Financially: How Strategic Money Management Powers Long-Term Wealth Creation

Financially: How Strategic Money Management Powers Long-Term Wealth Creation

In an era where financial literacy is no longer optional, mastering the principles of financial management has become the cornerstone of lasting prosperity. Far beyond mere budgeting or saving, financially intelligent decisions shape the trajectory of personal and institutional wealth recovery, risk mitigation, and opportunity capture. The latest research underscores that proactive financial behavior—not luck—drives sustainable growth.

From individual investors to corporate treasurers, understanding key financial instruments, liquidity planning, and capital allocation empowers stakeholders to not just survive volatility but to thrive amid it.

Financially effective strategies begin with a clear understanding of cash flow dynamics. Cash flow remains the lifeblood of any financial operation, serving as the real-time gauge of operational health.

Positive cash flow enables reinvestment, reduces borrowing dependency, and builds resilience against economic shocks. According to the Institute of Financial Planning, companies and households that monitor cash flow daily are 3.7 times more likely to meet long-term obligations than those relying solely on end-of-period reporting.

Optimizing Liquidity: The Key to Financial Agility

Liquidity—the ease with which assets can be converted to cash without loss—determines financial flexibility. Financially agile entities maintain a balanced liquidity profile, avoiding both excessive idle cash and dangerous over-leverage.Key tactics include: - Maintaining a cash reserve equivalent to 3–6 months of operating expenses, - Diversifying liquid assets such as Treasury bills and money market funds, - Accelerating receivables and delaying non-essential payables strategically. “Liquidity isn’t just about having cash—it’s about knowing how and when cash will be available,” notes financiers’ expert Dr. Elena Rios from the Global Financial Institute.

“Smart operational timing ensures that capital is deployed precisely when needed, turning short-term needs into strategic advantages.”

Institutions and individuals alike are adopting real-time liquidity dashboards—digital tools integrating bank feeds, invoice statuses, and cash forecast models. These systems provide early warnings of potential shortfalls and unlock dynamic decision-making. For small businesses, this technology can reduce cash crunches by up to 40%, according to a 2023 study by the National Small Business Financial Council.

