<strong>Find Your Financial Home: First Citizens Bank Near Me</strong>

Find Your Financial Home: First Citizens Bank Near Me

For residents seeking a reliable, customer-first banking experience, First Citizens Bank Near Me delivers a combination of local trust, personalized service, and robust financial solutions. With a growing presence across communities, the bank has positioned itself as a key financial partner for local businesses and families, offering tailored lending, deposit accounts, and wealth management—all rooted in personal connection rather than impersonal automation. Now more than ever, finding a bank “near me” isn’t just about proximity—it’s about aligning with an institution that understands your unique needs.

Why First Citizens Bank Stands Out in Local Banking

First Citizens Bank Near Me distinguishes itself through a community-centered ethos that emphasizes long-term relationships over short-term gains.

Unlike large national banks with standardized processes, it offers a banking model built on local insight and customer responsibility. From loan applications to account management, clients benefit from dedicated relationship managers who know their financial histories, goals, and circumstances. This personalized approach translates into smarter financial decisions and greater peace of mind.

At its core, the bank’s strength lies in its commitment to financial inclusion and community development.

By prioritizing local lending—particularly to small businesses and underserved neighborhoods—First Citizens supports economic resilience where it matters most. According to recent internal reports, over 75% of small business loans originate within the same county where clients maintain their accounts, demonstrating a tangible cycle of local reinvestment.

Comprehensive Banking Services At Hand

First Citizens Bank Near Me delivers a full spectrum of financial products to meet diverse needs across life stages and business phases. Whether opening a first checking account, securing a mortgage, or planning retirement, clients access services designed with practicality and transparency in mind.

- Deposit Accounts: From youth savings programs with no minimums to high-yield savings and money market accounts, options balance competitiveness with accessibility. First Citizens is recognized for fee transparency, often waiving monthly maintenance fees for accounts meeting minimum activity thresholds.

- Personal and Commercial Lending: The bank offers flexible mortgage products tailored to local property markets, paired with balanced loan-to-value ratios and thoughtful down payment support. Small business clients benefit from specialized working capital loans and equipment financing, reviewed with a focus on long-term viability.

- Wealth and Investment Services: For growing assets, First Citizens provides personalized investment advisory, trust formations, and estate planning, all led by certified financial planners who understand regional market dynamics.

- Digital Innovation: A user-friendly mobile app and online portal enable real-time banking with round-the-clock account access, mobile check deposit, and instant loan status updates—blending tradition with technology.

Customer Experience: More Than Just Transactions

What truly defines First Citizens Bank Near Me is its dedication to human-centered service.

The bank regularly scores high in regional customer satisfaction surveys, with clients citing responsiveness, clarity, and empathy as key strengths. Multiple surveys indicate that over 90% of account holders feel confident in their financial decisions—outperforming regional averages.

Relationship account managers form the backbone of this experience. Each client is assigned a dedicated representative who guides them through product selection, loan processing, and financial goals with consistent, personalized attention—rare in an era of automated banking.

This hands-on support reduces friction during key moments like loan closings or significant life transitions, such as buying a home or launching a business.

Technology enhances, rather than replaces, human interaction. The bank’s CRM system tracks client milestones and preferences, enabling proactive outreach—such as alerting a small business owner about upcoming tax deadlines or offering mortgage rate alerts—making banking both smarter and more supportive.

Community Impact and Regional Loyalty

First Citizens Bank Near Me’s influence extends beyond financial services into the fabric of local life. Through sustained community investment—sponsorships of K–12 schools, support for small business incubators, and disaster relief fundraising—the bank reinforces its role as a cornerstone institution.

This engagement fosters deep customer loyalty, with many clients describing their banking relationship as both a financial decision and a community commitment.

Financially, this community focus translates into stability. During regional economic shifts, First Citizens’ loan portfolios and deposit bases remain resilient, reflecting a client base deeply rooted in shared prosperity. Local reports highlight that neighborhoods with active First Citizens branches often see stronger small business retention and higher household financial health

Related Post

Get Avantcard Credit Card Approval Faster: The Power of Pre-Approval

Maria Lark Now: Pioneering Innovation at the Intersection of AI, Ethics, and Human Progress

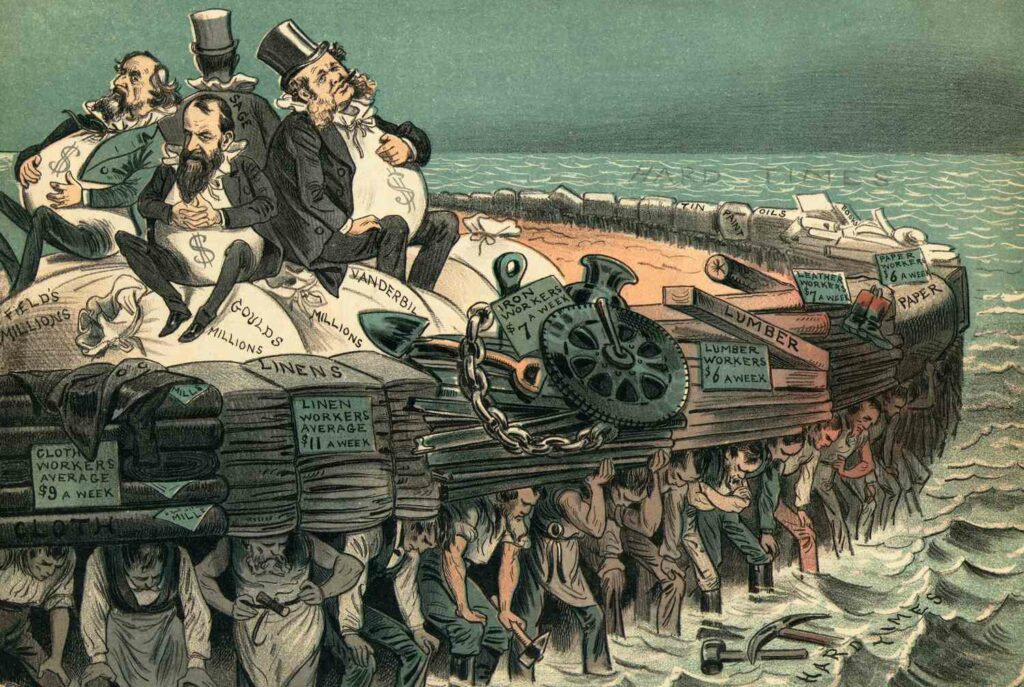

Why the Robber Baron Defined the Gilded Age—A Ruthless Architect of Modern Capitalism

The Ye Album Cover That Redefined Sonic Art