central bank policies influence GBP strength.

- **Economic Indicators**: GDP growth, employment figures, inflation, and trade balances deliver critical insights into each nation’s economic health. Stronger-than-expected British data can boost pound demand, while U.S. expansions often strengthen the dollar.

- **Geopolitical Risk**: Events such as elections, Brexit-related uncertainty, or international sanctions create volatility. During times of uncertainty, investors may flock to the dollar as a safe haven, altering exchange rates decisively. - **Market Sentiment and Speculation**: Currency traders respond to news, trends, and technical analysis, often amplifying short-term fluctuations.

Even minor shifts in sentiment can trigger meaningful movements in GBP to USD rates. Quoting a top forex strategist, “GBP/USD is far from static—its value dances across a dynamic landscape shaped by real economic forces and psychological market behavior,” highlighting that predictable trends require constant monitoring.

How to Calculate £349 into USD: A Step-by-Step Example Converting 349 GBP to USD begins with applying today’s spot rate—currently 1 GBP = 1.2715 USD.

Applying this rate yields: 349 × 1.2715 = $444.12 This precise calculation reveals that £349 converts to $444.12 at prevailing market rates. However, actual transaction values depend on the exchange provider, fees, and whether conversion is bought or sold at mid-market versus retail spreads. Most banks and financial institutions offer exchange rates some currency points below the spot value to cover service costs—a spread often ranging from 0.5% to 2%.

Online platforms and currency exchange services might fournissely smaller gaps, particularly in certain regions. Despite these variations, digital tools and real-time rate APIs allow users to compare transaction costs and lock in the most favorable rates. Technological advances now enable instant conversions via mobile apps, financial platforms, and electronic systems, reducing delays and increasing transparency.

For example, apps like Revolut or Wise provide real-time GBP to USD conversion with embedded fee breakdowns, empowering users to make informed, cost-effective decisions.

Strategic Considerations for Managing GBP USD Exchange

For individuals and businesses moving funds across the Atlantic, timing and platform selection are crucial. The GBP/USD rate fluctuates hourly—sometimes just within minutes—making it wise to monitor markets around key economic announcements, such as Federal Open Market Committee meetings or BOE interest rate decisions.Technical traders often use charts and indicators to identify short-term patterns or trends, allowing for calculated trades or conversions. Yet retail users should prioritize transparency: checking for hidden fees, evaluating fixed vs. floating rates, and understanding whether the rate offers mid-market parity or dealer spread.

- **Spread Awareness**: Retail exchange services commonly apply a spread, meaning the buy-sell gap widens the effective cost. Mid-market rates “just under” 1.2715 typically reflect true market value. - **Fees and Commission**: Banks may charge fees, especially for large transactions or cash pickups.

Comparing total net cost—rate minus fee—is essential. - **Currency Risk Mitigation**: For recurring international payments, consider forward contracts or hedging instruments to fix rates and reduce exposure to swings. - **Timing Matters**: Daily volatility increases mid-month around U.S.

and UK economic calendar events. Delaying conversion until after major data releases can capture more favorable rates. Experts emphasize that disciplined financial behavior—matching transaction goals with market awareness—enhances value capture.

“Users who combine real-time data, fee analysis, and strategic timing maximize returns from every pound sent,” notes a senior currency analyst.

In practice, converting 349 GBP to USD means navigating a fluid, data-driven exchange environment shaped by economics, policy, and global sentiment. While £349 reliably converts to approximately $444.12 at current rates, the actual amount depends on provider terms, spreads, and transaction timing.

By understanding key drivers, leveraging transparent platforms, and applying disciplined planning, individuals and businesses can efficiently manage international currency flows with confidence and precision.

