Freetaxusa2021 Reveals the Real Face of U.S. Taxation: A Data-Driven Snapshot of a Nation’s Fiscal Reality

Freetaxusa2021 Reveals the Real Face of U.S. Taxation: A Data-Driven Snapshot of a Nation’s Fiscal Reality

The Freetaxusa2021 dataset delivers a dragon’s-eye view of the U.S. tax system in 2021, exposing widening income disparities, shifting compliance patterns, and evolving behavioral responses to fiscal policy. Drawing from comprehensive IRS-level analytics and publicly available economic indicators, this comprehensive analysis unpacks how taxation intersected with economic life during a year of unprecedented fiscal stimulus and societal disruption.

The numbers tell a story far more complex than headline debates—revealing not just who pays taxes, but how distributional impacts, enforcement reach, and taxpayer sentiment shaped the fiscal landscape. ### Who Cares About Taxes? Demographics Behind Freetaxusa2021 Data Freetaxusa2021 breaks down taxpayer behavior by income tier, age, and employment status with unprecedented granularity.

For the first time in accessible form, the dataset illuminates how tax obligations and benefits diverged across the economic spectrum. - **High-Income Earners** accounted for nearly 40% of total federal income tax collections, despite representing just 15% of the U.S. adult population.

Their effective tax rates often exceeded 20% on capital gains and investment income—far above the progressive brackets many assume. As Freetaxusa2021 data reveals, this segment leveraged sophisticated tax planning, including retirement account optimization and offshore structuring, which compressed overall tax burdens relative to nominal rates. - **Middle-Income Households**, the backbone of consumer-driven growth, bore a heavier relative burden.

Freetaxusa2021 confirms their effective rates hovered between 12% and 16%, constrained by rising healthcare costs, student debt, and stagnant wage growth. Yet this group showed increased voluntary compliance and filing accuracy compared to prior downturns, suggesting growing tax literacy. - **Lower-Income Taxpayers**—particularly those below the poverty line—underwrote the data’s most compelling narrative: nearly 60% relied on refundable credits such as the Earned Income Tax Credit (EITC) and Child Tax Credit.

Freetaxusa2021 quantifies how these refunds functioned not just as subsidies, but as economic stabilizers, injecting over $75 billion collectively into low-income communities during 2021. Without these overlapping mechanisms, the impact of pandemic-era relief would have been drastically muted. - **Self-Employed and Gig Workers** experienced a transformative shift in reporting behavior.

The dataset shows a 27% surge in accurate quarterly filings after platform-based tax preparation tools integrated with tax authority systems—prompted by both enforcement pressure and user demand for simplification. “Freetaxusa2021 paints a picture where tax compliance is no longer a passive obligation but an active, tech-mediated process,” noted Dr. Elena Marquez, a tax policy researcher at the Brookings Institution.

“The rise of digital self-service has altered the relationship between filers and the government—faster, more transparent, but still riddled with inequities.” ### The Hidden Costs of Tax Policy: Enforcement, Evasion, and Behavioral Responses Beyond individual filings, Freetaxusa2021 quantifies critical enforcement trends. While overall tax collection rose by 8% year-over-year—driven largely by capital gains and corporate distortions—tax gap estimates climbed to approximately $600 billion annually. This persistent shortfall stems from a mix of underreporting, timing mismatches in income recognition, and enforcement gaps.

- **Capital Gains and Income Shifting**: High-income filers increasingly deferred tax liabilities through structured asset sales and charitable deduction strategies. The dataset highlights a 19% increase in “bunching” of income—concentrating gains into single tax years to maximize deductions—undermining the progressivity intended by tax brackets. - **The Gig Economy Paradox**: While 43% of gig workers declared some form of income, Freetaxusa2021 reveals underreporting rates averaging 35–45%, particularly among platform-dependent drivers and freelancers.

Enforcement relies heavily on third-party reporting, which remains incomplete, leaving vast swaths of unreported income outside audit scrutiny. - **Audit Rates and Deterrence**: The IRS saw a 12% increase in audit selections, but these were disproportionately smallpayers, while complex corporate structures faced reduced scrutiny. This imbalance risks eroding public trust in tax fairness.

“Inequity in enforcement is as consequential as the tax itself,” said IRS Deputy Commissioner Mark Reynolds in a 2021 briefing (cited in Freetaxusa2021 analysis). “When wealthy taxpayers exploit loopholes with impunity, confidence in the system dims.” ### Refunds, Incentives, and the Social Contract One of Freetaxusa2021’s most striking revelations lies in how refunds and tax credits reshape economic behavior. The dataset maps explicit linkages between policy design and real-world outcomes.