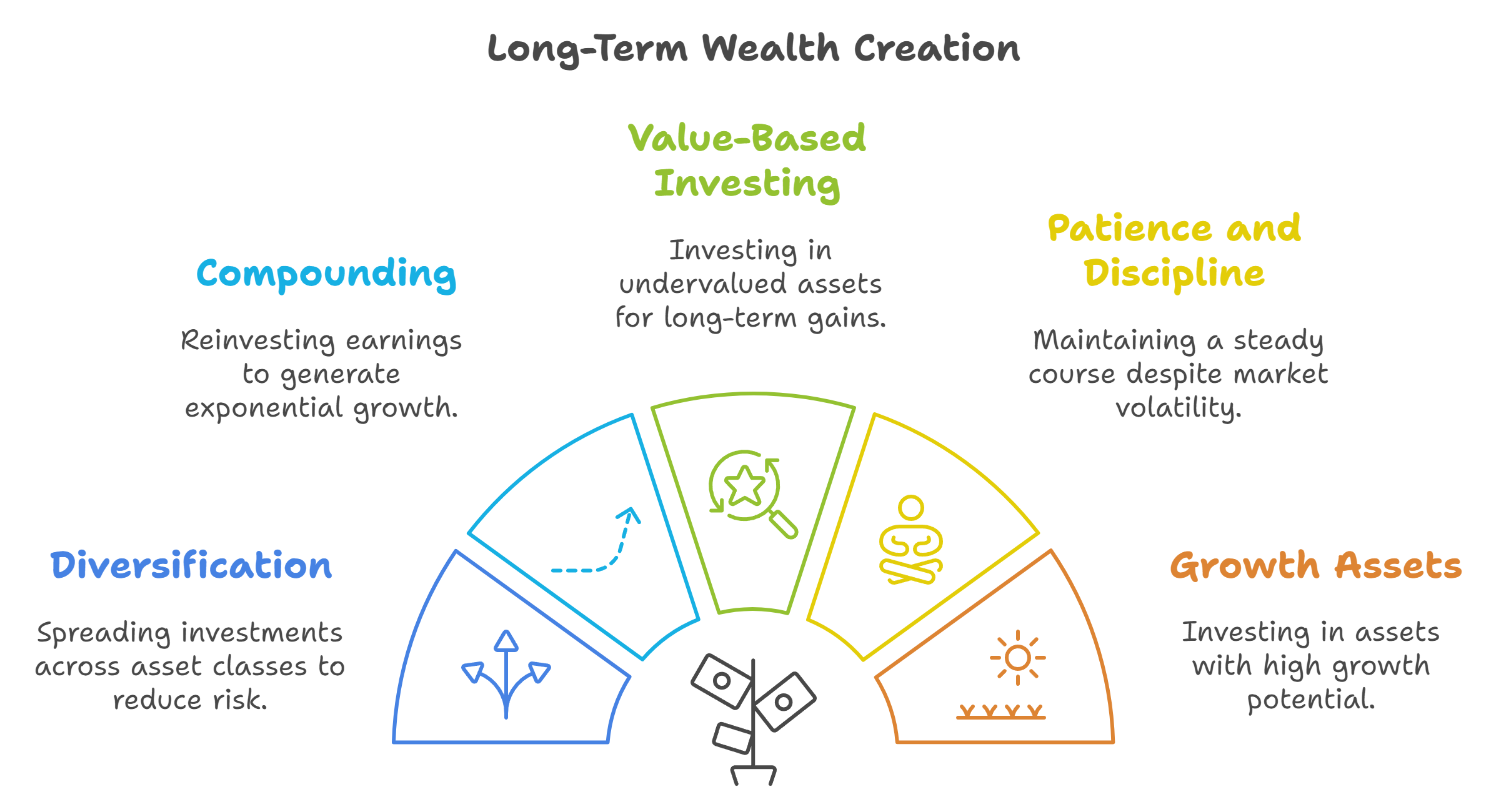

Capital Allocation: The Engine of Compounding Growth

Effective financial management hinges on disciplined capital allocation—the process of deploying resources toward investments expected to yield sustainable returns.Whether for personal portfolios or corporate expansion, the principle is unchanged: capital should flow where it generates the highest risk-adjusted return. Key considerations include: - Prioritizing low-cost instruments like index funds and bonds with stable yields, - Balancing growth assets with defensive holdings to cushion volatility, - Rebalancing portfolios periodically to maintain target risk levels. The compound interest effect amplifies returns over time: a $10,000 investment yielding 7% annually grows to over $76,000 in 30 years—demonstrating the profound impact of strategic allocation.

Warren Buffett’s long-standing advocacy for patient, value-based investing illustrates how financial discipline compounds exponentially. For institutions, allocating capital to innovation-driven sectors or emerging markets presents climbing opportunities, but requires rigorous analysis and scenario planning. Such decisions minimize downside risks while capturing outsized gains during market shifts.

Debt Management: Leverage as a Double-Edged Sword

Debt remains a necessary tool in financial strategy, offering growth momentum when used judiciously. The key is maintaining an optimal debt-to-equity ratio that supports expansion without eroding financial stability. Inflation-adjusted wages, rising interest rates, and fluctuating credit markets complicate this balance, making careful covenant management essential.“Debt isn’t the enemy—poorly structured debt is,” warns financial strategist James Chen, author of *Balancing the Balance Sheet*. “Prudent borrowers use debt to amplify value, not obscure loss. Maintain transparent, repayable terms aligned with cash flow projections.” - Use fixed-rate debt to hedge against interest rate volatility, - Avoid excessive reliance on short-term borrowing during market tightening, - Maintain covenant compliance to preserve credit access and investor confidence.

Retail investors benefit similarly—using low-interest lines for strategic investments yields stronger returns when debt remains manageable relative to income.

Risk Mitigation Through Financial Resilience

A financially strong entity isn’t just profitable—it’s resilient. Integrating risk management into financial planning safeguards assets and ensures continuity through downturns.Essential components include: - Building robust emergency funds covering essential expenses, - Diversifying revenue streams and investment portfolios, - Employing insurance coverage aligned with core exposures, - Utilizing derivatives and hedging strategies to neutralize market risk. Financial resilience isn’t about eliminating risk—it’s about managing it intelligently to withstand shocks. A 2024 survey by PwC found that

.jpg)

Related Post

Financially Understanding Its Meaning and Usage: Why This Cornerstone Drives Economic Success

Defining Normal Height Female: Understanding Statistical Norms in Human Physiology

Where Can I Stream Drop Dead Diva? The Complete Guide to Watching the Crime Comedy on Demand

Unlock Your Hidden Talent: Find Famous Songs Using Just Your Voice Like Never Before