Related Post

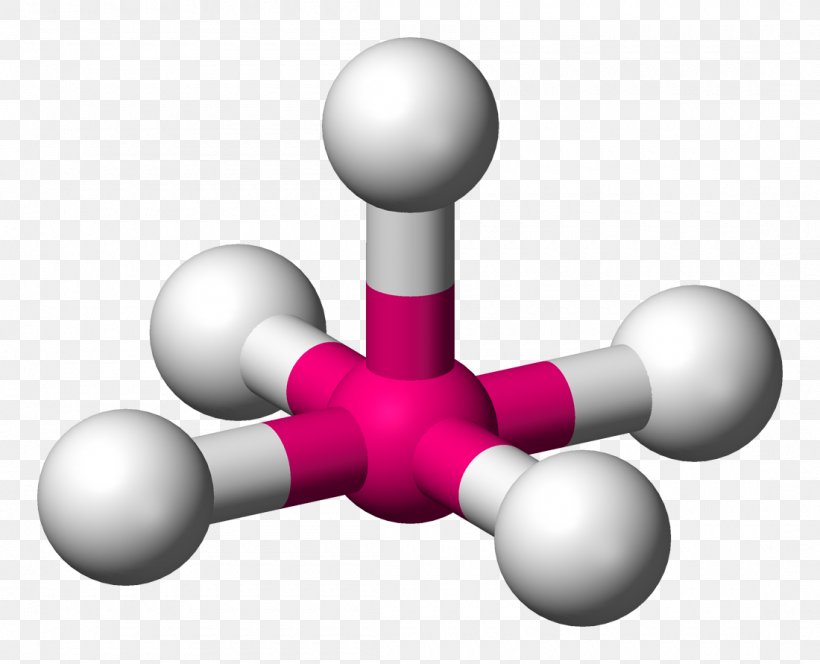

Trigonal Pyramidal Geometry: The Hidden Architecture Behind Molecular Precision

Peter Griffin’s Skin Exposed: Why the Mascot Spooked Fortnite Fans and What It Reveals About Game Culture

Plumpy Mage Eva: From Code to Cult Phenomenon in the Digital Realm

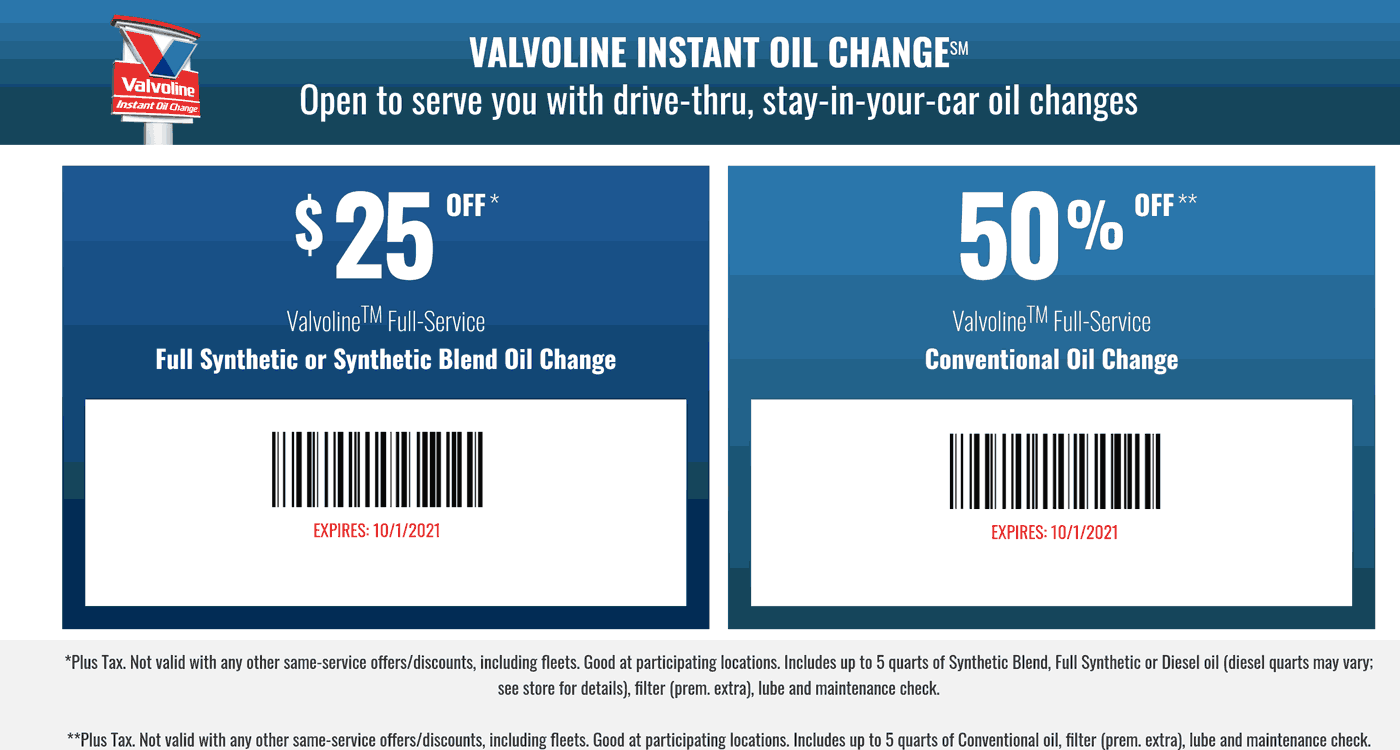

Valvoline’s $25 Off Oil Change Coupon: Your Car’s Maintenance Just Got a Serious Budget Boost