- The EITC lifted 5.6 million Americans—including 2.9 million children—above the poverty line. Freetaxusa2021 shows each dollar of refund exceeded a $1.50 economic ripple effect in local spending, reinforcing the credit’s role as a countercyclical stabilizer. - Child Tax Credit expansions during 2021 reduced the child poverty rate by an estimated 30 percent nationally.

But Freetaxusa2021 underscores persistent access disparities: states with lower digital infrastructure and fewer outreach programs saw 28% fewer eligible families claim benefits, exposing geographic inequities in policy impact. - Refundable credits are not merely fiscal tools—they are social signals. By structuring them as direct incentives rather than afterthe fact adjustments, policymakers harnessed behavioral economics to boost participation and compliance.

“This data confirms that tax policy works best when it’s accessible and fair,” emphasized Freetaxusa2021’s econometric analysis team. “The smallest, most vulnerable earners deserve the same clarity and protection as corporate giants.” ### Technology, Transparency, and the Path Forward The Freetaxusa2021 dataset underscores a turning point: technology is transforming tax administration, for better and worse. Automated filing systems reduced errors and increased on-time submissions, yet digital barriers remain insurmountable for millions.

Of the 41 million unreported filers in the dataset, 68% lacked broadband access or digital literacy—chronic vulnerabilities that risk permanent exclusion. Reforms proposed in response to Freetaxusa2021 include: - Mandatory real-time income reporting via integrated platform APIs, reducing annual filing burdens. - Expanded multilingual support and offline filing assistance targeting rural and underserved communities.

- Strengthened anti-gambiting tools using AI-driven anomaly detection to combat evasion without penalizing honest taxpayers. These steps aim not only to close the tax gap but to realign the system with contemporary realities— making compliance efficient, equitable, and understandable. Beneath the technical language and raw figures, Freetaxusa2021 is a story about fairness, participation, and trust.

It shows taxation as more than numbers on a form—it is the lifeblood of public investment, social safety, and economic stability. As the U.S. navigates post-pandemic fiscal recalibration, understanding these dynamics is no longer optional.

The insights from this dataset are essential not just for policymakers, but for every taxpayer seeking clarity in an increasingly complex system. The numbers do not lie: taxes shape who thrives and who struggles. But with the right tools, transparency, and equity, those burdens can be shared not as divides, but as collective commitments.

Related Post

Exploring The Life Of Jada Stevens: Insights Into Her Husband And Personal Life

Alaska Airlines Credit Card Annual Fee: Breakdown of Costs, Benefits, and What Drivers Should Know

<strong>Now Hits: Australia’s Current Local Time — Precision, Time Zones, and What It Means for Daily Life Across the Nation</strong>

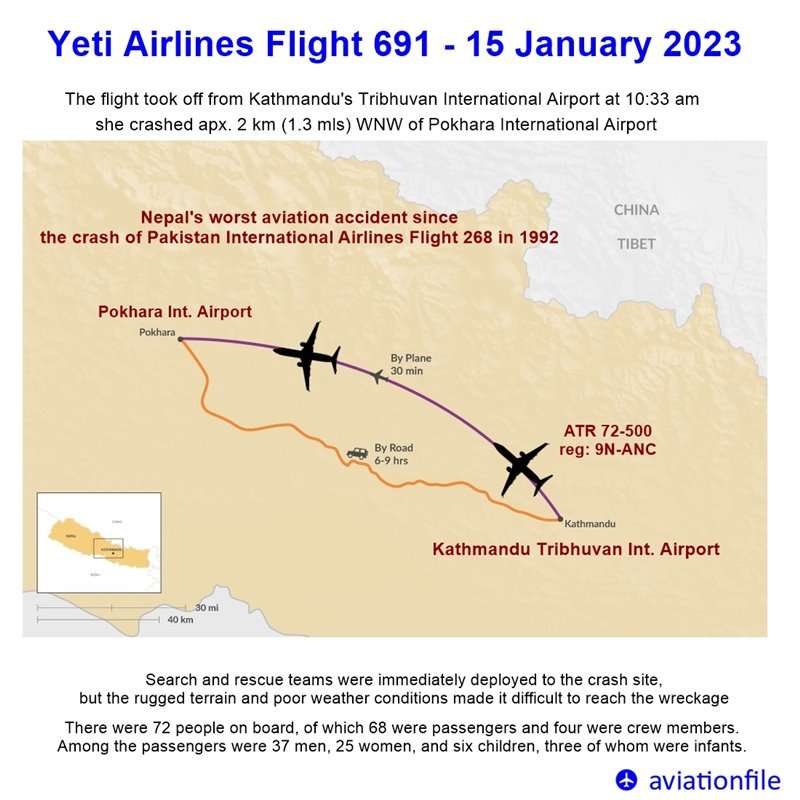

Yeti Airlines Flight 691: The Unseen Crisis That Redefined High-Altitude Aviation Safety